Best places to exchange currency without paying huge fees

You're all set for your trip abroad, and the question comes up: where can I exchange foreign currency? In this article, we'll go through all the options & tips.

Planning an overseas trip for work or leisure? The quickest and often cheapest way to get cash while traveling abroad is directly from an ATM.

ATM currency exchange tends to offer good rates, and as long as you can reduce or avoid excessive ATM fees you’ll be able to find an economical option to withdraw cash, more or less anywhere in the world. Instead of asking where is the best currency exchange near me, perhaps the question to ask is where’s the nearest ATM?

This guide walks through how to avoid ATM fees, including non-bank options like the Wise account, which has a linked low cost debit card, making it easier than ever to reduce costs when you spend overseas*.

As we’ve mentioned, ATMs can offer some of the best currency exchange rates out there - but you’ll still need to work out how to avoid international ATM fees to really reap the benefits. So what to look out for?

Do your homework on the various fees charged, and your pocketbook will thank you later. Here’s what you need to know:

This fee is added when you use a foreign ATM. Many banks charge higher fees for international withdrawals. You’ll either pay a flat rate (often between 1 and 5 USD) or a percentage of your total withdrawal (generally between 1-3%).

For example, Bank of America® has a 5 USD fee for most global withdrawals, which can be avoided by using a partner bank - and also adds a 3% charge to all withdrawals¹.

Even where your bank does not have a specific ATM fee, you’ll usually pay an additional ‘conversion fee’ of between 1-3% of the transaction.

It’s an unfortunate hidden surcharge that banks often charge for foreign ATM withdrawals - and indeed when you spend overseas with your card, in person or only.

That means that when you use a bank issued ATM card overseas it’s likely that you’ll pay a combined flat fee for using an ATM network, plus a percentage of the value of the withdrawn cash.

Non-bank alternatives like the Wise account can be a good way to avoid this cost - more on that later.

A surcharge may be added by the ATM as a fee for using the machine. The good news is you’ll be notified on the ATM screen and it will ask your permission to proceed with the transaction.

Your best chance of avoiding this might be to use ATMs at major banks or post offices. Smaller banks and independently owned ATMs mean a higher risk of surcharges.

ATM exchange rates are all tied to the interbank currency rates traded on the global financial market. The rates constantly fluctuate, but will likely hover around the same figure for months at a time.

With a quick search, you can find out what the current exchange rate is. Or just use an online currency converter to find out how much your money’s worth.

That way, when you run across an ATM, you can decide for yourself whether the ATM is providing a fair exchange rate.

Your card is probably linked to over a million ATMs globally through a financial computer system. This is known as an interbank network.

Through the network, you can conduct similar transactions at any ATM inside the network. For example, the Cirrus® network covers cards issued by MasterCard®, Maestro®, and Cirrus®.

If you see one or more of those three logos on an ATM, that means it’s a part of the Cirrus network. Not only that, but each network has an online ATM locator so you can find the nearest in advance.

Look at the symbol on your card to see which network it’s issued on, then use the network’s ATM locator to find the right place to head, to withdraw money conveniently.

For example, there’s a super convenient Visa® ATM locator², MasterCard® ATM locator³, or Amex® ATM locator⁴ available online, or you might be able to find an ATM through your own banking app.

So we’ve now learned all about the international ATM fees which might apply when you use your card overseas, and how to find a convenient ATM. But how do you make sure you reduce or avoid entirely the ATM costs often associated with international use. Here are a few tips.

