Canada Price Comparison Research

A dedicated comparison research team in Wise compared Wise to 3 Canadian bank accounts, as well as PayPal, Remitly and Western Union. They found that you can...

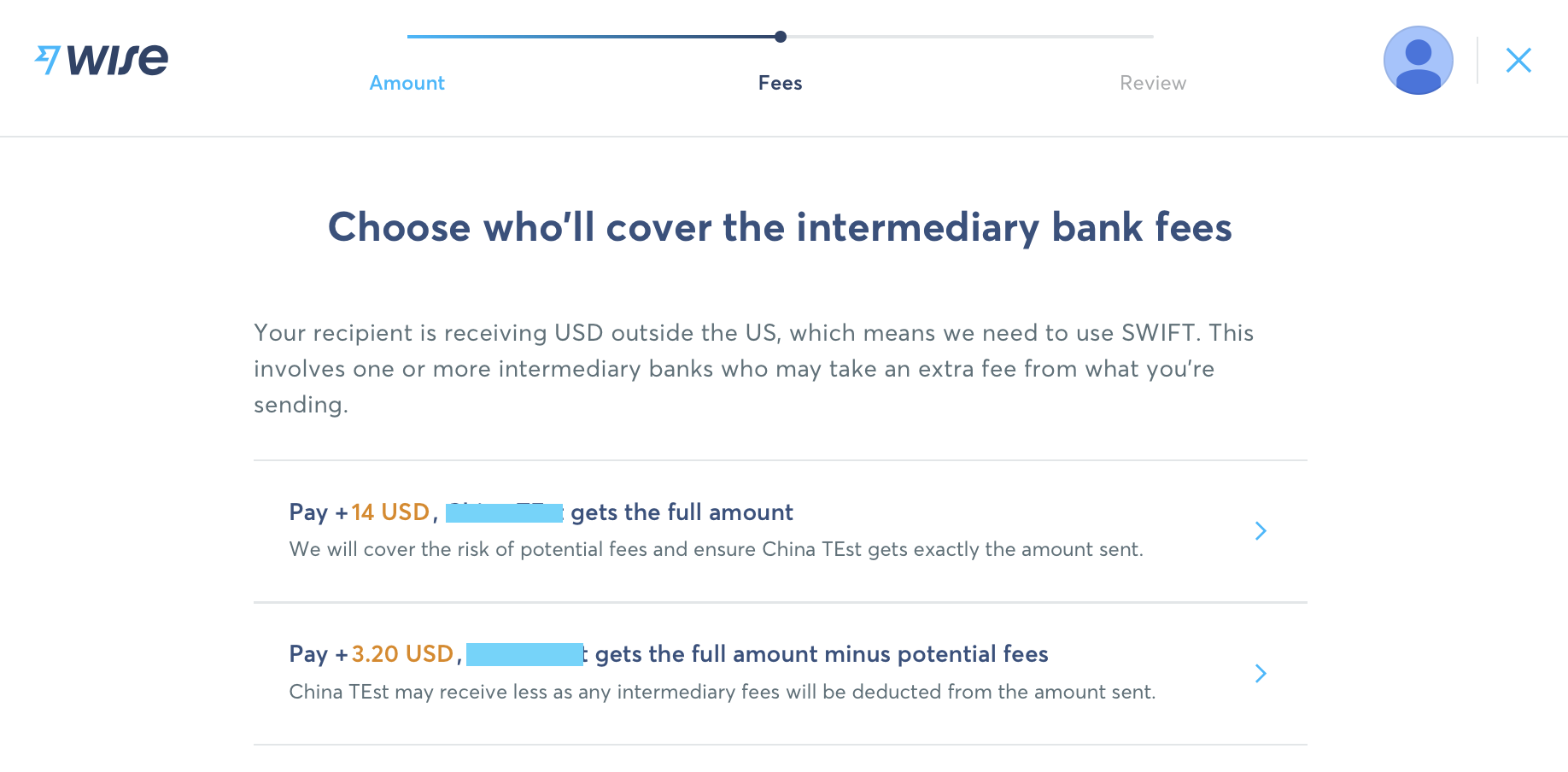

Good news! We have improved the experience of sending US dollars to bank accounts that are denominated in USD outside the US. USD is sent to bank accounts outside the US via the SWIFT payment network. This is different from a regular Wise transfer and, unfortunately, in some cases the transfer has unexpected fees, meaning that the receiver sometimes gets less money than sent by you. We have acknowledged that this is not a good experience and we now offer you a way to protect your payment from these unexpected charges.

While we wish we could eliminate these fees entirely, we're trying to make it as transparent and cheap as we can for Wise customers.

Why is this happening?

SWIFT is a cross-border payments network used by more than 11,000 banks across 200+ countries in the world. In a SWIFT transfer (also known as “Wire Transfer/Telegraphic Transfer), banks do not transfer funds to one another. Instead, a message called a payment order is generated from one bank to the other.

If our partner has a correspondent bank account with the receiver’s bank, then the transfer happens directly. Funds to the recipient are settled from the correspondent account of the sender’s bank.

However, SWIFT being such a huge network of banks, our partners don’t have a direct financial relationship and need to use an ‘intermediary bank’ to complete the transaction. In these cases, unless the payment is protected, the intermediary banks can charge a fee (usually $20-$50). Unfortunately, we don’t have any visibility about this fee before the transfer is sent out and then have no control over it.

How did we solve the problem?

You can now add protection to your payments before you send money. To do this, Wise pays an additional fixed fee to our partner so that they instruct the intermediary banks to charge any fee directly to them rather than taking it off the payment that you send. It’s more transparent for customers and it ensures that your receiver always gets the full amount you sent.

How do I opt in?

When you create a USD transfer to a receiver with a bank account denominated in USD outside the US, you’ll see this screen and can select the option to protect your payment or send it normally.

Your fee will depend on the country where the payment is made to. Please note that this is only available on web for now but we are working hard at making this available on mobile as well.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A dedicated comparison research team in Wise compared Wise to 3 Canadian bank accounts, as well as PayPal, Remitly and Western Union. They found that you can...

Wise has revealed a complete visual makeover, featuring a fresh green palette Our new look and feel features a bold new font, imagery and universal symbols ...

If you shop online, travel, or do business abroad, this little green card will save you money. We’re excited to announce the launch of our card in Canada — to...

Managing your money across borders — and specifically in and out of Canada — has just gotten easier thanks to the introduction of Direct Debits. Back in...

PLEASE READ THESE PRICE DROP REFERRAL CAMPAIGN TERMS CAREFULLY. This “Agreement” (these Price Drop Referral Campaign terms together with the documents...

You can now connect your Wise business multi-currency account with QuickBooks — the most requested accounting tool. This means your business activity...