How to open a foreign currency account in the US

Wondering how to open a foreign currency account in the US? Struggling to find information? Read on to find out what you need.

Moving to the US and need to manage your finances? Opening a US bank account as a foreigner can be challenging, but we're here to help.

We have made this list of the most expat-friendly banks, where you'll have the best chance of success in opening your new account.

Remember, there are alternative options like the Wise Account for managing your money in USD – more on this shortly.

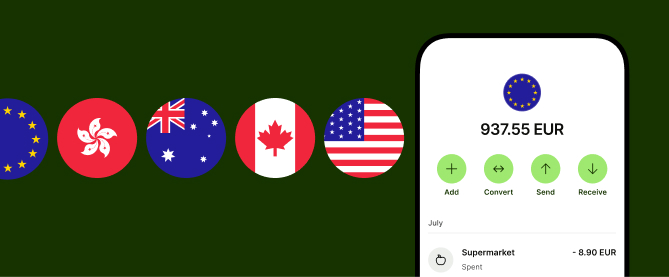

While Wise is not a bank but a Money Service Business (MSB), it’s a great alternative to cover many of your banking needs.

It’s especially useful for anyone who travels a lot, lives or works abroad. So if you’re moving to the US or regularly travel there, this could be the perfect solution.

With the Wise Account, you’ll get all these brilliant benefits:

It’s quick, easy and free to open a Wise Account online. And there’s even a handy Wise app so you can manage everything from your phone.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

Yes, you can open a US bank account as a foreign national. However, you do need to be living there, as most banks will require you to show proof of a US residential address.¹

You’ll also need other documents, which we’ll look at briefly next.

To open a US bank account, you’ll typically need the following:¹

Some banks may ask for more paperwork, such as proof of income or employment.

Now, let’s run through a few of your best banking options as a new arrival in the US:

Bank of America is one of the largest banks in the US, offering a wide range of checking, savings and student accounts.

One of its most popular accounts is Advantage Plus, a checking account with a minimum opening deposit of $100 and a monthly maintenance fee of $12. This is waivable if you meet certain conditions. The account comes with a debit card, access to Zelle and a Digital Wallet.²

Global banking giant Citibank has a full range of checking and savings accounts, plus credit cards, loans and other financial products.

Its Access Account may be a good option for new arrivals in the US. It offers the following features:

The account has a $10 monthly service fee, but this is waived if you make one qualifying bill payment or direct deposit a month, or maintain a monthly balance of at least $1,500.³

HSBC is an international bank, making it one of the best choices for expats looking to get set up in a new country.

In the US, HSBC offers a Premier Checking account. This offers priority services, global support, free everyday transactions and much more. However, you’ll need to have at least $75,000 in your account (or pay in $5,000 a month) or there’s a hefty $50 monthly maintenance fee.⁴

Known as one of the most helpful US banks to deal with, Capital One is also very tech-focused. This makes it a great option if you prefer to bank online and on your phone, and using digital tools.

Its 360 Checking Account is ideal for everyday banking. It’s fee-free, including offering free cash withdrawals at over 70,000 ATMs nationwide. It also comes with a debit card, access to Zelle payments and 24/7 mobile banking.⁵

Owned by JPMorgan Chase, the largest bank in the US, Chase has over 4,700 branches and 15,000 ATMs nationwide⁶. It offers a range of everyday and premium checking accounts, plus dedicated accounts for children and students too.

The Chase Total Checking account is one of its most popular options for everyday banking. It comes with a $12 monthly fee, waivable if you meet certain conditions.

You’ll get access to Zelle to send and receive money, online and mobile banking, and online bill pay features too.

Another of the major US banks, Wells Fargo offers a wide choice of checking and savings accounts, along with other products.

As a new arrival, you’ll probably want to go for the Everyday Checking account. It can be opened with just $25 and has a $10 monthly fee, waived if you can maintain a $500 minimum daily balance (or you’re a young person aged 17-24).⁷

You’ll get access to mobile deposit, Zelle and other digital services, and get a contactless debit card.

The US has a huge number of banks to choose from, including a growing number of digital banks. It can be difficult to know where to start if you’re new to the country, but hopefully this guide has given you a few good leads to follow up on.

However, it’s worth bearing in mind that most of the banks we’ve mentioned here aren’t necessarily the best or cheapest for managing your money internationally.

If you need to send money overseas or spend in another country, the Wise Account could be a better option.

Sources used for this article:

Sources checked on 01-June-2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how to open a foreign currency account in the US? Struggling to find information? Read on to find out what you need.

Considering closing your foreign bank account? Discover the tax implications, benefits, and steps involved in making this decision. Learn more here.

Learn how to close your ADCB account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your UAE bank account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your AIB bank account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your Emirates NBD account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.