Xero pricing Australia: Plans, costs & features guide

Explore Xero pricing in Australia. We break down all 4 plans, hidden costs, and features like payroll & multi-currency. Find more.

There are always risks involved in running a business. The right insurance helps protect you, your assets, your employees (and much more), and cover potential financial losses if something unexpected happens.

In Australia, LLC doesn’t technically exist — Pty Ltd is the equivalent structure offering limited liability, but the same principle applies. Business insurance is in your company’s best interests.

The blog explains everything you need to know about LLC insurance in Australia, covering things like insurance types, coverage, benefits, and costs, plus tips on how to better manage your business finances.

| Table of contents |

|---|

In Australia, an LLC is most similar to a proprietary limited, or Pty Ltd company. It’s a private business structure where shareholders’ personal assets are legally separated and protected from any business debts and liabilities¹.

Business insurance for an LLC is essentially a legal and financial safety net for this structure. A way of protecting against the cost of unforeseen events like property damage, legal claims, cyberattacks, and customer injuries, so you’re not out of pocket afterwards.

While your company structure provides personal liability protection, it doesn’t prevent the business itself from losing money when things go wrong.

Certain types of business insurance are also required by law in Australia, so it’s not something you can skip over when setting up a company.

The exact types of business insurance you’ll need for an LLC will depend on the type of business and the risks faced. Understanding which insurance applies to your business is key, both for suitable coverage and to avoid wasting money on policies you don’t need.

It is recommended that you speak to a legal adviser to fully understand your legal obligations.

Here are some of the most common types of business insurance for an LLC.

Public liability insurance protects against claims made by the general public for any incidents or injuries caused by your business activities. This is important if you’re in retail or trades, for example, and are regularly interacting with customers and operating in public spaces.

While it’s not a legal requirement in all industries, the government says that it’s mandatory for certain types of jobs in ‘some’ territories and states².

Who needs it: Any business interacting with the public.

If your business has employees, you are legally required to have workers’ compensation insurance, either managed at the state or territory level. This insurance supports employees, covering things like medical expenses and lost wages if they are injured at work or develop work-related injuries.

Who needs it: Any business with employees.

Professional indemnity insurance protects against claims of negligence or error when offering professional advice. If a client claims that you’ve made a mistake or given bad advice that affected them financially, this policy will protect your business from the cost of defending yourself and paying damages if you’re found liable.

Who needs it: Any company offering professional advice or expertise, such as consultants, accountants, and marketers.

Building and contents insurance is just one of the policies that can safeguard your assets in the event of a fire, break-in, or other disaster. When these unfortunate events occur, the policy can pay to repair or replace the property that’s been lost. It’s often bundled in with related policies like business interruption insurance.

Who needs it: Any business that owns the building it operates from.

Sudden events like fires can force businesses to close temporarily. In cases like this, business interruption insurance covers the lost income and ongoing expenses when you can’t operate due to an insured event.

Who needs it: Any business reliant on physical premises or with essential equipment and supply chains.

If you’re a dropshipper or a business that manufactures or sells products, you’ll get value from a comprehensive product liability insurance policy. This protects you against any claims that your products caused injury or property damage, covering the costs of any legal proceedings or compensation.

Who needs it: Manufacturers, importers, distributors, retailers — pretty much anyone in a supply chain responsible for defective products harming consumers.

If your LLC has multiple directors, getting management liability insurance can protect them from claims that their decisions or actions in running the business caused loss or harm. While LLCs have limited liability, it doesn’t cover claims made directly against directors or managers.

Who needs it: LLCs with multiple directors that operate in regulated industries.

Cybercrime is on the rise — the average cost per report for small businesses in Australia has jumped 14% to $56,000³. With growing threats from hackers and scams, most LLCs will benefit from taking out cyber liability insurance, which covers losses from data breaches and cyberattacks, plus stolen sensitive customer data.

Who needs it: Any business that processes online payments and stores customer data, or relies on technology for core operations.

Third-party personal insurance is mandatory if your business owns a vehicle. It covers any personal injury claims related to any accidents involving these vehicles. This is one of the easier policies to sort — it’s usually included in your vehicle registration fee.

Who needs it: Any business owning and operating vehicles.

Small business insurance isn’t an insurance type per se; it’s a collection of policies designed to protect startups and LLCs. The cover types usually include business liability — both public and product liability — plus other ‘add-ons’ relevant to the business type. For some, this is easier than taking out multiple, single policies.

Who needs it: Startups and small businesses looking for broad protection against common business risks.

Insuring your LLC (Pty Ltd) company in Australia is beneficial for a number of reasons.

Finally, let’s look at the general LLC insurance cost in Australia. The premiums do vary quite dramatically, depending on factors including:

On average, small business insurance packages with bundled policies start from around $100 per month, while public liability insurance costs around $40 per month. However, it will depend on your field and level of cover.

For example, a construction business working regularly on client sites or in public spaces has a higher chance of causing injury or damage to property and is likely to pay more. Conversely, a marketing agency with much lower physical risks would have a lower premium.

It’s best to contact insurance companies directly and compare quotes to get more accurate premium costs and find the best LLC business insurance deal.

Safeguarding your Pty Ltd involves more than just selecting the right policies; it also means keeping a close watch on your operational costs. While insurance defends against the unexpected, business accounts like Wise Business helps support your daily financial management by offering a low-cost way to handle payments.

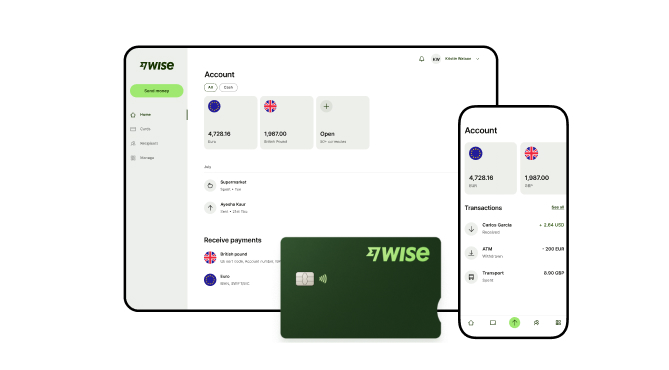

Whether you are paying premiums, settling invoices with vendors, or managing international transactions, a Wise Business account helps avoid hidden fees and ease the load of administrative work when it comes to cross-border business transactions. This allows you to maintain better control over your cash flow while your insurance looks after the risks.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

1. Is business insurance legally required for an LLC in Australia?

Some business insurance policies are mandatory for LLCs in Australia, but it depends on the business type. For example, you’ll need workers’ compensation insurance by law if you employ staff. Others, like professional indemnity, might be required by industry bodies or clients, but not by law.

2. What's the difference between general liability and professional liability insurance?

The main difference is that general liability covers physical injury or property damage caused by business activities, such as customer visits, and product handling, while professional liability covers claims stemming from errors or negligence from professional services — bad advice, libel, misrepresentation, etc. — that cause financial loss.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore Xero pricing in Australia. We break down all 4 plans, hidden costs, and features like payroll & multi-currency. Find more.

Wondering how to reactivate your ABN? Find out more on ABN reactivation, eligibility, required documents, and overall process.

Discover how Xero integration connects works and connects to over 1,000 apps, from ecommerce to payments. Read here.

Learn how to create a compliant tax invoice in Australia. We cover ATO requirements, GST rules, mandatory fields, and more.

Aussie guide on finding the right dropshipping supplier. Explore directories vs wholesalers, checklists, and saving on international payments.

What does it mean to buy direct from China suppliers safely. Discover platforms, steps, and best ways to pay vendors overseas.