Everything you need to know about Revolut IBANs in Ireland

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

If you’re already a Credit Union member - or are thinking of becoming one - you may be interested to know you can now open a Credit Union current account. This guide walks through all you need to know including how to find Credit Unions with current accounts, services available - and the fees you have to pay.

As with any financial product it’s crucial to look at the full range of fees and costs before you choose to open a Credit Union account. Depending on how you prefer to manage and spend your money, you could find there are better options out there. To help with a comparison we’ll also introduce the Wise multi-currency account as a good choice if travelling and shopping online with international retailers is important to you.

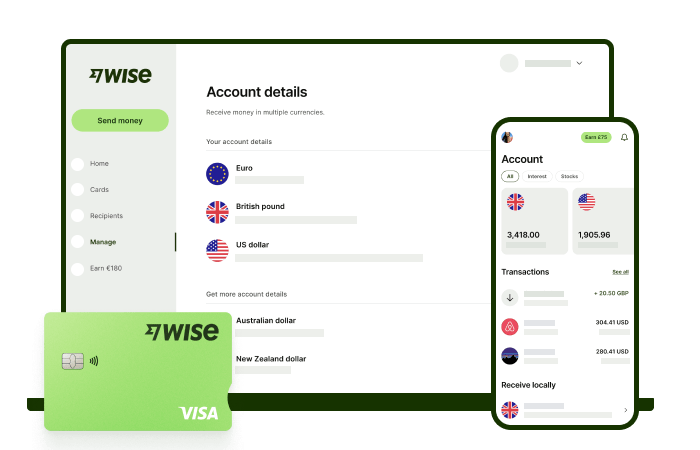

The Wise multi-currency account lets customers hold 40+ currencies, to send and spend money all over the world using the mid-market exchange rate.

Current accounts are available to members of participating credit unions throughout Ireland. That covers over 115 branches.

If you’re not already a Credit Union member you’ll need to find which unions you’re eligible to join. Credit Unions are a good choice for customers who may have had a problem getting an account with a bank or building society previously - as well as people who’d rather manage their money with a local organisation.¹

Credit Union membership is typically based on where you live, the job you do, or other connections to an existing group. There’s a full list of the Credit Unions which offer current accounts available on the current account website, which is a great place to start.²

Your Credit Union current account will let you manage your money day to day with ease³, using the Credit Union current account app⁴, your linked Credit Union debit card, and branch services. Many regular transactions are free, although there are some fees to consider, which we’ll cover in just a moment.

No matter which Credit Union you open your current account with, you’ll need to understand the same set of costs and fees.

Opening your account is fee free, but there’s a monthly maintenance charge to pay. Many other basic transactions are free, but it’s important to understand the overall costs and limits, as some services do come with fees, which can mount up. Here’s what you need to know:⁵

| Service | Credit Union current account fee |

|---|---|

| Account opening | Free |

| Maintenance fee | €4/month |

| ATM withdrawals in EUR | Members get 5 free ATM withdrawals a month - A fee of €0.50/withdrawal applies after that. |

| ATM withdrawals in non-euro currencies | 3.5% of withdrawal amount - minimum €3, maximum €12 per withdrawal. |

| Direct Debit charges | Direct Debits are free to set up, cancel and pay. There’s a €10 charge for Direct Debits that can not be paid due to lack of funds. |

| Standing Order charges | Set up - €2.50Amendment - €2.50. There’s a €10 charge for Standing Orders that can not be paid due to lack of funds. |

| Postal statements | €2.50 |

| Foreign currency transactions | 2% of the transaction value, to a maximum of €12 per purchase. |

You’ll get a linked debit card with your Credit Union account, and can also use your account with services like Google Pay for mobile payments. Many card services are free, including buying online or in stores in euros. You can also make up to 5 ATM withdrawals fee free. After that, there’s a €0.50 charge for each withdrawal. There are also extra costs if you’re spending or withdrawing in a non-euro currency. These apply as a percentage of the amount you’re spending, and can quickly mount up.⁶

If you love to travel or spend with international retailers, you may find that you can save with a Wise multi-currency account and linked debit card.

Simply top up your account in euros, and switch to the currency you need online or using the app for a low conversion fee, with the real mid-market exchange rate. Or let Wise auto-convert for the lowest possible fee every time. There’s never any fee to spend currencies you hold with your debit card, and no account maintenance fee, which can cut your costs significantly.

If you’re already a Credit Union member you can easily open a current account online by heading to the current account website³ and following the onscreen prompts. You’ll need to find your credit union, check that current accounts are available, and complete the specific account application processes according to your Union⁷. You may need to register for online services with your Credit Union before you can open a current account.

If you’re not a Credit Union member yet, you’ll need to join before you can open your current account. In most cases you’ll need to check the eligibility terms and make sure you comply, before submitting a set of documents and an application form. You may be able to complete your application online by providing scanned copies of documents including the following:

Once you have an account open, you can manage it using a range of simple options including the Credit Union current account app⁴, online services, or by visiting your local branch.

Over 115 different credit unions in Ireland offer current account products. These include popular credit unions like :

You can get a full listing of Credit Unions with current accounts, here.

A Credit Union current account is simple to open if you’re already a member of a Union, and means you’ll get up to 5 free ATM withdrawals per month as well as a range of simple services fee free. But you’ll have to pay an ongoing maintenance charge of €4/month, with fairly high fees for specific services like international transactions and non-euro ATM withdrawals.

If you’re looking for an account which has no monthly fee or minimum balance, and which lets you hold and spend multiple currencies easily, you may be better off with the Wise multi-currency account.

You can manage 40+ currencies all in the same account, receive payments in 9+ currencies with your own local account details, and spend around the world with your linked debit card.

Whenever you need to convert from one currency to another you’ll get the mid-market exchange rate with no markup. That means you pay a low, transparent fee for conversion, and then can spend any currency you hold using your card with no foreign transaction fee. That can work out much cheaper than alternative options if you travel or shop with international online retailers.

Sources:

All sources last checked on February 15, 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

Wondering if Revolut is safe in Ireland? Our comprehensive analysis covers deposit protection, security measures, and more.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

If you need a UK bank account, read this article, as it covers the requirements and documents needed.

Discover how you can open a bank account in Australia from Ireland, including the documents and steps.