Stop typing, start uploading — your shortcut for adding new recipients

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past year.

At the end of 2024 our average fee was 0.59% and now, just a year later, it’s 0.53% globally — that’s the lowest it’s been in 5 years.*

Over the past 12 months, Wise customers have moved £145bn around the globe saving £2bn by choosing Wise instead of a traditional bank.

How do we help customers save on fees? By looking for ways to reduce our costs while we develop the infrastructure that can move the world’s money instantly and for less. We cut costs by doing things like improving connections to payment systems, and encouraging more people and businesses to use Wise. However, sometimes the cost of providing secure, reliable transfers increases, so our fees do too.

We regularly review our fees so that they more accurately reflect the cost of moving and managing money around the world. And after our most recent review, fees for doing some things with Wise are going up.

The fee for your transfer is based on:

We share an update every time we make changes to our pricing because we’re committed to two things: price transparency, and dropping our fees whenever we can.

The rest of this post outlines the currencies and payment methods that have changed and why.

Use our fee calculator to see if your route was impacted by this change and how much your next transfer will cost.

See Terms of Use or visit Wise Fees & Pricing for the most up-to-date information.

For some currencies and payment methods, you'll see a small fee increase. This is primarily to cover some increasing costs of providing our service. Our commitment to transparency and using the real, mid-market exchange rate remains unchanged. You will always see a clear breakdown of the fee and the exchange rate upfront before you confirm any transfer.

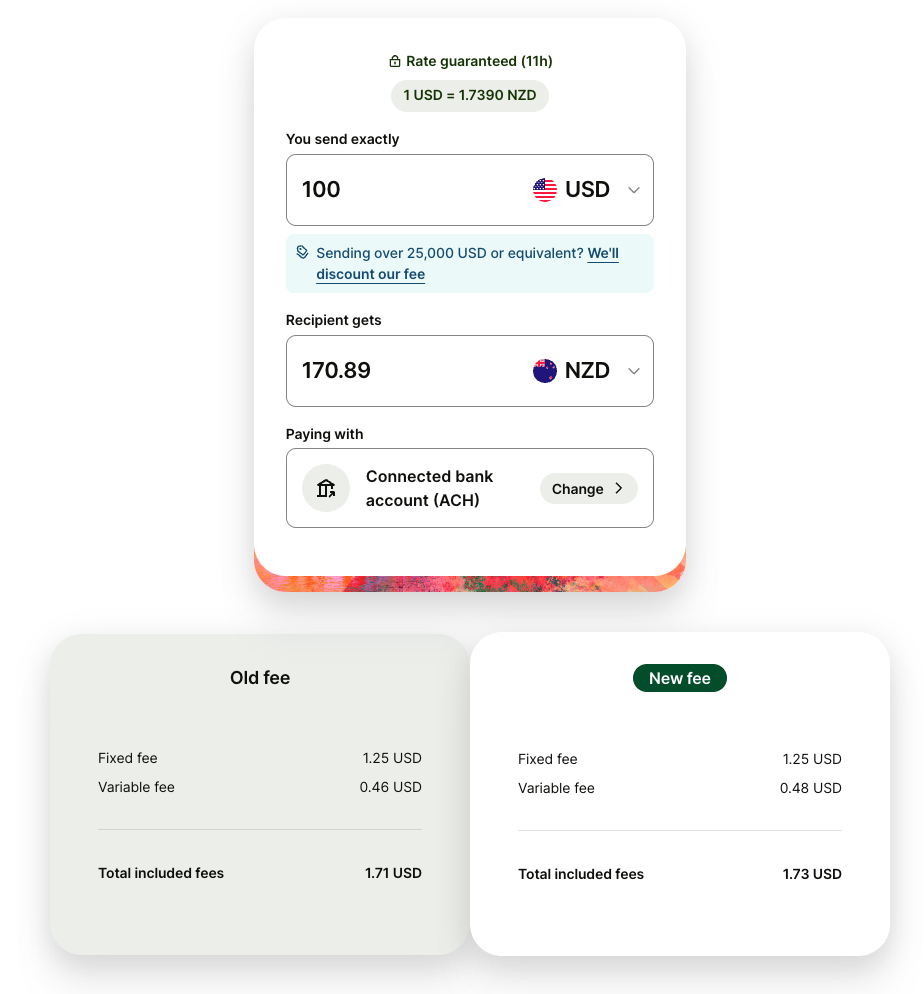

Transferring to and from New Zealand dollars (NZD)

It’ll be slightly more expensive to transfer NZD to other currencies. In addition, the fees for funding NZD transfers, or transferring other currencies to NZD are increasing to better reflect our costs, including a regulatory requirement to recover our costs across all fees. This means to keep our pricing fair and compliant with regulations, we need to make sure that the fees you pay for a service cover the actual costs of providing it.

