Your Wise Card Transactions: Understanding Invalid Disputes

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

To the Wise community,

How much closer did we get to making our mission of Money Without Borders a reality in Q2 2020?

A reminder on our mission - we want to make money move instantly, transparently, conveniently, and - eventually - for free. There are now more than 8 million of you using Wise, moving over 4 billion pounds a month. That includes more than 1 million of you who are using Wise debit cards and holding more than 2 billion pounds in your Wise accounts.

Our progress on our mission is funded by this community, through your contribution of transparent fees, so we believe it’s important we share regular updates on how we’re (re)investing your money into making our services better for you to use.

Read on to find out how much closer we got to achieving our mission in Q2.

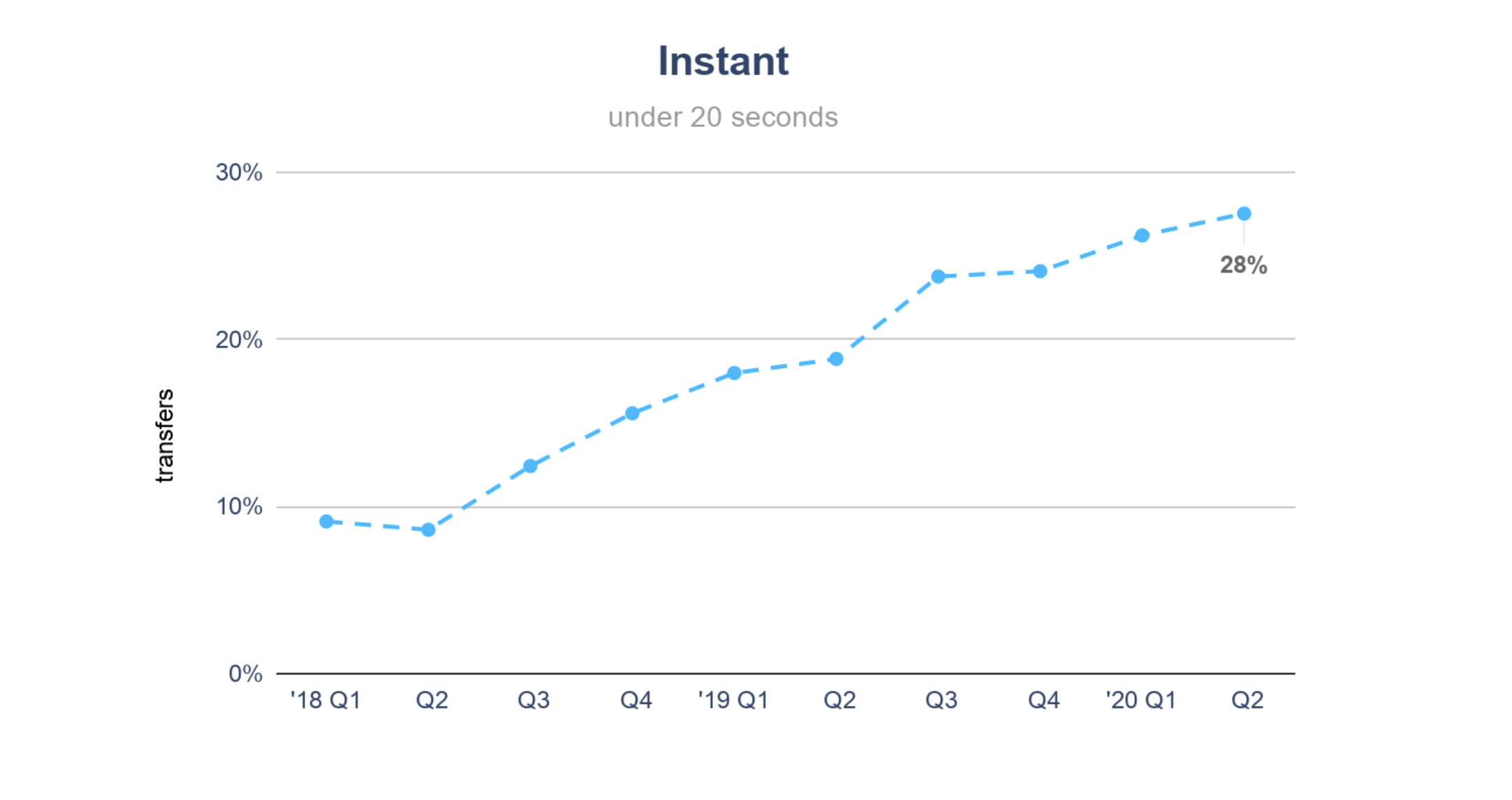

In Q2, 28% of transfers with Wise arrived instantly – i.e., money left your bank and arrived in the recipient’s bank account, in a different country, and a different currency in less than 20 seconds.

This quarter’s biggest boost to instant came from technical improvements, which made our internal checks and validations faster.

The cumulative effect of the improvements we made to speed of transfers to Pakistan, Sri Lanka, and Thailand that were mentioned last mission update also contributed.

It was only one quarter ago that we re-launched sending money to Colombia - something we'd previously shut down because the experience wasn't up to our standard. Today, 65% of transfers to COP are already instant.

That's not all of Latin America. Adding an extra daily payout to Argentina has also helped us increase delivery speed to recipients there.

Your Euro account numbers were previously supplied by a partner bank. Over the last 9 months, we have gradually replaced these with newer IBANs (starting with BE) that are issued by ourselves. We cut out the middleman and now, where the sending bank is connected to the European instant payment network, we will receive payments instantly to your EUR account.

