Wise Business vs Revolut Business: Which one is right for your Irish business?

Compare Wise Business vs Revolut Business in Ireland. Detailed analysis of fees and features to help Irish businesses choose the best solution.

Revolut is a digital financial service launched in the United Kingdom in 2015. It started offering money transfers and currency exchanges.¹ Today, it provides a range of products to private and business customers in select countries worldwide, including Ireland.

This article will explore what there is to know about the Revolut Business account, including the plans, pricing, business eligibility, and features.

We'll also take a quick look at Wise as another option for an online business account.

Manage your company's money

with Wise Business account 💼

Whether or not you can open a Revolut Business account depends on your type of business and your location.

To be eligible to apply for a Revolut Business account, you’ll need to fit within one of these business types²:

- Private Limited Company

- Single Member Company

- Designated Activity Company

- Public Limited Company

- Unlimited Company / Private Unlimited Company

- General Partnership

- Limited Partnership

Revolut used to accept freelancers and sole traders as a business type but this has changed and they don't activate these users anymore.⁵ ²

Revolut only offers their business accounts in certain countries so you will need to be in one of the following places to apply³:

- United States of America

- Countries in the European Economic Area (EEA)

- Switzerland

- United Kingdom

⚠️ Keep in mind: Revolut requires your business to be registered and have a physical presence in an eligible country to apply.³

The Revolut Business account is an online service that enables people to do business globally.⁶

In terms of money transfers and currency exchange, Revolut Business offers the following services⁴:

- International and local payments

- Free payments to Revolut accounts

- Hold and exchange +25 currencies

- Spend in +100 currencies

- Local GBP and EUR account details

- Manage recurring payments

Depending on the plan, the multi-currency account can be attached to a metal or plastic debit card.⁴ It's also possible to generate virtual cards.

Revolut offers 4 plans for companies that need a business account.⁴ The freelancer plans that Revolut used to offer have been discontinued and are no longer available as of July 8 2024.⁵

The Revolut Business plans are organised in tiers with pricing increasing as you move up the plans. Here are the tiers and pricing for the Revolut Business Company plans.⁴

| Revolut Business Company plans⁴ | |||

|---|---|---|---|

| Basic | Grow | Scale | Enterprise |

| €10 monthly | €35 monthly | €125 monthly | Custom pricing |

Along with the monthly plan fees, there are additional fees for certain services offered by Revolut Business.

Here are some of the fees that apply to the Free, Grow, and Scale plans available to companies.⁴ The fees for the Enterprise level are all custom, so you'd need to speak to Revolut directly.

| Service | Basic | Grow | Scale |

|---|---|---|---|

| Metal debit card | No metal card | 1x free allowance | 2x free allowance |

| International payments | €5 per payment | €5 per payment outside 5 transfer free allowance | €5 per payment outside 25 transfer free allowance |

| Local payments | €0.20 per payment outside 10 transfer free allowance | €0.20 per payment outside 100 transfer free allowance | €0.20 per payment outside 1000 transfer free allowance |

| Foreign exchange at the interbank rate | 0.6% markup | 0.6% markup outside €10k free allowance | 0.6% markup outside €50k free allowance |

With Revolut, the exchange rate and their fee are combined to give you the total cost of the transfer.

Revolut shows the exchange rate and applies a 0.6% markup to any currency exchanges outside of your account's free allowances.⁴

Revolut Business gives its customers their interbank rate for currency exchanges. They determine the rate based on market conditions like liquidity and volatility, which might differ from averages published by other sources.⁷

Revolut makes it clear that is a variable exchange rate and that it is constantly fluctuating.⁴

⚠️ It's also important for you to pay attention to the weekend fees that Revolut charges when exchanging currencies.

You'll have to pay an additional 1% fee when exchanging currencies outside foreign exchange market hours (22:00 GMT Fri to 23:00 GMT Sun). This is valid for all plans.⁸

| Read also: How to close a Revolut Business account |

|---|

If you're searching for an online business account that allows you to work in many currencies, then it's worth looking at what Wise could do for you.

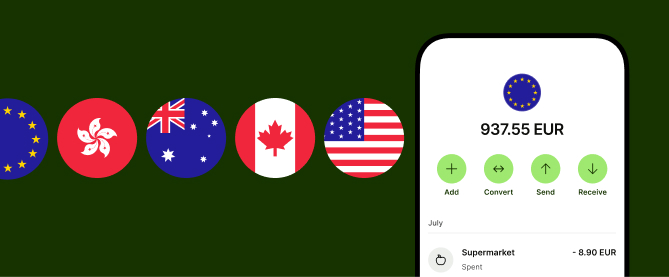

Wise offers a business account without high rates, no hidden charges, and no monthly fees. You can pay employees, get paid and manage your cash flow overseas.

With a Wise business account, you can hold more than 40 different currencies in a single account and convert them using the mid-market exchange rate with no markups or weekend fees.

You can get local account details for +9 of those currencies, including EUR, CAD, and GBP, making it even easier to receive payments like a local company.

Along with the multi-currency account you’ll also get access to a range of business tools including company debit cards, accounting integration, batch payments and the ability to add team members.

Open your Wise account online 🚀

Sources used:

Sources last checked on date: 09 September 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare Wise Business vs Revolut Business in Ireland. Detailed analysis of fees and features to help Irish businesses choose the best solution.

Revolut Business account fees confusing you? Get a simple, clear breakdown of all the costs. See what you'll pay for plans, transfers, and money conversions.

Learn about the requirements for opening a Wise Business account and discover what's needed.

Discover what are the fees and charges your business will need to pay when using PayPal in Ireland.

Read about how to open a business account with PTSB in Ireland, including the requirements you may need to meet.

Discover if you can open a business bank account in Canada as a non-resident and how it works.