How to open a bank account in Costa Rica as a foreigner: US guide

Learn all about opening a bank account in Costa Rica as an American, including costs, requirements, and alternatives.

Looking for a new bank account? Perhaps you’ve just arrived in the US and need a newcomer-friendly provider. If so, you’ll want to check out Majority.

It’s a digital finance platform that offers bank-like services aimed at migrants, but is open to everyone.

In our Majority review, we’ll cover everything from features to fees, so you can decide if it’s right for you.

We’ll also show you a great alternative - the Wise Account, offering low, transparent fees for managing your money internationally.

Majority isn’t a bank, but it does offer a checking account and debit card, just like a bank. Other services include mobile top-ups, international transfers and global calls.

It’s a digital finance platform with headquarters in Houston, Texas. It was originally founded in Sweden, although launched in the US in 2020.

Majority bills its platform as “the first digital finance service for migrants”. With a diverse team of multilingual specialists on board, it aims to make it easier and more affordable for migrants to access banking services.

Majority is able to offer its banking services by working through another licensed bank. This is Axiom Bank, N.A, an FDIC insured member institution based in Florida.²

Majority offers two main products - a checking account and a Visa debit card.

The checking account is available for a monthly subscription fee of $5.99, with a free 30-day trial available.² It comes with a free debit card, and offers all the services and tools you need for everyday banking. It’s FDIC insured, thanks to Majority’s partnership with Axiom Bank.

And when you sign up for an account, you’ll get access to other Majority services, such as:

- Money transfers

- Mobile top-ups

- International calling

- A personalized advisor.

We’ll look at some of these in more detail in just a moment.

Majority has no physical branches, so accounts are managed wholly through the mobile app.

So, what can you do with the Majority account? Let’s take a look at the main features:³

- Early Direct Deposit - get your paycheck up to 2 days early

- Easy deposits - including cash, bank account and card

- No overdraft fees

- Access to Zelle payments

- Free mobile top-ups

- Free personalized Visa debit card with discounts and cashback at partner retailers.

- Free unlimited international calls to 20+ countries.

When you get a Majority account, you’ll get access to international calling services.

You can call friends and family in over 20 countries for free using the Majority app. This includes Mexico, Canada, the UK and Spain. You can call other countries for a cost, but Majority promises low rates.⁴

Calls are unlimited, made over high-quality connections, and you can call any mobile or landline phone.

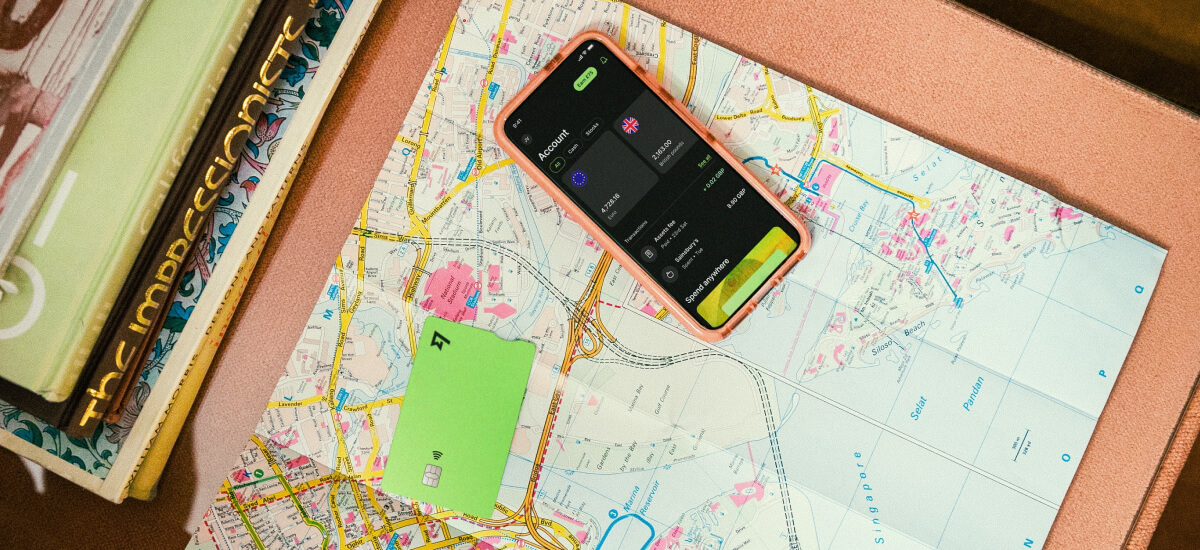

When you open a Majority account, you’ll automatically get a Majority Visa debit card. It’s contactless and can be used anywhere that Visa payments are accepted.