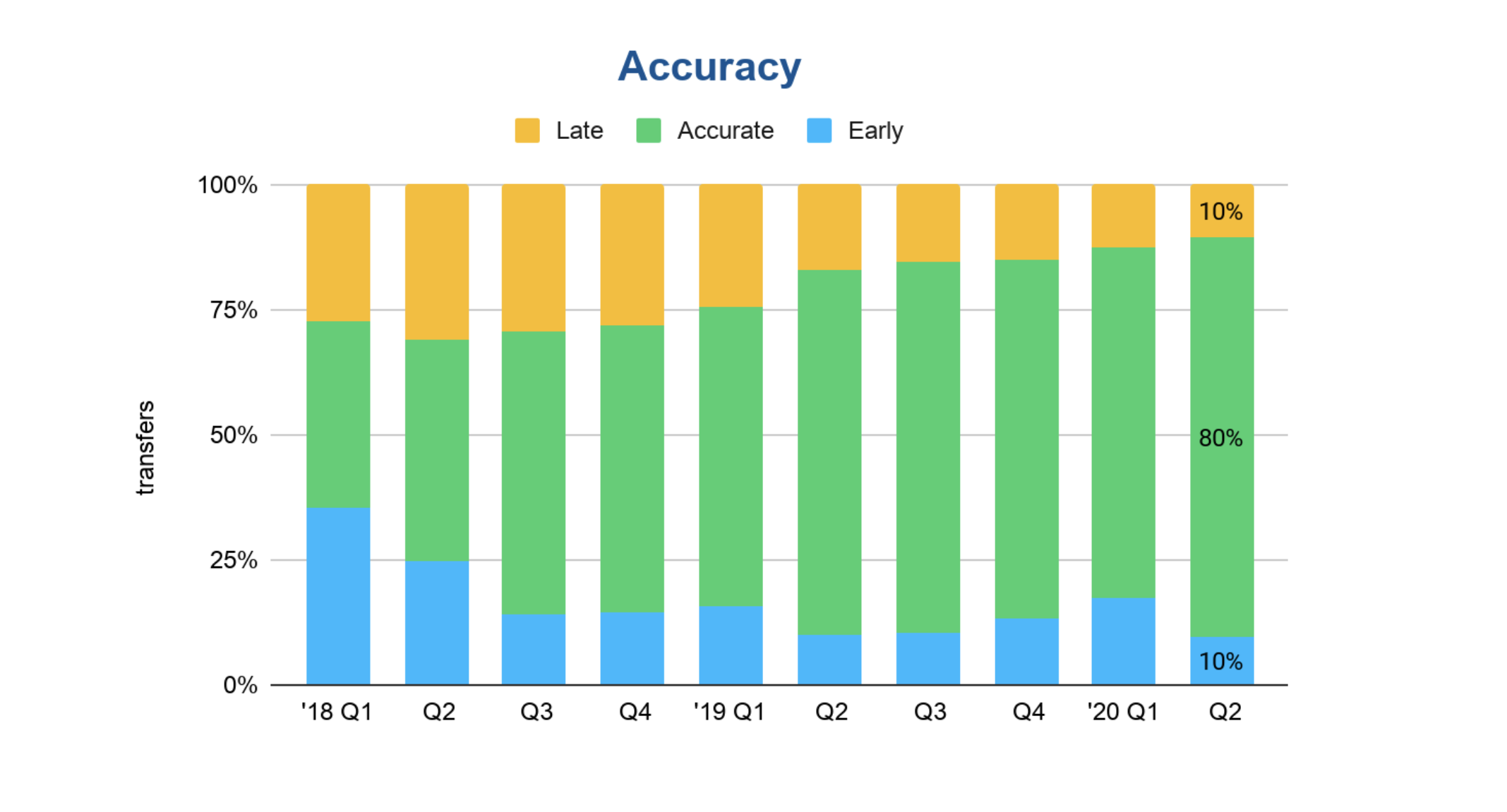

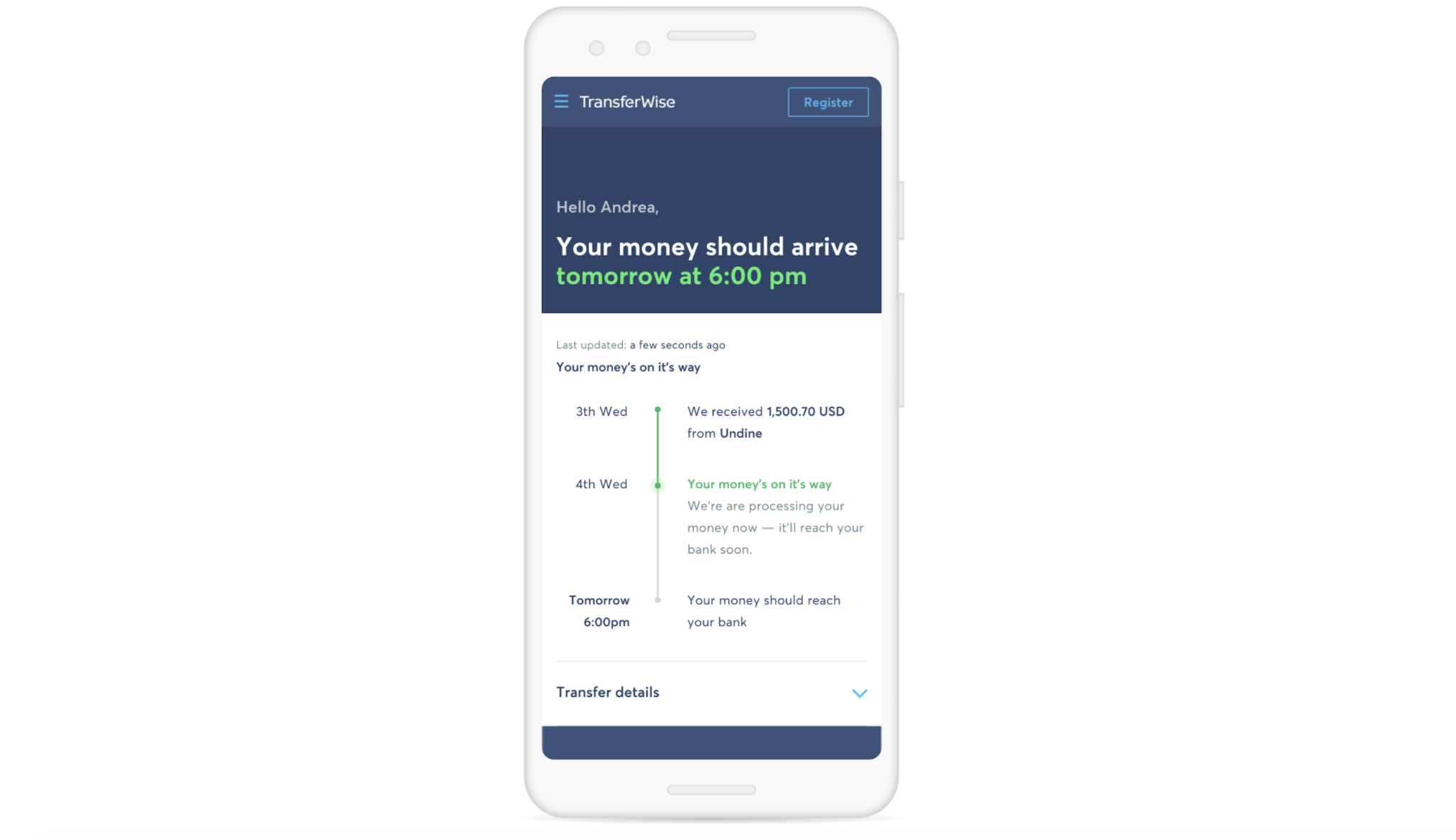

Our apps give a precise estimate of when the money arrives at the recipient’s bank at the start of a transfer. For example, the estimate could be “instant”, “in 3 hours” or “Wednesday 2 pm”. These estimates are getting more accurate, last quarter 90% of transfers arrived on time or before.

A big chunk of that 10% was down to us estimating that the transfer will be instant – i.e. less than 20 seconds. In some of these cases, our systems couldn’t complete all checks in time and the transfer took a couple of minutes, or even 21 seconds instead.

The story with price was tricky this quarter.

Firstly, the average price increased from 0.69% to 0.75%. This isn’t great news as a big part of our mission is to reduce the cost of moving money. This number is surprising as we didn’t increase the fees this quarter - the opposite, we managed to reduce fees on routes from Japan.

The real story was that some expensive routes had much more volume than usual and more cost-effective routes had lower volumes. To illustrate this, transfers from Brazil to Portugal cost 2.63%, while transfers from the UK to the US only 0.37% in fees. As it happened, we had a substantially higher share of volume from Brazil and other more expensive routes.

Secondly, we corrected the definition of average fees, making it specific to fees we charge on cross-border transfers. While the numbers are a little bit smaller under the new definition - 0.75% vs 0.81% for Q2 under previous the methodology, the shape of the curve remains the same. It is still going in the wrong direction.

