Wise vs Western Union: Which is Cheaper for Malaysians? (2026)

Transferring money from Malaysia? Compare Wise vs Western Union fees and exchange rates for 2026. See which provider is cheaper for your next transfer now.

Instarem1 is a popular, safe and simple way to send money from Malaysia to bank accounts in 60+ countries. Set up your transfer online or in the Instarem app, to send money to friends and family around the world.

This guide will walk through how to use Instarem in Malaysia, including a review of the key features and fees. Plus, to help you find the best provider for your requirements, we will also take a look at an alternative as a comparison - low cost international payments with Wise. Learn more about Instarem and check you’re getting the best available deal, here.

| Table of contents |

|---|

Instarem is a digital money transfer service which lets customers in Malaysia, as well as countries and regions including the UK, Eurozone, Singapore and Australia, send money overseas. Most transfers are deposited in bank accounts, but Instarem does also offer payments to e-wallets and for cash pick up in destinations like the Philippines.

Instarem is founded by the same people who are behind NIUM - a Singapore based business transfer company.

When you send money with Instarem Malaysia, you set up your transfer online or in the Instarem app, pay with bank transfer or FPX, and then you can simply sit back and wait for your money to be deposited. Eligible transfers earn InstaPoints2 which you can then use for discounts against future payments if you’d like to.

Yes. In Malaysia Instarem is the trading name of NIUM which is regulated by the Central Bank of Malaysia. It’s a safe service to use. Usually your money is sent immediately to your recipient when you use Instarem - but if there’s any delay, your funds are held in a separate account to Instarem’s own operating capital, for safeguarding purposes.

You can send money with Instarem Malaysia to 60+ countries, in currencies including EUR, SGD, USD, CAD, HKD, SGD and AUD. For some destination countries you can only send the official currency of that country, but there are many destinations where you can also send major currencies like USD alongside the country’s primary currency.

If you’re a Singapore resident you’re able to apply for an Amaze card from Instarem. This is a payment card which lets you pay from linked cards when you’re overseas, earning InstaPoints. However, this product is not marketed for Malaysian customers.

| 👀 Wondering about how Wise fares against Instarem? Check out the full comparison of Instarem vs Wise here. |

|---|

If you’re sending money to a bank account overseas it makes sense to check out a few providers to make sure you get the best deal in terms of both cost and convenience. Here’s a roundup of how to send money with Instarem, what it’ll cost and what exchange rate you get

The exchange rates used by Instarem are decided by taking the mid-market exchange rate you’ll find on Google, and adding a small markup. The markup is - in effect - an extra fee.

Instarem rates may include a smaller markup than that used by a bank. However, as with any service, it’s well worth comparing a few different providers to make sure Instarem offers the best value for your particular currency route.

When you start to use Instarem you’ll first model your transfer which will allow you to see the fees and exchange rate which will be used. Instarem fees vary depending on which currency you’re sending, and the destination country. Promotional offers may reduce or waive the fee you pay to transfer - at least at first. Bear in mind though, that exchange rate markups still apply, which can push up the costs overall.

Instarem payments can take a day or two to arrive in your recipient’s account. Ultimately, the processing time depends on the currency and country you’re sending to - but 2 business days is around the average you can expect.

Ready to send money overseas? Here’s how to get started with Instarem.

Promotional offers apply frequently to new users which can lower the transfer costs. However, exchange rates include a markup on the mid-market rate you’ll find on Google. That’s why it’s important to check out several providers before you decide which to use for your international transfer. We’ll highlight an alternative option - Wise - next.

Before you send your transfer, compare the fees and exchange rate offered by Instarem against Wise.

While Instarem adds a markup to the exchange rate used for international transfers, Wise uses the mid-market rate - the one you get from Google - and splits out any fees so they’re easy to see and compare. Currency conversion with Wise can be as little as 0.33%.

