Can I open a UK bank account from Ireland?

If you need a UK bank account, read this article, as it covers the requirements and documents needed.

If you’re a non-resident living, working or visiting Ireland you might find yourself wanting an Irish bank account. Doing this can be a little tricky but there are banks and financial providers out there that do allow foreigners to open a Euro account.

In this article we’ll take a look at the process for opening a Personal Current Account with the Bank of Ireland as a non-resident including what documents you'll need and the associated fees.

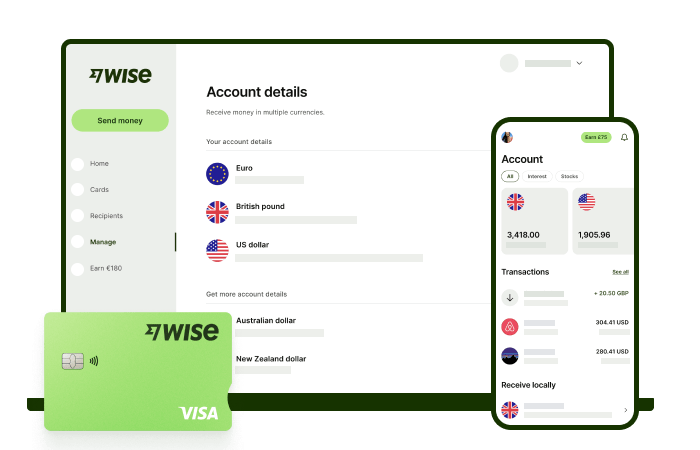

We’ll also introduce you to the Wise Account. Wise is an excellent alternative e-money service provider that offers local account details for 9+ currencies, including the Euro, and also allows you to hold and manage more than 40 currencies.

🔎 The Bank of Ireland doesn’t have a special account for non-residents.⁵ Instead they allow non-residents to open a standard Personal Current Account based on slightly different documentation than residents need to provide.¹

Here’s some of the features of this account:

- Visa Debit card

- An agreed overdraft amount

- Online, mobile and telephone banking

- Access to the Bank of Ireland ATM and branch network

- Able to make foreign currency payments

When opening a Bank of Ireland account as a non-resident you’ll need to provide certified copies of the required documents with your application.¹

If you plan to continue living abroad rather than moving to Ireland you’ll need to apply over the phone between 9am and 5pm, Monday to Friday.

- 0818 354 454 within the Republic of Ireland

- +353 1 4044034 from abroad

To open a Bank of Ireland account as a non-resident you’ll need to provide two proofs of photo ID and one proof of address.¹

1️⃣ Generally your drivers licence and passport are acceptable as proof of ID.

2️⃣ For your proof of address you’ll need to provide a household bill such as the electricity, water, gas or landline phone bill.¹ Keep in mind the Bank of Ireland doesn’t accept mobile phone bills.

Once you have your documents you’ll need to get scanned copies and have them certified by a solicitor or police officer.¹ If the bill isn’t in English you’ll also need to get it translated.

Country restrictions apply. Visit wise.com/ie for more information.

The cost of having a Personal Current Account with Bank of Ireland is the same for residents and non-residents.⁵

Here’s a look at some of the main fees for a Bank of Ireland Personal Current Account, with the Wise Account included for comparison.

| Service | Bank of Ireland³ | Wise Account⁶ |

|---|---|---|

| Account maintenance fee | €6 monthly fee | No fee |

| Foreign currency card transactions | 2% (Max. €11.43) + cost of foreign currency exchange | No fee if you have the currency in your account. If not, conversion fee from 0.41% (depending on the currency) |

| Foreign currency ATM withdrawals | 3.5% (Min. €3.17 & Max. €11.43) + cost of foreign currency exchange | Withdraw €200 per month in 2 or less withdrawals for free.⁷ Above this there’s a fee of 1.75% + €0.50 |

| International transfers | | |

Earlier we mentioned the Wise Account so here’s what you need to know. Wise is an international payments specialist that’s authorised to provide financial services in Ireland.

With a Wise Account you can hold over 40 currencies, send money to more than 160 countries and receive money in +9 currencies with local account details, including Euro, British pound, US dollar and other currencies.

If you need to change between your home currency and the Euro, Wise can take care of this without hidden fees to worry about. You'll always get the mid-market rate (the same you see on Google) when exchanging money and you’ll know what it costs up front, before you make the transfer:

If you have a Wise Account you can also get access to the Wise debit card which makes daily spending in more than 40 currencies simple.

If you have the local currency in your Wise Account the card will use it and charge no fees. If you don’t, it uses smart technology to auto-convert your Balance at the mid-market rate, for a small fee. You can check all the Wise card costs online.

To see how a Wise Account could benefit you, why not take a look for yourself? There are no monthly account fees to worry about and opening an account is free.⁸

Open your Wise Account

today 🚀

| 🔎 For more details on this provider, you may check our articles: |

|---|

| |

Sources used:

Sources last checked on date: 9 January 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you need a UK bank account, read this article, as it covers the requirements and documents needed.

Discover how you can open a bank account in Australia from Ireland, including the documents and steps.

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

Read this guide on how to open a PayPal account in Ireland. Discover the documents, costs and more.

Discover how Revolut works in Ireland. Explore the mechanics of Revolut's operations tailored specifically for Irish customers.

All you need to know about opening a bank account in Ireland. See what documents, how long it takes and how it works.