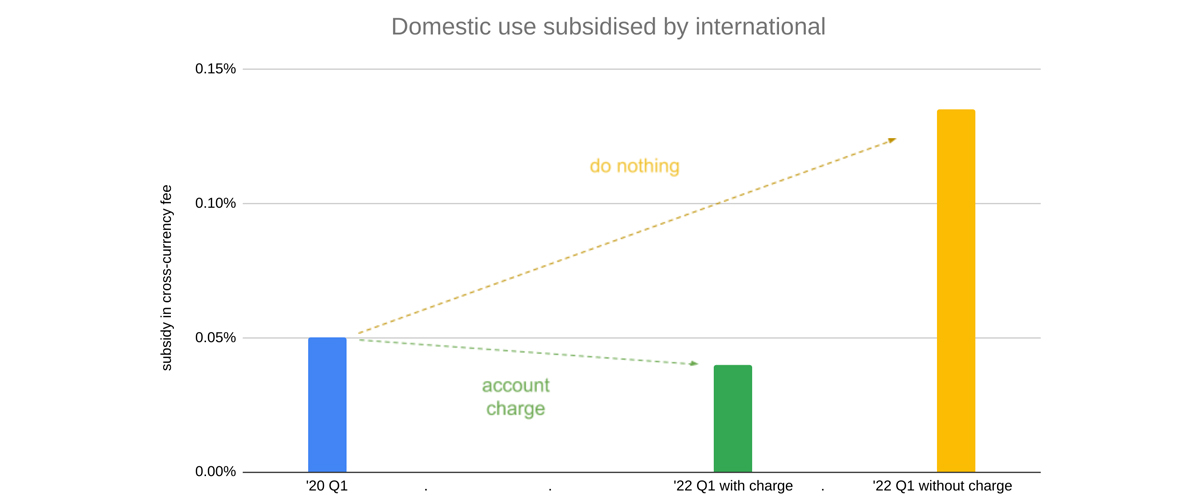

In Q2 we’ve introduced a new fee: an account charge. A one-time fee for customers to receive debit cards and businesses to get account numbers in multiple countries. Adding a new charge would at first glance seem to go against our mission but, in fact, is critical to our journey to eventually free.

We designed the borderless accounts and debit cards for international businesses, freelancers, and people without borders. Turns out that these accounts are now often better locally than the alternative bank accounts. The neat product therefore also attracts domestic customers, who we’d love to onboard and do their banking, but we wouldn’t want the international users to cover the cost of the service for domestic users. With this account charge, we avoid future price increases for our cross-border users.

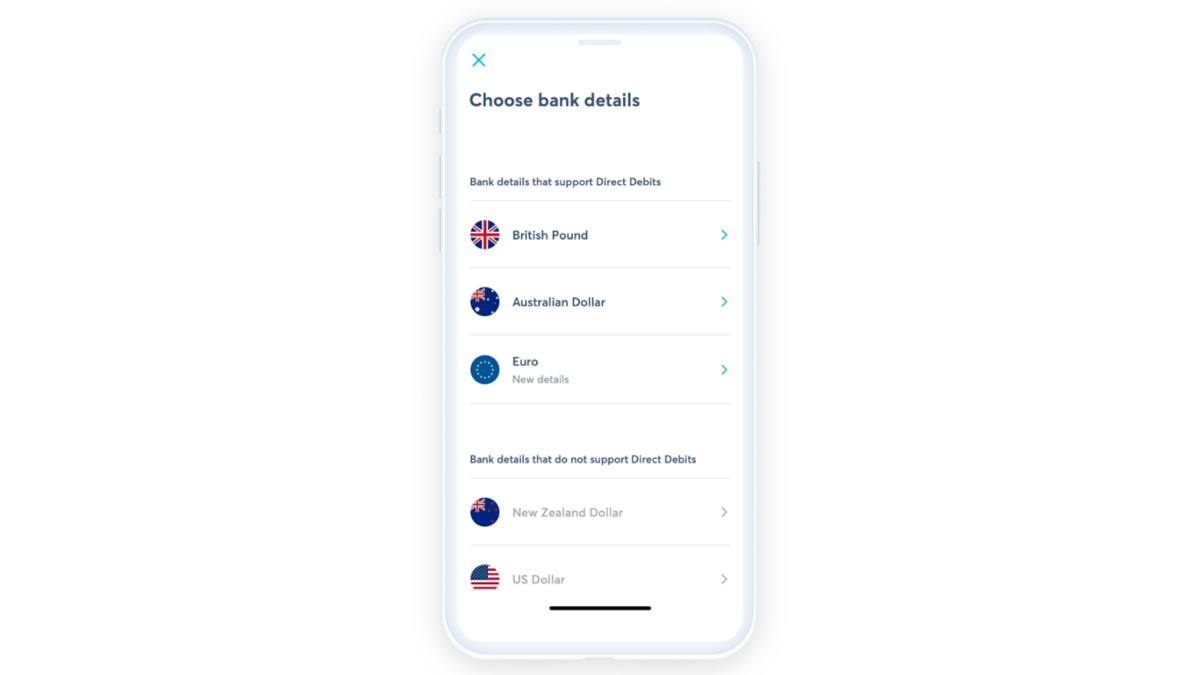

This quarter we launched one of the most requested features in Asia - Singaporean bank account details in the multi-currency account.