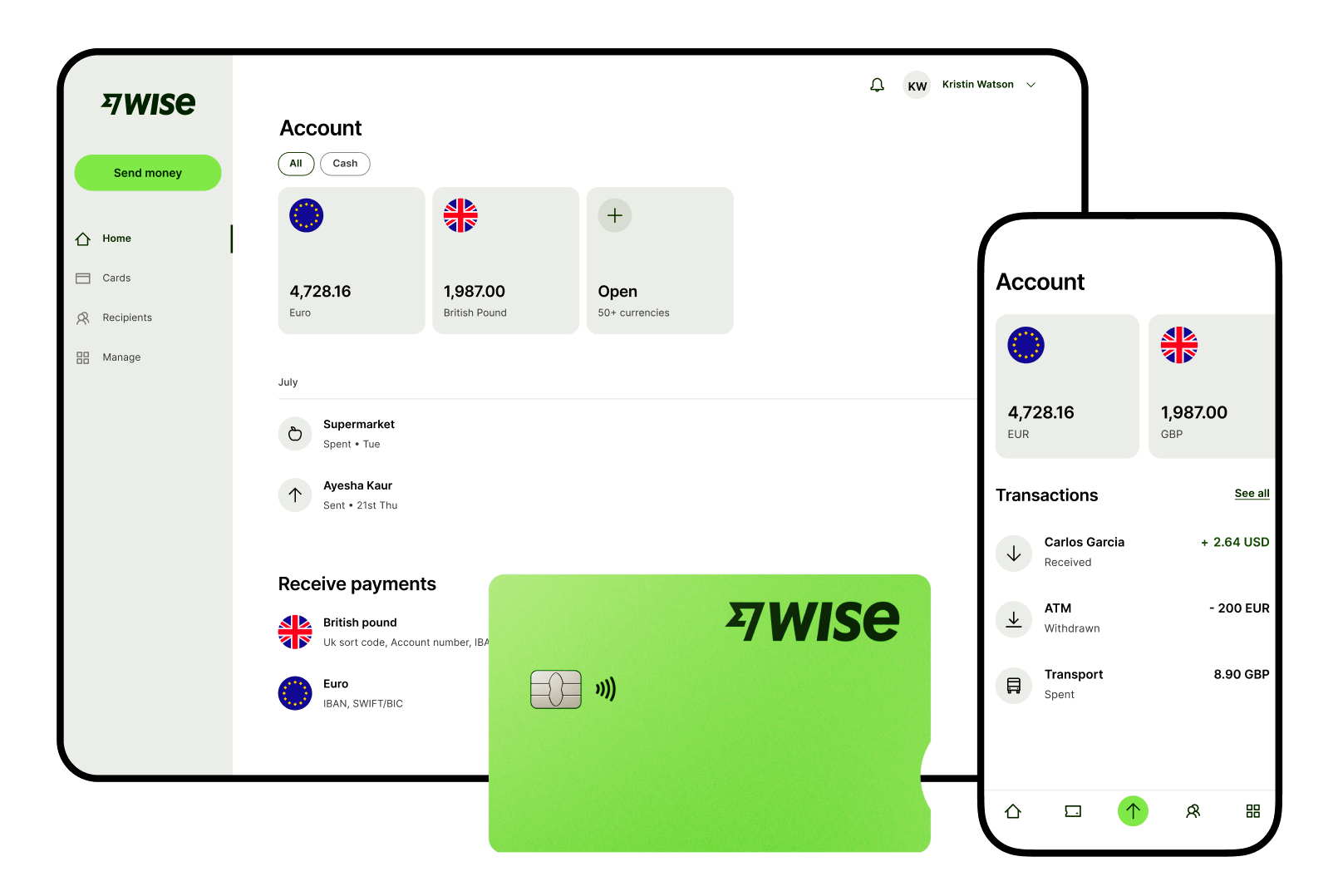

Send money to 140+ countries with Wise, with fast or even instant deposits to bank accounts. Set up your payment online or in the Wise app, pay using FPX, bank transfer or your card, and your money will be on the way in no time.

Looking for more? Wise also offers accounts which support 40+ currencies for holding and exchange and the Wise card for spending and withdrawals in 150+ countries around the world. Whenever you need to convert from one currency to another you get the mid-market exchange rate with a low conversion fee from 0.33% - usually cheaper than using your bank card for online and in person spending in foreign currencies.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Shopping around is good practice before you send a payment overseas. After all you need to check your provider is safe, reliable and the very best deal out there. This guide walks through how Instarem works and what their costs are so you can decide if it’s right for you. Before you confirm your transfer, look at what instarem will cost you for your transfer compared to alternate providers like Wise to make sure you’re getting the lowest fee and the fastest delivery time available.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Transferring money from Malaysia? Compare Wise vs Western Union fees and exchange rates for 2026. See which provider is cheaper for your next transfer now.

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Learn more about how to change Maybank transfer limits as well as transfer time, fees, and more when making an online transfer.

Learn more about how to make an Bank Islam online transfer including limits, transfer time, and fees.

Learn more about how to make an Affin Bank online transfer including limits, transfer time, and fees.

Learn more about how to use Lulu Money in Malaysia, as well as benefits, fees, and more.