Maximizing Your Small Business Profits During the Holiday Season

The holiday season is often hailed as the most wonderful time of the year, but for small businesses or e-commerce stores, it can also be the busiest and most...

In 2022, the number of global PayPal users reached more than 200 million.¹ By 2025, PayPal is predicted to have 249.9 million active users.

To tap into this global customer base, the first step is being able to accept international payments. You can do this by changing your settings.

Let’s take a look at how to accept international payments on PayPal.

| 📝 In this article: |

|---|

Accept international payments with ease

Join Wise Business today

To accept international payments on PayPal, you need to:²

From here, you’ll be able to receive payments from abroad.

Now you need to decide whether you want to convert foreign payments manually or automatically, or to hold them.

To have foreign payments converted automatically, you need to:³

With this payment preference selected, foreign payments will be converted automatically to USD. PayPal uses the latest exchange rate and credits the payment to your PayPal business account.²

To have foreign payments converted manually, you need to:³

With this setting selected, PayPal will notify you every time you receive a foreign payment.

To convert a payment manually, you need to:²

Like this, you’ll be able to convert payments when it makes the most financial sense.

If you don’t want to convert a payment immediately, you can open and hold a foreign currency balance in your PayPal account.

To do this, you need to:²

This allows you to convert currencies at a later date, taking advantage of competitive exchange rates.

| PayPal currently allows you to open foreign currency balances in: |

|---|

|

Here’s an overview of the pros and cons of accepting international PayPal payments.

| Pros | Cons |

|---|---|

|

|

Accepting international payments with PayPal can be expensive. This is where Wise Business comes in.

Wise a smart online alternative to traditional banks. With a Wise Business account, you simply open your account online, verify your business, and get access to local account details for 10 major currencies.

To open a balance, you’ll only need to:

This allows you to receive like a local to these currencies, free of PayPal cross border fees. You can also hold more than 50+ currencies in your Wise Business account.

If you want to convert your balance to USD, then you’ll have access to the real, mid-market exchange rate. This is free of hidden fees and high markups.

Register with Wise Business today 🚀

Cut fees and complexity when accepting foreign payments with Wise Business.

| 🔍 Read more articles on PayPal: | |

|---|---|

Sources:

All sources checked May 2, 2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

The holiday season is often hailed as the most wonderful time of the year, but for small businesses or e-commerce stores, it can also be the busiest and most...

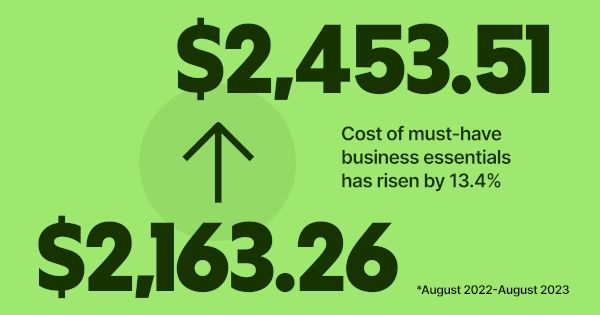

At Wise Business, we're focused on building a multi-currency account helping businesses grow internationally while tackling the rising costs of doing business

Getting paid is a key moment for your business - it means that your product fit and marketing strategy has hit the mark and customers are happy to exchange...

Explore how to get investors for small business to raise the capital you need to succeed. 1. Friends and Family 2. Small Business Loans and more

Handling finances manually is slow, repetitive, and full of errors. From chasing invoices to approving expenses, finance teams spend too much time on admin...

As the holiday season approaches, managing cash flow effectively becomes critical for business owners. The final months of the year can be make-or-break, with...