Both personal and business users can now activate their own local SGD account numbers to receive funds in Singapore dollars - just like they already can with USD, EUR, GBP, AUD, NZD.

Since launch, tens of thousands of customers have activated their bank details and the first few millions of SGD has been received in salaries, invoice receipts, and other income.

We launched direct debits from Australian account numbers. This lets borderless customers conveniently pay for their bills by sharing their Wise Australian bank account numbers with Australian merchants, enabling merchants to automatically deduct money from their AUD balance. Customers also enjoy using their Wise AUD account number to automatically receive money from merchants/platforms like Stripe, PayPal, and AMEX.

We’ve now fully rolled out micro deposit debits in the US. This feature lets customers verify and connect their Wise account with banks and third-party services such as banks, PayPal, Venmo, Stripe, online brokers, and others. And lets users withdraw USD from these services straight to their Wise balance.

Up until Q1, we only allowed senders to track the precise status of payments into their accounts. But, naturally, recipients also want to know when payments are landing on their account.

So we built a tool for the recipients to track the precise status of the arriving payment – even if they’re not Wise users themselves. Previously, this information was available to senders only and caused lots of contacts to our support team. The recipient experience requires a user to enter the recipient’s email and is already live for the US, Brazil, and Canadian transfers. It will be rolled out globally next.

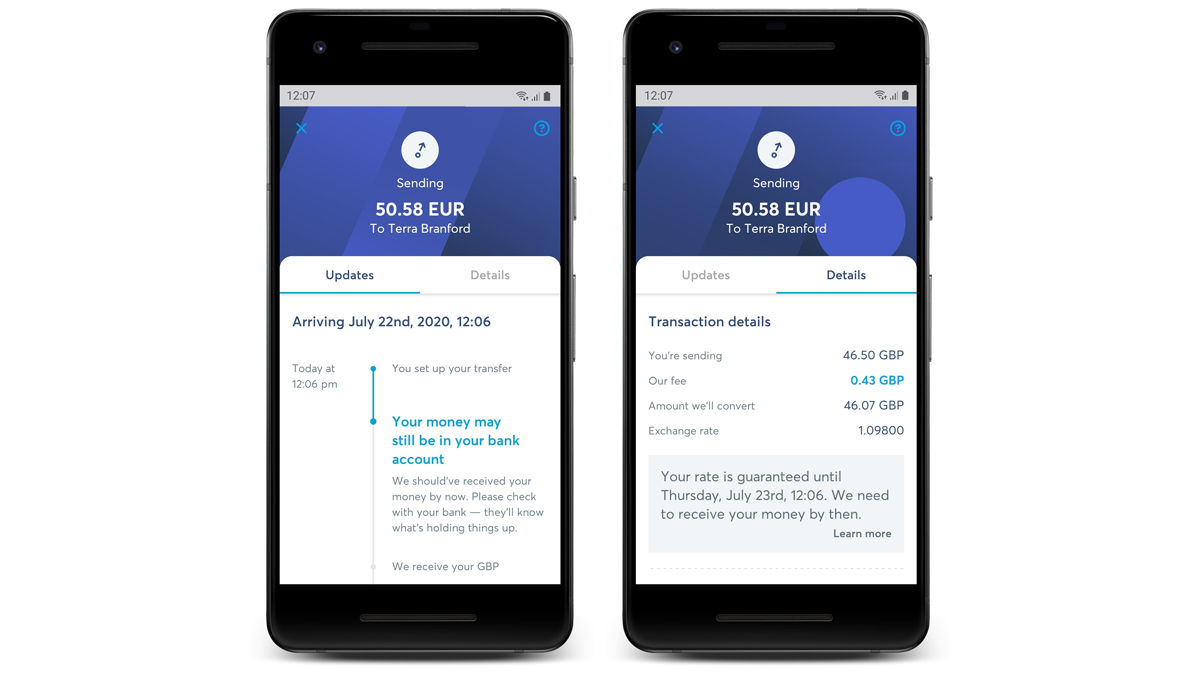

It's now easier than ever to locate a transaction on your activity list. We've added a filtering option to our iOS and Android apps, so you can find specific transactions quickly either by date, balance, recipients, source and target currencies, and more.