Other card features include:⁵

- Exclusive local discounts when you spend at any of Majority’s community discount partners. This includes grocery stores and restaurants, as well as professional tax and legal services.

- Fee-free cash withdrawals at over 55,000 ATMs in the US

- ATM withdrawals and payments abroad, with no foreign transaction fees. This includes online purchases from overseas retailers.

- Anti-fraud protection on all purchases

- Compatible with mobile wallets such as Google Pay and Apple Pay.

Majority offers a few different ways to deposit money in your account. You can:²

- Deposit cash at any major retailer

- Make a card deposit (with another bank’s debit card)

- Link a bank account to make a deposit.

We’ve already mentioned the $5.99 monthly fee for the Majority account, and all the extra services included in the subscription.

Majority also charges no fees for:⁵

- Using your card abroad

- Withdrawing cash at 55,000+ network ATMs throughout the US - although you’re likely to be charged if you use an out-of-network ATM.

- International transfers - although there may be service fees and/or exchange rate mark-ups for currency conversion.⁶

- Overdrafts.

With Majority, you can make transfers within the US and internationally. US transfers are made through the Majority Pay service, while global transfers are made through a separate tool.

Majority Pay works in a similar way to Zelle. Available through the mobile app, it’s a free, instant and easy way to pay friends and family who are also signed up with Majority.

You can use it to send money gifts, split the bill and receive payments too. All you need to make a payment is the Majority member’s phone number.

There are no fees, and you can pay up to $500 a transaction (maximum of $1,000 a day or $2,500 a month). Payments arrive instantly.⁷

You can also send money overseas with Majority. It doesn’t charge any fees for international transfers,⁸ but be aware that service fees may be applied by Majority or any receiving/correspondent banks for currency conversion.⁶

Majority promises ‘the most competitive exchange rates’⁸, but doesn’t make the exact rates available until you’ve signed up. Then, you should be able to check them in the app.

Not all countries are supported, so you’ll need to check here to see if your recipient’s destination is on the list.

As for whether you can receive international payments into your account, Majority doesn’t say whether it’s possible. So you’ll need to get in touch with the digital finance company to check.

With Wise, you’ll always know exactly what you’ll pay upfront. You can check both fees and exchange rates at any time on the Wise website and in the Wise app.

Open a Wise Account online for free and you can:

Wise is a money service business, offering a multi-currency account with no monthly fees, plus international money transfer services and a debit card.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

Like the sound of Majority so far? To sign up for an account, all you need to do is download the app.

It’s available in the App Store and Google Play for compatible devices. Or you can enter your phone number on the Majority website - just tap ‘Get started’.

Once you have the app, simply follow these steps:

- Enter and verify your phone, email and other details when prompted

- Follow the app instructions to confirm your identity

- Complete the sign-up process and wait for confirmation that your account has been opened.

One thing about Majority that you don’t need a Social Security Number (SSN). The only requirement is that you live permanently in the US.

You don’t need an SSN to open a Majority account, but you will need some form of government-issued ID. This doesn’t have to be a document issued in the US.

Examples of acceptable documents include:⁹

- A passport

- A government-issued identification card

- A government-issued driver’s license.

Majority is quite unique in its offer, as its services are designed to make banking easier for newcomers to the US.

But it’s not the only digital money platform out there. Alternatives include:

And that’s pretty much it - everything you need to know about Majority, from its current account and card to other useful services. After reading our comprehensive Majority review, you should have all the info you need to decide if it’s the right option for you.

There is a monthly fee of $5.99² to factor in. Although this isn’t too high considering all the other fee-free services you’ll gain access to. This includes free international calls to 20+ countries, free mobile top-ups and free international transfers (although you’ll need to watch out for potential currency conversion fees).

Unfortunately, Majority doesn’t provide info about exchange rates and other potential international transfer fees upfront. This would be helpful when comparing alternative providers, such as Wise (which makes all of its rates and fees available upfront).

Sources used for this article:

Sources checked on 03-Aug-2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn all about opening a bank account in Costa Rica as an American, including costs, requirements, and alternatives.

Learn all about opening a bank account in Monaco as an American, including costs, requirements, and alternatives.

Need to close Fidelity bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close Capital One bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close Santander bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close PNC Bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.