Review of Statrys: Great Business Account for Singapore Companies?

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Singapore has long been a leader in digital innovation, and the move toward e-invoicing is its latest step forward. Since its launch in 2019, the nationwide InvoiceNow network (built on the secure Peppol framework) has become the go-to channel for submitting invoices to government agencies¹.

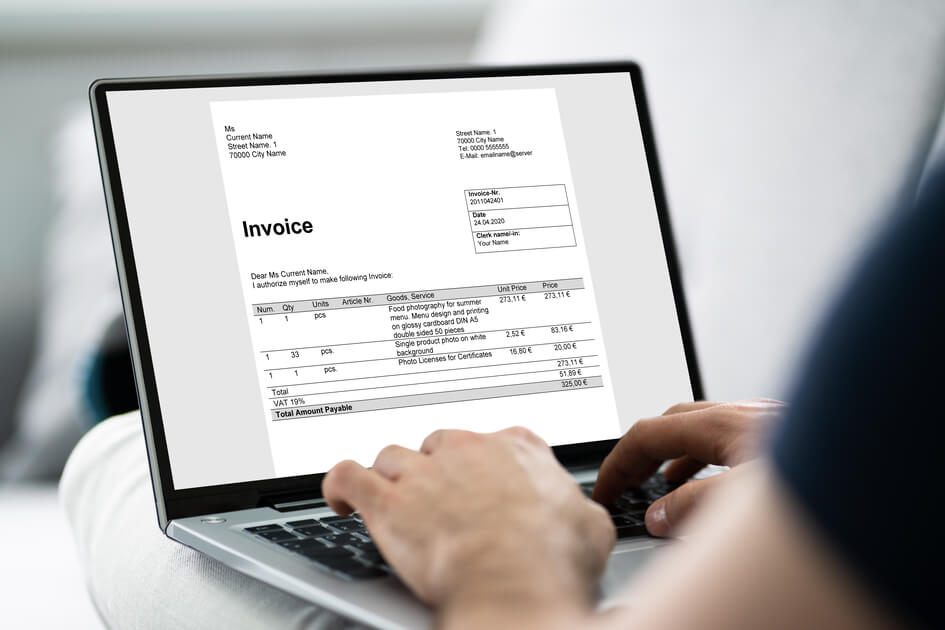

From 2025, all GST-registered companies will be required to use e-invoicing, making the shift from paper or PDF invoices no longer optional.

Xero makes this transition seamless with its built-in InvoiceNow. This guide explores what the switch to InvoiceNow means for Singapore businesses, and how to set it up with Xero accounting platform.

We'll also elaborate on how businesses using Xero could potentially save more on international payment fees when they use a Wise Business Account to manage their money.

| Table of contents |

|---|

What began as a voluntary initiative is now moving into a phased rollout with clear timelines for companies to comply.

Currently, e-invoicing for both B2B and B2G transactions is not mandatory, but the Infocomm Media Development Authority (IMDA) strongly recommends it. More importantly, invoices issued through InvoiceNow are fully valid for tax purposes.

Timeline for mandatory InvoiceNow adoption

The Inland Revenue Authority of Singapore (IRAS) has also announced plans to expand InvoiceNow. They plan to start with a voluntary soft launch that allows GST-registered companies to transmit invoice data directly to IRAS through InvoiceNow solutions.

This requirement will be introduced gradually as per the following schedule²:

The strategic setup of these milestones reflects the Singapore government’s commitment to making e-invoicing a standard while allowing businesses time to adjust and adapt.

Benefits of e-invoicing for business

As a key driver of business digitalisation in Singapore, InvoiceNow delivers efficiency gains at a national level. Today, the network connects over 60,000 businesses and is supported by over 200 service providers³.

It’s commendable how InvoiceNow levels the playing field for many SMEs by providing access to automated, efficient processes once reserved for large corporations. Quite impressively, these advantages go beyond basic compliance.

Key benefits you’ll notice once the system is in place are:

Sync your Wise Business account with Xero or other popular accounting platforms today to eliminate manual data entry and cut down on cross-checks.

| ➡️ Learn more about connecting Wise to your accounting |

|---|

As noted earlier, InvoiceNow uses the Peppol-based e-delivery network, initially developed in Europe, to send invoices directly between finance systems. The features that stand out in it are:

High-security infrastructure powered by Peppol

The strength of this framework lies in its security and reliability of the Peppol network. It ensures trusted exchanges with the following:

These measures guarantee that e-invoices and related documents are delivered safely and directly to the intended recipient.

