PayPal merchant fees in Ireland: Account, transactions and payments

Discover what are the fees and charges your business will need to pay when using PayPal in Ireland.

Running a business is an evolving experience. What suited your needs in the past may not be the best options moving forward, and as a result you may find yourself changing various things like location, banking partner, accounting softwares and workflow tools.

If you have a business account with Revolut but are planning to change to something new, one part of that process is closing your account. This guide is going to show you how to close a Revolut business account in Ireland, with insights into the requirements that need to be met.

We’ll also introduce you to the Wise Business account, an alternative service for Irish businesses in general as well as those of you who like to be able to send, hold and receive money in multiple currencies.

Discover the

Wise Business account 💼

Closing your Irish Revolut business account is a two part process. First you need to make sure you meet all the requirements to close the account, then you can go ahead and actually close it.¹

In order to be able to close the Revolut account you need to make sure each of the closing requirements are met:

- You’re the account owner

- Add, withdraw or send money to other Revolut users so that the balance of the accounts, Crypto and Merchant account is zero

- Ensure there’s no pending transactions

- Pay for any metals cards that were issues in the last three months

- The default currency account is still open.

Once you meet all of the requirements you can go ahead and close the account. Follow the steps below:

1️⃣ Login to the account and go to “Settings”

2️⃣ Choose the “Account & documents” option

3️⃣ Scroll to the bottom of the page and press “Close business account”

4️⃣ Select the reason you’re closing the account and confirm.

⚠️ Keep in mind that once you close your Revolut account you won’t be able access it anymore. As such, it’s a good idea to download any information or statements that you might need in future before you lose access.

As mentioned at the start, the Wise business account may be what you're looking for after closing your Revolut account.

