Axis Bank NRI Account: All you need to know

Learn all about the Axis Bank NRI account- how to open, interest rates, minimum balance, benefits, and how you can save money when sending money to India.

The Wise Travel card lets you hold 40+ currencies and spend at the interbank exchange rate with no forex markups or hidden fees - now available to order for free (Limited time offer, while stocks last).

Order your free Wise Travel card 💳

HDFC Bank is a great option if you’re looking for foriegn exchange options in India. With one of the most diverse portfolios of currencies available at an Indian bank, HDFC has taken steps to make global banking more accessible. But that doesn’t mean it comes cheap.

Read on to see how HDFC Foreign Exchange works and what to keep in mind next time you want to exchange money in India.

| Receive money to your local Indian bank account with Wise 🚀 |

|---|

Open your free Wise account now

| 📝 Table of contents |

|---|

Yes, you can get and exchange foreign currencies at HDFC Bank. And there are four main ways to do it:

You can exchange Indian Rupees to foreign currencies at any HDFC branch.

They all have the capabilities to do so, and can even exchange back any foreign currencies you have, subject to availability.

HDFC branches carry 20 different global currencies, including:

USD, GBP, EUR, AUD, SGD, CAD, SAR, KRW, OMR, AED, CHF and THB

An HDFC branch can provide you up to $3,000 USD or the currency equivalent in cash, but any additional above that amount would have to be provided to you through a HDFC forex card.¹

HDFC Bank has over 5 different cards that can carry foreign currencies that you can use abroad. Whether you are traveling for fun, business or as a student, HDFC has a card for you.

Not all the HDFC Forex cards offer the same currencies or options, here is a quick snapshot:

| HDFC Card | Features |

|---|---|

| MakeMyTrip HDFC Bank ForexPlus Card | Available for 22 currencies, and you don’t need to be a HDFC Bank customer |

| Regalia Forex Card | Only for USD currency purchases |

| Multicurrency Platinum ForexPlus Chip Card | Available in 22 currencies |

| ISIC Student ForexPlus Card | Only in USD, GBP, EUR |

Most of the HDFC Forex cards can be applied to online through the HDFC website.²

RemitNow is available through HDFC’s Netbanking and lets customers send money to bank accounts outside of India.

| ⚠️ RemitNow is not available to NRI customers, non-HDFC customers or corporates |

|---|

RemitNow lets you send money to bank accounts abroad in 19 different currencies. These include:

USD, GBP, EUR, AUD, JPY, SGD, CAD, SAR, KRW, OMR, AED, CHF, THB, ZAR

RemitNow has a minimum transaction requirement of the currency equivalent of $100 USD per transaction. And it is only accessible through the online HDFC Net Banking system.³

| ⚠️ The Reserve Bank of India lets residents only send the equivalent of $250,000 USD out of India per year. As a resident, you are only allowed to keep $2,000 USD or its equivalent of foreign currencies with you at home. |

|---|

HDFC lets Non-Resident Indians (NRI) save and send money to India through the HDFC NRI Accounts.

You can have different NRI accounts depending on which direction you want to send or receive funds.⁴

| Type of account | Description |

|---|---|

| NRE Savings Account | An NRE Savings Account is a 100% repatriable account for overseas income |

| NRO Savings Account | An NRO Savings Account lets you store income generated in India |

| RFC Account | Ideal for Non-Resident Indians who plan to return to India, with an option to store money in USD, GBP, and EUR. |

It is a good idea to speak to a tax professional when looking at NRI accounts to find the best way and situation for possible tax savings for you and your family.

There are 2 main methods to get or send foreign currencies: In person at an HDFC bank branch, or online.

For physical foreign currency cash from a HDFC bank, you can head to your nearest branch and request the currencies you would like from those available.

You will be required to complete an A2 Form, and possibly a LRS Declaration if required before receiving the cash. Depending on the availability at the HDFC branch at that time, you will be able to collect your cash right then and there.⁵

HDFC bank sets their own exchange rate, different from the mid-market rate you see on Google, and it changes daily. Be sure to check with your HDFC bank representative or online for the day’s exchange rate.

For HDFC’s Forex Cards, RemitNow or the NRE/ NRO accounts, you can start the processes online.

For HDFC’s Forex Cards, you may be asked for a combination of the following⁶:

Check with the documentation requirements for the exact card you are interested in.

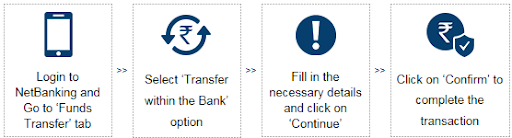

For RemitNow, you can head to HDFC’s NetBanking and follow these steps for outward remittances⁷:

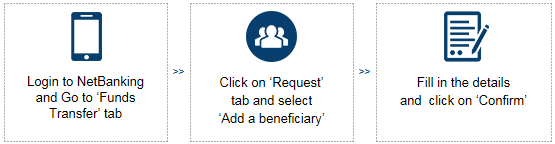

Add your beneficiary,

And finally, to complete foreign outward remittance,

For NRE/NRO accounts you can start the process by applying online through the HDFC website, under the NRI tab. Once you complete the form, a representative from HDFC will be in contact with you for next steps.

The foreign transaction fee is also often called the service fee. It is the fee that the bank charges to you for exchanging currency, whether online or in-person.⁸

| Activity | Amount equals less than $500 USD | Amount is greater than $500 USD |

|---|---|---|

| Foreign Currency Exchange Transaction | ₹500 | ₹1000 |

| Remittance Outwards (RemitNow) | ₹500 | ₹1000 |

The Foreign Currency Exchange Transaction fees are levied for in person cash exchanges, but as well for NRE/NRO accounts.

HDFC Forex cards operate differently and carry a few different service fees. Here is an example of the MakeMyTrip HDFC Bank ForexPlus Card fees⁹:

| Activity | Fee |

|---|---|

| Issuance Fee | ₹500 |

| Reload Fee | ₹75 |

| Currency conversions internally among wallets | 2% of the transaction |

| ATM Cash Withdrawal Fee- Example for US cash withdrawals | $2.00 USD |

For NRE & NRO accounts, they have their own structures such as requiring an average minimum balance requirement of ₹10,000 to avoid fees. Check which account is right for you and then take a close look at the fees they come with.¹⁰

The HDFC foreign exchange rate is set every day for the major currencies it deals in. HDFC sets their rate to be different from the mid-market exchange rate.

The mid-market exchange rate is the rate you see on Google, and is the same one that banks use themselves. It does not have any mark-ups and is the most transparent exchange rate to use.

By setting their exchange rate weaker than the mid-market exchange rate, HDFC is able to sneak in an additional fee in the difference with every rupee you convert. And that can quickly take a bite out of your wallet.

You can send money to India at the real mid-market exchange rate with Wise. Either online or through the award-winning Wise Android/ iOS app, you can send money directly to any local bank account in India, across the country.

Open your free Wise account now

Often for the most popular routes to India, the money can arrive in the Indian bank account in a matter of minutes.

Check out Wise and see why over 8 million people have chosen Wise for their global money transfers.

Sources

All sources checked as of 20 February, 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn all about the Axis Bank NRI account- how to open, interest rates, minimum balance, benefits, and how you can save money when sending money to India.

Learn all about how to exchange foreign currency at SBI in India. Know the transaction fees, exchange rates, and an awesome way to send money to India ?

Know all your options to exchange foreign currency in India- banks, money changers, airports, and online services, and decide which is best for you. Learn more.