Your Wise Card Transactions: Understanding Invalid Disputes

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

ZA Bank becomes the first Bank in Hong Kong to launch international transfers with no FX mark-ups or hidden fees using Wise Platform

We are excited to announce that Wise has partnered with the No 1 virtual bank¹ in Hong Kong, ZA Bank, to give their customers quick, convenient and low cost international money transfers with no hidden fees, available directly from the ZA Bank app. The integration is powered by Wise Platform’s easy-to-use APIs..

This partnership makes ZA Bank the first bank in Hong Kong to provide international money transfers with no exchange rate mark-ups and full-price transparency. It also marks Wise Platform’s first launch in Hong Kong, with ZA Bank being its first neo-bank partner in East Asia.

Using Wise Platform, Wise’s infrastructure offering for banks and non-banks alike, ZA Bank users will be able to make cheap, fast and transparent international money transfers from HKD to 14 currencies, including AUD, USD, GBP, CAD, SGD and more within the ZA Bank app.

Most people are unaware of the actual cost of sending money abroad using their traditional banks until after their transactions are complete, due to a widespread lack of transparency around fee structures. A recent study² found that a whopping 86% of respondents in Hong Kong could not identify the true cost of sending money abroad — which is often both the upfront transaction fee plus a hidden markup in the exchange rate.

With this in mind and a strong focus on customers’ needs, our Wise Platform team supported ZA Bank through all stages of the build to ensure a seamless experience for their banking platform.

Calvin Ng, Alternate Chief Executive and Co-Head of Retail Banking at ZA Bank, said:

“We are delighted to partner with Wise, the UK-listed global tech company specialised in cross-border transactions, and become its first Hong Kong banking partner to launch this splendid experience. We always understand that high fees and low transparency are users’ common pain points in remittance. As the industry Game Changer, we successfully tackle these problems and now offer a hassle-free service to users, without worrying about any FX markup, hidden charges, and transfer progress. We believe that the combined strengths of ZA Bank and Wise will bring users unrivalled service and convenience. We are looking forward to enriching our offerings in the era of ‘Banking 2.0’”.

Vinay Palathinkal, Regional Head, Wise Platform said:

“Bringing Wise Platform to Hong Kong takes us another step closer to achieving our mission of making moving money faster, cheaper, and more transparent for everyone, everywhere. We’re thrilled to have ZA Bank onboard as our first partner in Hong Kong, which would enable millions of more Hongkongers to access faster, cheaper international transfers from HKD.

“Though an email can travel around the world in a matter of seconds, moving money internationally is still incredibly cumbersome, slow, and expensive. Wise and ZA Bank have a shared vision to change the status quo and provide a fairer, more transparent banking experience for everyone.”

Learn More About Wise Platform

Wise Platform lets businesses, banks and other financial institutions integrate the power of Wise into their own platforms via the Wise API to offer cheaper, faster, easier payments to their own customers. Globally, Wise Platform is live with more than 50 bank and non-bank partners across the world, including Monzo in the UK, N26 in Germany, Shinhan Bank in South Korea and Aspire in Singapore.

Wise Platform also comes pre-integrated in core banking platforms like Temenos, Mambu and Thought Machine.

About ZA Bank

ZA Bank Limited (“ZA Bank”), licensed by the Hong Kong Monetary Authority (“HKMA”) on 27 March 2019, is one of the first batch of virtual banks in Hong Kong.

ZA Bank was established by ZhongAn Technologies International Group Limited (“ZA International”). With its “Community-Driven” approach, ZA Bank encourages users to directly contribute to its product development and design processes, helping the bank create innovative services that better serve the needs of Hong Kong customers.

¹“No.1” is defined by ZA Bank’s leading position in the virtual banking industry in terms of customer deposits, loan & advances and number of users as of 30 Jun 2022. Source: Annual results announcements of eight virtual banks.

²Independent survey commissioned by Wise and conducted by Coleman Parkes Research. This took place between January 2022 to February 2022 with 1,000 consumers in Hong Kong.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...

GMO Aozora Net Bank, Ltd. partners with Wise Platform in Japan

Wise has revealed a complete visual makeover, featuring a fresh green palette Our new look and feel features a bold new font, imagery and universal symbols ...

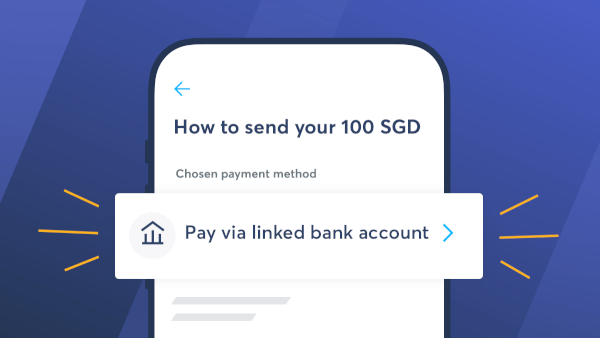

Pay your Wise transfers easily with a linked bank account powered by eGIRO. Quick payments without leaving the Wise app.

We’re excited to announce Tiger Brokers Singapore has integrated with our Wise Platform to bring cheaper, faster international transfers.