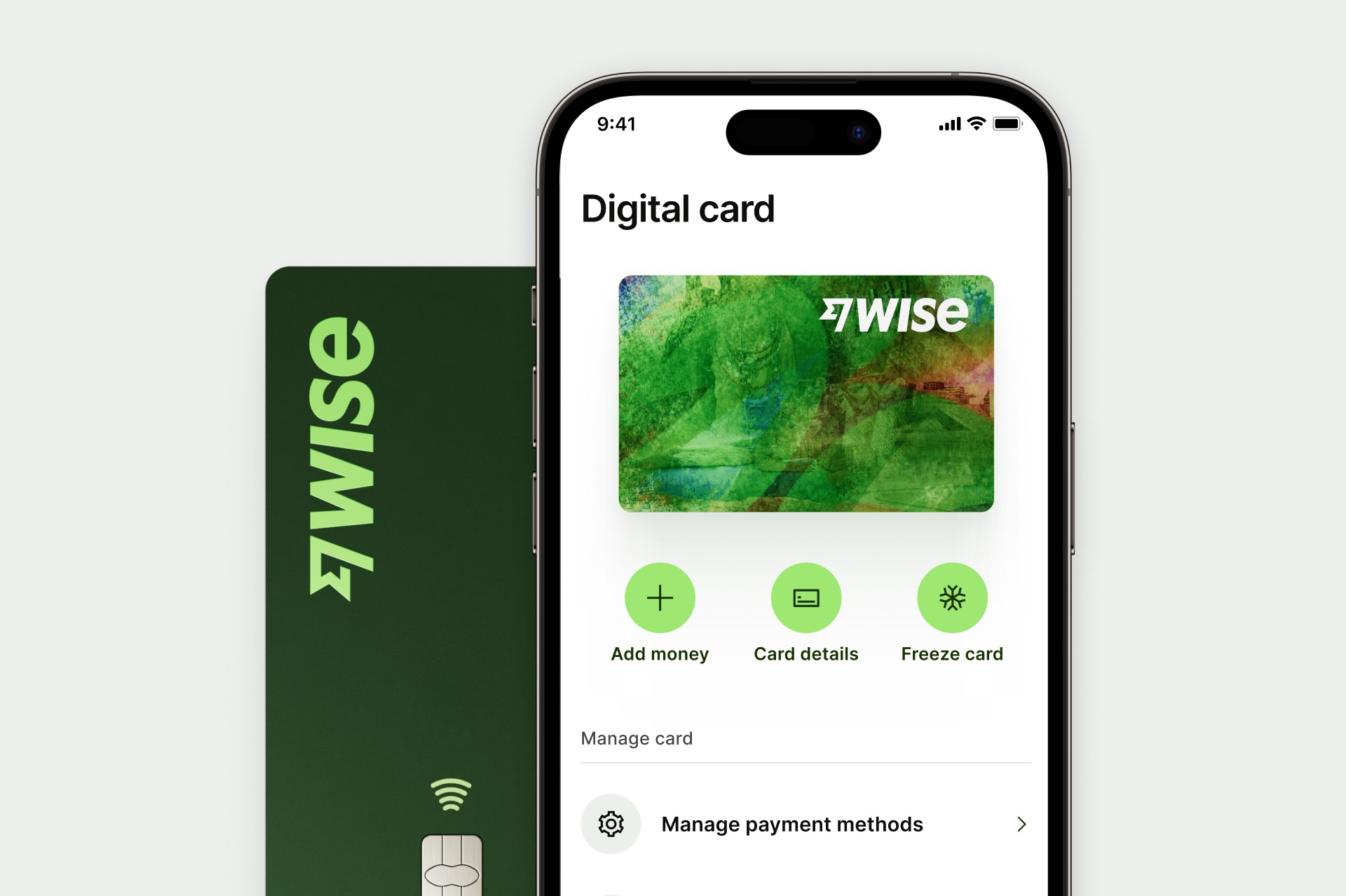

With a Wise business account you can send, hold and receive money in different currencies. You can get access to local account details for 8 of the world’s major currencies, including EUR, GBP and AUD. Spending, sending, and receiving money is made simpler as there are no monthly fees or hidden costs to worry about.

Whenever you need to convert money, Wise will use the mid-market exchange rate (the same you normally see on Google).

The account also offers a business debit card that allows you to easily make ATM withdrawals and shop online or in-store. You'll be able to get card for your and for your team to spend in +40 currencies.

The Wise business account's can also interact with some of the more popular APIs, making cash flow management and reporting simpler. Software like Xero, QuickBooks, Odoo, and Oracle NetSuite can be synced with your account, cutting down on the need for manual data entry and cross checks. All you need to do is log into your Wise account, and head to the App Marketplace to get started.

Experience the benefits of a Wise for your business and make transacting in the 21st century simpler.

Open your Wise account online 🚀

Still have some questions about closing a Revolut business account in Ireland? Look no further, the answer could be below.

There’s no fees for closing a Revolut business account in Ireland.

In general, your Revolut account closure is done instantly provided you meet all of the conditions.¹ If there is an issue it can take longer to process.

If you choose to close your Revolut Business Account you can open a new one provided you meet the eligibility criteria.² But, if Revolut closed the account you can’t reopen it unless you’re doing it under a different capacity and again, you need to meet the criteria.

Due to the nature of the Revolut Business account you can’t simply change it to a personal account.

One alternative course of action would be to close the business account, if that’s what you want to do, then open a new personal account for yourself.

Sources used:

Sources last checked on date: 3 November 2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover what are the fees and charges your business will need to pay when using PayPal in Ireland.

Discover what you need to open a business bank account in Ireland, including documents, process and how it works.

Read how you can open a Bank of Ireland business account, including documents and requirements.

Before opening a PayPal business account, read this guide with all the information you need to know.

Everything you need to know before opening a Fire business account in Ireland is here. Check out fees, types of accounts, features, and more.

You need to read this article before opening a Revolut business account in Ireland. Check out plans, fees, charges, features, and who can open an account.