Complete Guide to Revolut in India: Upcoming Launch and Services

Revolut is not yet available in India, but you can join the waitlist. Learn about their plans for India and discover Wise as an alternative for money transfers.

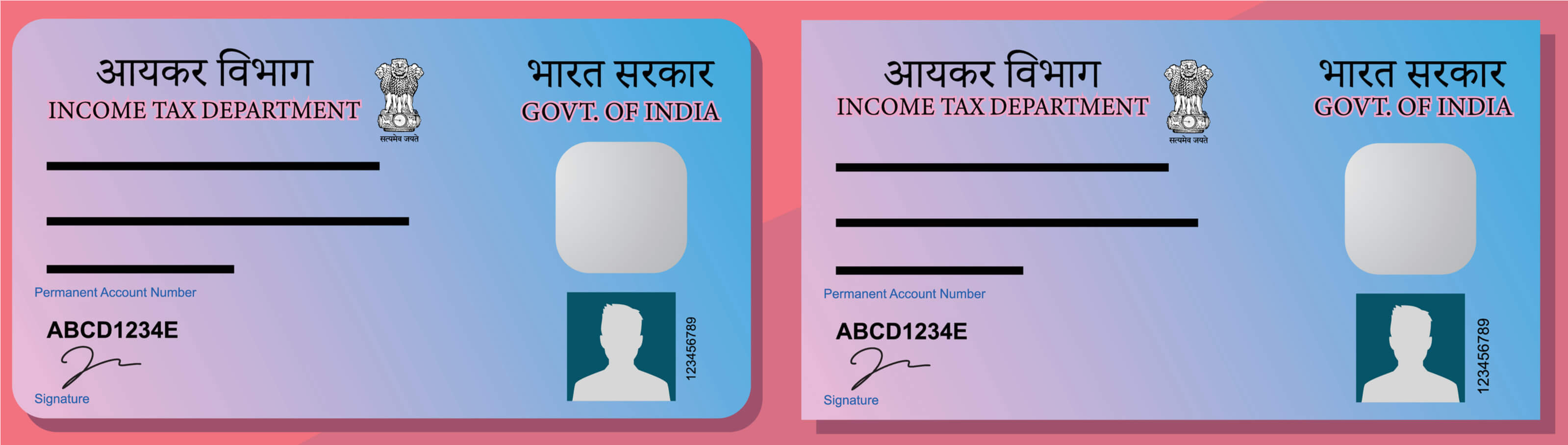

Whether you are going to the bank, doing your taxes, making a sale or verifying your identity in India, you are likely going to be asked for your PAN card.

But what is a PAN card, and how does it apply for Non-resident Indians? Read on to learn about the PAN card for NRIs.

| 📝 Table of contents |

|---|

Let’s start with what a PAN card is in India. The PAN is short for Permanent Account Number.

It is a unique identification given to tax paying individuals and is made up of a combination of English letters and numbers.

The number is presented in the form of a card with your photo on it, and so it becomes a PAN card. The PAN card is issued by the Income Tax Department in India to those that apply for one.

| ⚠️ A PAN card is not automatically issued to residents or taxpayers, instead all individuals with financial transactions have to apply for one. |

|---|

A PAN or PAN card is necessary for any individuals who are earning income or dealing with finances in India.

The income tax department of India has made it so that a PAN has been made required for all the following transactions, and more:

And since the PAN card is government issued, it can also be an acceptable form of identification for all government and non-government institutions.¹

| ℹ️ Who is an NRI? A citizen of India, or person of Indian origin, who resides outside of the country and is in India less than 182 days a year.² |

|---|

So if you are a Non-resident Indian (NRI) and are doing either of the following, you are required to have a PAN:

A PAN card is required especially for items such as selling a car, two wheeler, or immovable property valued at 10 lakhs or higher.³

Once you are issued a PAN card, it is valid for life and does not need to be renewed. Even if you change your address. Also, you can not hold more than one PAN under your name and identity. Doing so can lead to a ₹10,000 fine.

Let’s take a look at how an NRI can apply for a PAN card.

Applicants for a PAN card are required to fill out Form 49A and provide supporting documents.

The easiest way to apply for a PAN card for NRIs is to fill out the online application.

| ⚠️ There is also an ePAN option but you may be required to meet the following criteria to complete this faster issuance application |

|---|

In any case, once you have completed the online application, you will be asked to submit supporting documents to verify your identity and address.

Here is a quick step by step guide on applying for a PAN card. Note that you can’t move to the next step without completing the previous one.

You can choose to do your application through NSDL or UTITSL. Both will help get your PAN full and complete application processed and issued.

Another way to apply for a PAN card is to head to a PAN Card Application Centre in person in India.

You can still download the application online to complete and bring to the centre, along with your documents.⁴

| 🔔 Get exchange rate alerts from Wise, send money to India at the perfect time |

|---|

Here are a list of documents you will need if you are applying for a PAN card as an NRI:⁶

A foreign address is allowed for foreign citizens or NRIs if there is no proof of residence in India.

Learn more about which documents are permitted on theIncome Tax Department of India website.

Foreign citizens will have to go through a similar process as Indian citizens, but will have to complete the Form 49AA. Here is how to do it:⁵

Foriegn citizens can submit their foreign passport, PIO card or OCI card as part of their proof of identity documents.

The time it takes depends on how you have applied for the PAN card. If you have applied for an ePAN, it is possible to get a PAN number instantly.

In other cases with an online application, it may take 2 weeks or longer to be issued a PAN card. Check with your PAN card processing centre or track your application on the NSDL or UTITSL websites.

The PAN card issuance fee depends on if you are applying from within India or not. Here is how much it costs:⁷

| Address on Application | Fee |

|---|---|

| Mailing address is within India | ₹107 |

| Mailing address is outside India | ₹994 |

You can pay for the PAN card application fee by:

Save money the next time you are sending money from India with Wise online, or with the Android/ iOS app

Wise is FCA regulated, and used by over 10 million people around the world to send money overseas. ise is the safe, secure and fast way to send money online.

Wise uses only the mid-market rate for global money transfers, and sends money directly to bank accounts globally. All you have to pay is one low transfer fee. That’s it.

If abroad, you can get the Wise multi currency account that lets you hold multiple currencies, including Indian Rupees, and gives you a card to swipe, spend and receive money from all over the world.

Open your free Wise account now 🚀

Sources used for this article:

All sources checked as of 11 August 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Revolut is not yet available in India, but you can join the waitlist. Learn about their plans for India and discover Wise as an alternative for money transfers.

WhatsApp UPI for India: Can you send or receive money international? Discover limits, safety & Wise as a global transfer alternative.

Complete review of Vance Money Transfer services to India in our guide to that covers their features, fees, and supported countries.

विदेश पैसे भेजने के आसान तरीके सीखें। नकद, बैंक ट्रांसफर, और Wise जैसे ऑनलाइन विकल्पों की जानकारी। फीस और एक्सचेंज रेट समझें।

Review of the best banking choices and alternatives for NRIs in New Zealand with our guide for Indian Expats living in New Zealand.

Complete guide to TCS applicable when remitting from India to cover foreign travel such as for overseas tour packages. We go over the TCS rate and how to claim.