Best Credit Card for Airline Miles in India (2026): Features & Charges

We compare the best credit cards in India for frequent flyers, from co-branded airline cards to flexible reward programs like Axis Atlas and Amex.

The Wise Travel card lets you hold 40+ currencies and spend at the interbank exchange rate with no forex markups or hidden fees - now available to order for free (Limited time offer, while stocks last).

Order your free Wise Travel card 💳

Indian Overseas Bank, or IOB for short, was started almost 100 years ago to help make transactions and commerce easier in the South Asia region.

But if you want to send money using IOB today, it can feel more like a challenge compared to modern ways of sending money globally.

Read on to learn more about how IOB handles overseas money transactions from India and if there are other better options out there.

| With an award-winning app, Wise lets you send money to 150 countries with just one low transfer fee and at the real exchange rate 💸 |

|---|

Open your free Wise account now

The best option to send money to India or from India with Indian Overseas Bank is through a wire transfer. IOB does offer demand drafts, but a SWIFT or wire transfer would be easier and faster to complete.

IOB is a member of the SWIFT system which lets banks send money globally. Each bank has a specific SWIFT code, which you will need to get from your beneficiary..

To get started on sending money abroad, you will have to go down to an IOB branch. If you are an existing IOB account holder the process should be easier to register your transfer. If you are not, you may be required to open an account with IOB to send your overseas transfer.

Any money sent out of India is seen as an outward remittance in the eyes of the bank, and gets the applicable charges. Check out the section below on charges and fees to know how much it may cost you.

But, if you are an Non-Resident Indian (NRI) trying to send money to India, IOB makes that process easier with an NRI remittance process for the following currencies:

| US dollar | Australian Dollar | Canadian Dollar | New Zealand Dollar |

| Singapore Dollar | Hong Kong Dollar | Danish Kroner | Norwegian Kroner |

| Great Britain Pound | Japanese Yen | Swiss Franc | Euro |

Inward remittances to India will need to be done through the same SWIFT system with IOB.¹

Before sending money abroad, make sure to check if you're getting the best deal with Wise's honest comparison tool

You will need to go to an IOB branch to open an account with the bank. Once you have an account open you can then move forward with sending money abroad.

Make sure to bring photo identification, such as an Aadhaar card, address verification, and other documents plus passport sized photos, with you when you go to the IOB branch.²

You can also enter in your name and contact number on the IOB website to get a call back from the bank, as an alternative to going to the branch first.

There are a few fees when sending outward remittances with IOB bank. The first is a service charge of .075% on the amount you are sending.

The service charge is capped at ₹ 4,000 with a minimum floor of ₹ 150.

You will also be charged with a SWIFT fee of ₹ 500. ³

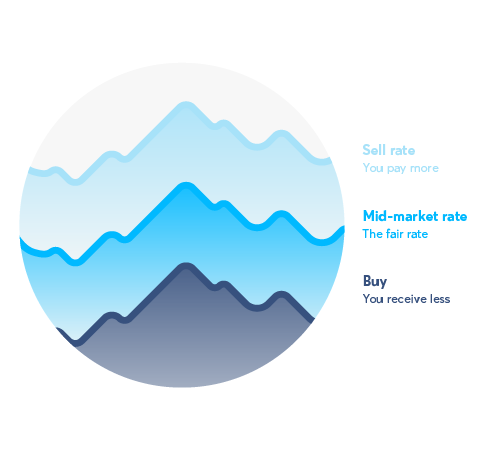

Last but not least, you will be hit with a hidden fee, tucked away in the exchange rate from IOB. IOB sets their exchange rate to be weaker than the real exchange rate that the banks use themselves.

And with that small difference in the exchange rates, IOB is able to take a cut of every rupee that you convert. You can see how this can add up in the next section.

IOB has not listed a transfer limit for sending money, however you will have to follow the Indian government’s Foreign Exchange Management Act (FEMA) regulations for sending money abroad.

As an Indian resident, the maximum amount you can send abroad is the currency equivalent of $250,000 USD per year.

IOB in most cases will require you to go to a physical bank branch to get your transfer completed.

That additional time to go to an IOB branch can be added to the time that SWIFT transfers usually take. The SWIFT transfer time can range from 3-4 days, but check with the IOB bank representatives when you are submitting your transfer.⁴

Did you know you could sign up for Wise for free online? With a free Wise account, you can send money directly to bank accounts in 60+ currencies from your computer or while you’re on the go from your mobile.

There are few big hurdles in the way when you are sending money with IOB.

The first is that there is no easy way to send money globally online or through your mobile. You will have to take time out to head to an IOB branch.

Next, your outward remittance from India will have a minimum fee of ₹ 150 although it can go up to ₹ 4,000 as a percentage of your transfer.

You will also get a ₹ 500 SWIFT fee on top of that. And a hidden fee in the exchange rate with IOB.

Let’s see what that looks like in an example comparing using IOB vs. the online and transparent Wise. Say you are sending ₹ 20,000 to the UK as a gift:

| IOB | Wise | |

|---|---|---|

| Sending Amount | ₹ 20,000 | ₹ 20,000 |

| Outward Remittance fee | ₹ 1500 | - |

| SWIFT fee | ₹ 500 | - |

| Transfer fee | - | ₹ 840.98 |

| Exchange Rate | ₹ 95.18 | ₹ 94.6011 |

| Receiving Amount | £ 189.11 | £ 202.52 |

In this example, you saved more than £ 13 GBP on your transfer just by using Wise. With more than half saved in fees, Wise is the cheaper and easier way to send money globally.

Getting the real exchange rate on every international transfer matters. Especially on your wallet.

The real exchange rate is one of the reasons why over 8 million people choose to send money globally with Wise. You get the same exchange rate that the banks get and the one you see on Google. No mark up or hidden fees here.

Wise uses smart technology to make your online transfers to or from India secure, easy and fast. And to help save you money in the process.

So take it easy, and sign up now for a free Wise right from your home computer or mobile. And see how much you can save on your next global money transfer.

Sources used for this article:All sources checked as of 8 October, 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We compare the best credit cards in India for frequent flyers, from co-branded airline cards to flexible reward programs like Axis Atlas and Amex.

Discover the best credit cards for airport lounge access in India.

If you're looking for airport lounge access, compare the best SBI credit cards in India to find the perfect fit for your domestic and international trips.

Looking for lounge access when you travel? Compare the top ICICI credit cards in India for domestic and international travels.

What is an international debit card and how does it work? Compare features, benefits, and charges for the best international debit cards in India.

Thinking about getting the Amex Platinum Travel Card? Explore its fees, rewards, perks, lounge access, and overseas charges.