Find IFSC and MICR codes for Citibank India: Pune branch

Learn how to find the right IFSC for your bank branch, and get a faster and cheaper way to send money to India.

Citibank India Pune IFSC code

Here are all the details you’ll need for this branch.

If you’re sending or receiving money, always remember to check the details with your bank or recipient first. Using the wrong IFSC code can lead to payments failing, or being sent to the wrong destination.

Citibank India Pune IFSC code

Branch | Pune |

Bank | Citibank India |

IFSC code | CITI0000005 |

MICR code | 411037001 |

Address | 2413, Kumar Capital, East Street, Pune - 411001 |

District | Pune |

State | Maharashtra |

What is an IFSC?

IFSCs (Indian Financial System Codes) help Indian banks identify individual bank branches. You’ll need to use an IFSC code if you’re sending money to India from abroad, or domestically within the country.

IFSC codes are issued by the RBI (Reserve Bank of India), and are used for any online payments on the NEFT, IMPS and RTGS networks. They’re usually made up of 11 characters, with the first 4 representing the bank (like Citibank India), and the last 6 representing the branch (like Pune).

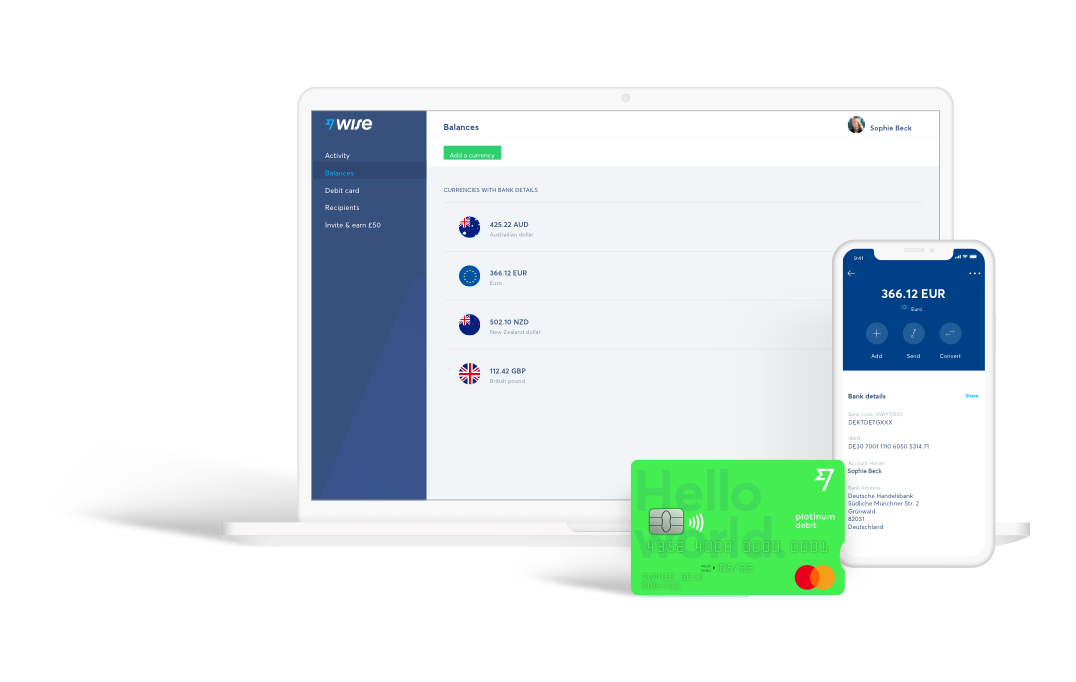

Wise: the faster, cheaper way to send money to India

Sending payments from one Indian bank to another can be easy enough. But sending money to India from abroad is a different story. Thanks to hidden fees and marked-up exchange rates, the process can be very expensive and time-consuming.

With Wise, you'll always get a great deal. We use the best possible exchange rate (just like the one you'd see on Google), with a single, low fee. No surprises, and no marked-up exchange rates. With our efficient process, we can send money faster and cheaper — passing the savings onto you.

Try Wise for fast, secure and cheap cross-border payments. All over the world.

Send money to India with just an IFSC and account number

Join over 5 million people who save when they send money at the real exchange rate.

Where to find an IFSC code on a cheque

You can usually find your bank’s IFSC and MICR codes in your cheque book, or on the front page of your passbook.

IFSC and MICR codes — what’s the difference?

IFSC and MICR codes have a very similar purpose — they both help to identify individual bank branches in India. They differ in how they do this, though.

IFSC (Indian Financial System Codes) are issued by the RBI (Reserve Bank of India) to identify bank branches within the country. Every branch has one, and you can use them when sending money online to someone in India.

MICR (Magnetic Ink Character Recognition) codes also help to identify bank branches, but they’re only used when processing cheques. These codes are machine-readable, which means that banking systems can quickly identify the destination branch when you deposit a cheque. You won’t need to use an MICR code when sending money online.