For example, paying for a 100 USD to NZD transfer using ACH used to cost 1.71 USD. This now costs 1.73 USD. Try our fee calculator to check how much your next transfer will cost.

Transferring Hong Kong dollars (HKD) to other currencies

Fees for funding HKD transfers will be increasing. This is changing to reflect the increased costs associated with setting up new accounts and providing the high-quality service you've come to expect.

For example, paying for a 1,000 HKD to USD transfer using a bank transfer used to cost 14.55 HKD. This now costs 16.22 HKD. Try our fee calculator to check how much your next transfer will cost.

Funding transfers from Euros (EUR) with iDeal

There will now be a small variable fee when you use iDeal for funding your EUR transfer. This helps us cover a fee we pay to our provider to make your payments as fast as possible.

For example, paying for a 100 EUR to USD transfer with iDeal used to cost 2.45 EUR. This now costs 2.59 EUR. Try our fee calculator to check how much your next transfer will cost.

Sending Euros (EUR) outside of SEPA region using SWIFT

These changes won’t apply when you convert Euros to other currencies, or send Euros within the SEPA region, which includes most European countries.

This will only affect you if you send money from any currency outside of the SEPA region and want your recipient to receive Euros. For example, if you're sending a transfer to someone in Turkey and they receive euros, not Turkish lira. In this case, the transfer would go through the Swift network.

What’s changing?

We're simplifying our pricing for sending money to a EUR account using SWIFT to provide a clearer, more predictable cost for you.

SWIFT is a secure global network of banks that facilitates international transfers. These types of transfers sometimes pass through intermediary banks, each with its own fee.

To account for these fees upfront and to eliminate any hidden costs, we are now including all potential costs in a single, fixed transfer fee. This means you will now see one clear, all-inclusive price upfront, ensuring your recipient gets the full amount you intended to send without any surprises.

The fees for sending Euros to a personal or business PrivatBank account in Ukraine are also increasing due to the increase in the related bank fees.

Find out how your next Swift transfer will be affected by this change.

To see the exact fees and the estimated time for your Swift transfer to arrive, set it up on the Wise website or app. We will always show you the total fee and the predicted arrival time before you press send.

Transferring money to Chinese yuan, Thai Baht (THB) and Turkish Lira

You will see some adjustments to the fees for sending money to these currencies with the recipient methods below. These changes are to ensure our prices keep up with our current costs, such as bank fees and the cost of protecting your money from currency volatility.

Try our fee calculator to check how much your next transfer will cost.

| Transfers to (currency) | Recipient Method | Example |

|---|---|---|

| Chinese yuan (CNY) | Alipay, Bank of Shanghai | Paying for a 100 USD to CNY transfer with ACH for a recipient to get it to their Alipay account used to cost 4.17 USD. This now costs 4.31 USD. |

| Thai baht (THB) | All methods | Paying for a 100 USD to THB transfer with ACH used to cost 2.36 USD. This now costs 2.87 USD. |

| Turkish Lira | All methods | Paying for a 100 USD to TRY transfer with ACH used to cost 6.80 USD. This now costs 7.30 USD. |

We’ll always let you know if and when we change our fees. The way we do it depends on the type of fee and how it changes. The date for these changes depends on where you live, how you fund transfers, and whether the fee is decreasing or increasing.

For the most up-to-date information, see our Terms of Use or visit Wise Fees & Pricing.

Price decreases

When we decrease our prices, the change is immediately available for all Wise customers. We’ll do this before notifying you, so that you can start benefiting from the savings as soon as possible.

Price increases for using your Wise account and Wise card

If you pay for transfers using the money in your Wise account, convert currencies between Wise balances, or spend using the Wise card, US customers will be notified at least 21 calendar days before a price increase.

The notification period is the minimum number of calendar days, required by our regulators, between the date we sent you the notification, and implementing the change. If you disagree with these changes at any point, you have the right to close your account with us.

Find out more about the notification periods and how they apply for other regions.

*The price provided is a global average based on a fixed basket of representative currencies as of Q3 2025 and may not reflect specific prices for consumers in their regions. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Paying someone new? Don’t waste time typing out their bank details or double-checking their IBAN. Upload a screenshot or invoice instead. Our new AI feature...

This new test feature from Google will make transparent and convenient international payments more accessible in the U.S.

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...

We're thrilled to announce that Wise has officially launched in Mexico, revolutionizing the traditional landscape of international money transfers. With this...

Study abroad rates in the US have been on the rise following a sharp decline during the pandemic. As more American college students seek out new experiences...