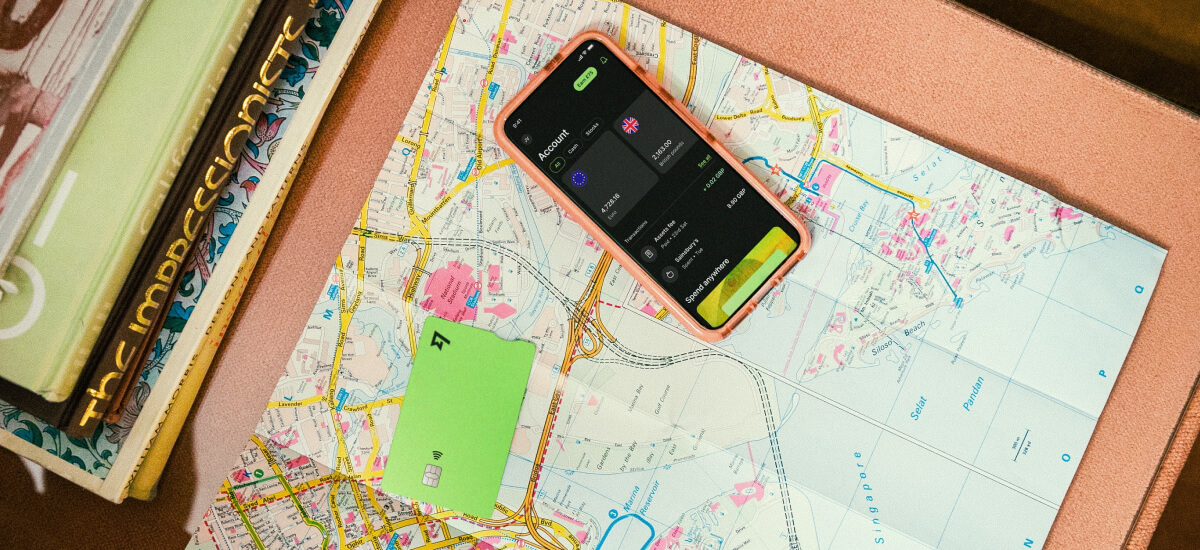

Looking for an alternative to banking to keep your money without a minimum balance? Wise has you covered.

| The Wise Account lets you: |

|---|

|

Get a Wise Account

in minutes!

Some ATMs may offer you the choice of paying in your home currency. This option is called dynamic currency conversion.

For US issued cards, this means you’ll be asked if you want to pay in dollars when shopping or withdrawing overseas. On the surface, it seems like a helpful service, as it means you skip the mental math and see instantly what your transaction is costing in USD.

Unfortunately it’s not so simple. When you accept or choose DCC, you’re giving the foreign ATM or merchant permission to do the currency conversion on your behalf.

The exchange rate you’re offered is highly likely to include significant fees which you might not be able to see in advance. Instead, it’s best to stick with your own bank or card network’s deal and, therefore, always choose to pay in the local currency.

While it’s never a good idea to travel with loads of cash on hand, you can avoid frequent ATM fees by withdrawing large amounts of cash at one time. Try to map out a rough budget in advance.

Planning your withdrawals will mean you don’t end up with a lot of spare cash at the end of your trip.

US banks often work together with banks and ATM operators overseas to reduce or waive international withdrawal fees.

This means that in some cases, when you’re traveling, you can find a friendly ATM on nearly every continent. Check with your bank in advance to know which ATMs to use, to reduce or avoid extra costs when you make overseas withdrawals.

Now you have the facts. When you go abroad, skip the kiosk and head straight to an ATM. They’re always open for business, they’re everywhere, and they’re usually your most cost-effective option. Pick a low cost ATM card from your preferred bank, or skip banks entirely, and open a Wise Account.

Accounts support 40+ currencies for holding and exchange, and come with linked low cost debit cards, making it easier than ever to avoid international fees when you spend overseas*.

Sources checked on 05.09.2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

You're all set for your trip abroad, and the question comes up: where can I exchange foreign currency? In this article, we'll go through all the options & tips.

Heading abroad? Here’s everything you need to know about ordering Canadian dollars in the US.

Going abroad and in need of foreign currency? In this article, we'll explore where to exchange currency - from good deals to the places you should avoid.

Heading abroad? Here’s everything you need to know about ordering pesos with Chase bank.

Heading abroad? Here’s everything you need to know about ordering pesos with Wells Fargo.

Heading abroad? Here’s everything you need to know about ordering euros with Bank of America.