Integration with smart features of Xero

Xero’s integration with InvoiceNow automates many accounting workflows for SMEs:

In short, Xero and InvoiceNow make invoicing less draining than before.

They reduce manual work while keeping everything secure and compliant.

💡If you’re comparing Xero with other accounting tools, check out our guide on QuickBooks vs Xero in Singapore for a deeper look.

Registration and initial setup

The table below shows what registration and initial setup for InvoiceNow using Xero should look like:

| Steps | Requirement | Notes |

|---|---|---|

| Xero subscription | Must have an active Xero plan (any tier) | InvoiceNow capability is part of the standard Xero offering in Singapore. |

| Singapore UEN and CorpPass | Business must have a valid UEN and access to CorpPass | CorpPass is used to authenticate the business during registration. |

| Registration via Invoici | Use the Xero-integrated Invoici app (via my.invoici.net) | Log in with Xero, select your organisation, and proceed to register. |

| CorpPass authorisation | Authorise using CorpPass (often via QR code / SingPass) | This verifies your business identity with IMDA standards. |

| Receive Peppol ID and email address | System issues a unique Peppol ID and Xero InvoiceNow email | All Peppol IDs in Singapore start with the prefix “0195:SGUEN…”⁴ |

Sending and receiving e-invoices

The subsequent steps are:

💡You can also create and send your own invoices to your clients with Wise Business

Best practices for adoption

Keep the following pointers in mind during implementation:

Peppol international (PINT) specifications

The Peppol International (PINT) Billing specification for Singapore (PINT-SG) is designed to meet the country’s specific requirements. It also includes its Goods and Services Tax (GST) framework. This supports local payment methods such as PayNow and Giro, ensuring smooth integration with domestic business practices.

As e-invoicing adoption expands, cross-border trade has become a key priority. The broader PINT specifications enable businesses to send e-invoices internationally without adapting them to each country’s domestic rules. This global standard simplifies international invoicing by handling different taxes and currencies, making it easier and more reliable for companies to enter new markets.

Expanding the digital process

The network is no longer limited to e-invoices. Businesses can now send and receive documents like electronic Purchase Orders (ePOs) and Invoice Responses. This makes the whole buying and payment process more digital, resulting in less manual work and enhanced supply chain efficiency.

It doesn’t just end here. The framework tries to stay in the tech loop and introduce new features for all its users.

Xero also supports InvoiceNow with features like direct bank feeds, tools like Hubdoc that scan and read receipts, and easy bank reconciliation. These tools give businesses a quicker, safer way to manage invoices, while supporting Xero’s aim of helping SMEs grow⁵.

Here’s what you can avail with each of these features:

Note that this framework includes compliance support. It updates automatically with Singapore tax rules, including GST changes, so businesses can stay compliant without extra effort.

With Singapore pushing forward its digital invoicing goals through InvoiceNow, businesses can enjoy smoother and accurate financial workflows. But while Xero and InvoiceNow take care of the invoicing process, the fact remains that sending money overseas to pay your invoices can still be tricky. Slow transfers, high conversion fees, hidden exchange rate markups, other hidden charges and complicated processes are common headaches.

| 💡Whether you're handling one-off invoices, recurring payments, or mass payouts, Wise Business makes it easy to simplify your financial operations and maximise profits. |

|---|

➡️Start Paying Overseas Invoices for Less with Wise Business

Sources:

Sources checked on 4 October 2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Thinking of investing in Singapore properties without having to deal with high ABSD? Read this complete guide to buying commercial property in Singapore.

There are two ways to close a company in Singapore: strike off or wind down. This article guides you through both processes.

Discover HubSpot's 2025 pricing plans, compare features across Marketing, Sales, Content, and Service hubs, and learn how to optimise costs with Wise Business.

Discover how much Telegram Business Pricing Plans in Singapore cost and everything you should know before building your business on Telegram.

Looking for a corporate e-learning platform? Discover LinkedIn Learning corporate pricing plans, features, and how they stack up to competitors like Udemy.