Your Wise Card Transactions: Understanding Invalid Disputes

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

An independent researcher compared Wise to the big banks and travel cards in Singapore.They found that we're up to 7x cheaper for sending, spending and withdrawing money abroad.

The research was carried out in Sep and Oct 2019 by market research agency, Consumer Intelligence, in conjunction with Wise. The data was gathered through publicly available pricing information and mid-market rate comparison data provided by Reuters.

The different fees recorded for this price comparison include:

^The costs collected are made up of both the foreign transaction fee and any exchange rate mark up.

Research took place on transfers from SGD to AUD, EUR, GBP, HKD, INR, JPY, MYR, THB , and USD routes. The companies compared were Citibank, DBS, HSBC, OCBC, Standard Chartered, UOB, and YouTrip.

Fees to withdraw $250 using a debit card every month

SGD → AUD: Wise debit card is 8x cheaper

SGD → MYR: Wise debit card is 8x cheaper

SGD → INR: Wise debit card is 9x cheaper

SGD → EUR: Wise debit card is 7x cheaper

Fees to make a $250 POS transaction using a debit card

SGD → AUD: Wise debit card is 2x cheaper

SGD → GBP: Wise debit card is 2x cheaper

SGD → MYR: Wise debit card is 4x cheaper

SGD → THB: Wise debit card is 3x cheaper

Fees to make a $1,000 POS transaction using a debit card

SGD → AUD: Wise debit card is 2x cheaper

SGD → GBP: Wise debit card is 2x cheaper

SGD → MYR: Wise debit card is 4x cheaper

SGD → THB: Wise debit card is 3x cheaper

Fees to send $250 using Wise

On average, it’s 12x cheaper to send money internationally with Wise compared to the big banks in Singapore.

SGD → AUD: Wise is 15x cheaper

SGD → GBP: Wise is 15x cheaper

SGD → EUR: Wise is 17x cheaper

Thinking of using Wise? Check out our product disclosure statement first. This advice has been prepared without taking account of your individual objectives, financial situation or needs. Before acting on the advice, you should consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. Wise Singapore Pte. Ltd. (Unique Entity Number 201422384R) is registered at 12 Kallang Avenue, #03-20 Aperia, Singapore 339511. TransferWise Limited is registered at 6th Floor, TEA Building, 56 Shoreditch High Street, London, E1 6JJ, United Kingdom and is the parent company of Wise Singapore Pte. Ltd. In Singapore, Wise is licensed by the Monetary Authority of Singapore (“MAS”). For full conditions of use refer to wise.com/legalstuff.

The Wise Platinum debit Mastercard® is issued by is issued by Transferwise Singapore Pte Ltd. pursuant to license by Mastercard Asia/Pacific Pte. Ltd. For full conditions of use refer to wise.com/legalstuff. Mastercard is a registered trademark, and the circles design on the card is a trademark of Mastercard International Incorporated.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...

GMO Aozora Net Bank, Ltd. partners with Wise Platform in Japan

Wise has revealed a complete visual makeover, featuring a fresh green palette Our new look and feel features a bold new font, imagery and universal symbols ...

Wise Platform partners with leading virtual bank ZA Bank

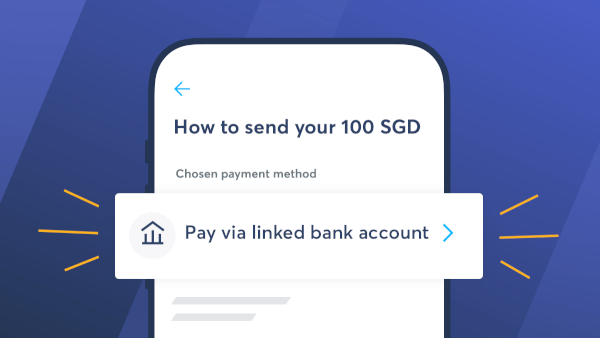

Pay your Wise transfers easily with a linked bank account powered by eGIRO. Quick payments without leaving the Wise app.