Complete Guide to Revolut in India: Upcoming Launch and Services

Revolut is not yet available in India, but you can join the waitlist. Learn about their plans for India and discover Wise as an alternative for money transfers.

UTR number stands for Unique Transaction Reference number. It is used for identifying a particular transaction in India. It is a unique number that is generated for recognizing any fund transfer and is created by the bank that facilitates the transfer.

You will find the UTR number in your bank statement listed as Ref no under the transaction details. It may look something like XXXXR520190109599036XX. The starting characters will vary depending on your bank. The format of the UTR and its components have been explained further in this article.

If you are considering sending money to India, Wise can help you save a lot. Before making your next transaction, compare exchange rates to check the exact amount you will be receiving with leading banks and service providers.

Do not confuse UTR number in India with that in the UK. UTR code in the UK stands for Unique Taxpayer Reference number, which is not similar in any way to the UTR number in India.

The main purposes of a UTR number is to identify and monitor financial transactions. UTR number can be used to track your fund transfers if they are stuck, taking more time than usual, or if you just want to refer an earlier transaction.

In India, UTR is generated when transferring money between two bank accounts. There are two methods of transferring funds between accounts held in different banks in India. They are NEFT and RTGS. UTR is generated both in NEFT and RTGS transactions.

NEFT stands for National Electronic Funds Transfer. NEFT transactions are processed in batches and therefore the fund transfer is not immediate. Presently, NEFT operates in half hourly batches from 8 am to 7 pm on weekdays and working Saturdays.

RTGS stands for Real Time Gross Settlement and under RTGS the fund transfers are immediately processed. Once you transfer funds using RTGS, it is deposited within 2 hours in the beneficiary account. It is the fastest method of inter-bank fund transfer. However, RTGS can be used only if the fund transfer value is more than Rs. 2,00,000.

UTR number is 22 characters long for RTGS, and 16 characters long for NEFT. The format of the UTR number for RTGS transactions is “XXXXRCYYYYMMDD########” where:

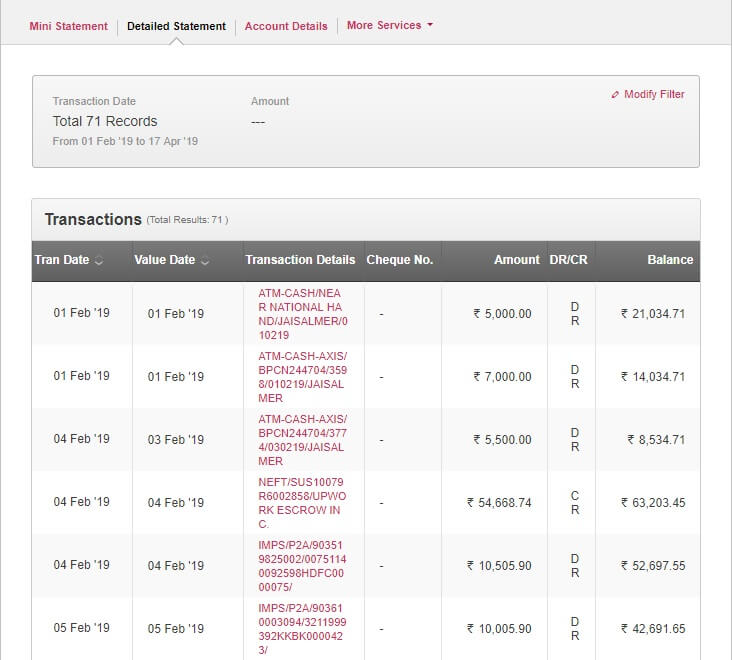

To find the UTR number on any transaction, you can visit the detailed account statement in the online banking section. To know the UTR for any transaction, click on the transaction details or narration. A detailed description of that transaction will be displayed. You can identify the UTR by its format. The UTR will be displayed in the statements of all banks like SBI, ICICI, HDFC, AXIS etc.

For example, AXIS bank displays the transactions as shown below:

Clicking on the transaction details would display a pop up with the UTR reference for the specific transaction. You can use this UTR to follow-up the status of the transaction.

There are two ways you can check the status of a transaction with UTR:

Unlike banks, Wise uses real mid-market exchange rates as seen on Google, and has fixed transparent charges. Wise makes international transfers a breeze, and can end up saving a lot for you on every transaction. Make sure to compare Wise vs leading Indian banks before making your next international transaction.

Open your free Wise account now

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Revolut is not yet available in India, but you can join the waitlist. Learn about their plans for India and discover Wise as an alternative for money transfers.

Learn all about NRI accounts- NRE and NRO, what do they mean, how are they different, how to send money to them, and how can you open one. Know more.

Find out how Public Provident Fund (PPF) can work for you if you are an NRI. Learn about the benefits of opening a PPF account, and how to open one. Know more.

Understand the tax implications for NRIs selling property in India. Learn about you TDS is computed, and how can you use it to your advantage. Know more.