You can now also check the status of your transfer and review the details by simply flipping between the tabs on the Android app. An iOS update to follow.

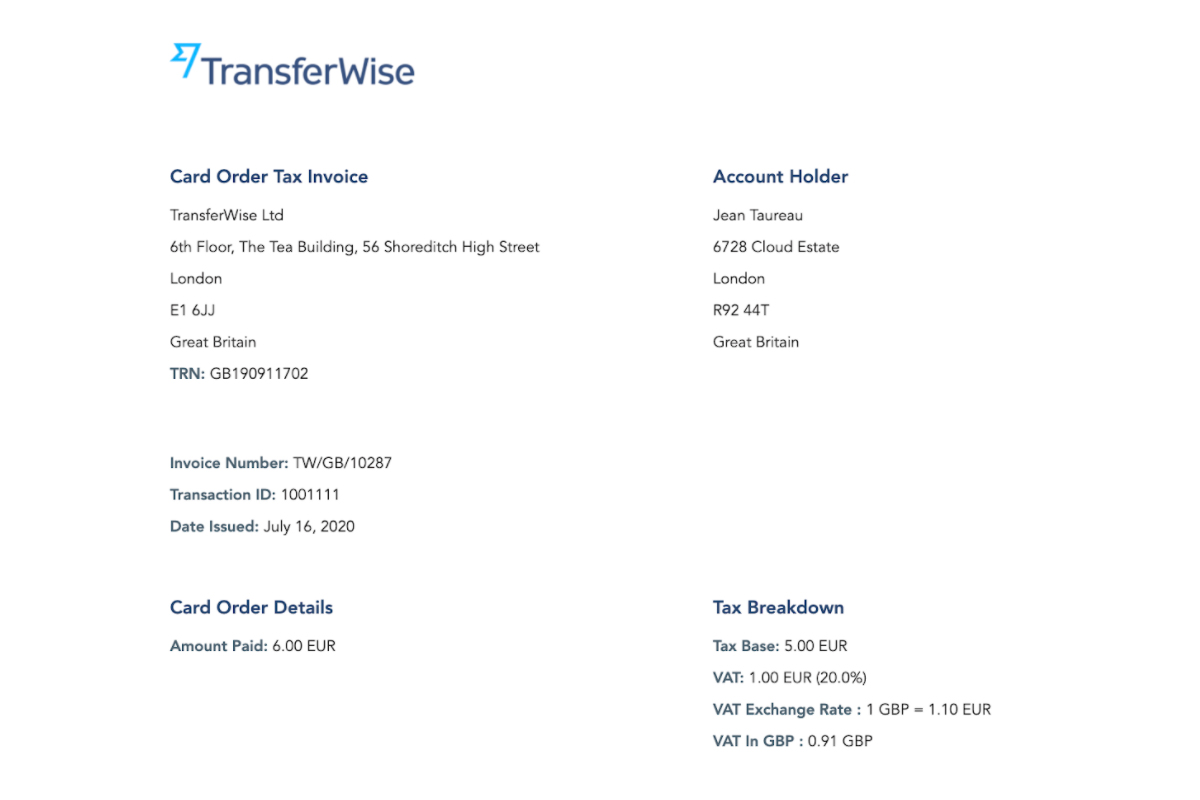

In some countries, we have to charge value-added tax (VAT) or goods and services tax (GST) to our customers. For example, when our European customers order a debit card.

Getting a receipt for your tax from Wise used to be cumbersome and required printing multiple statements from your account. We’ve changed this so that now you download a simple invoice for each transaction as you need it.

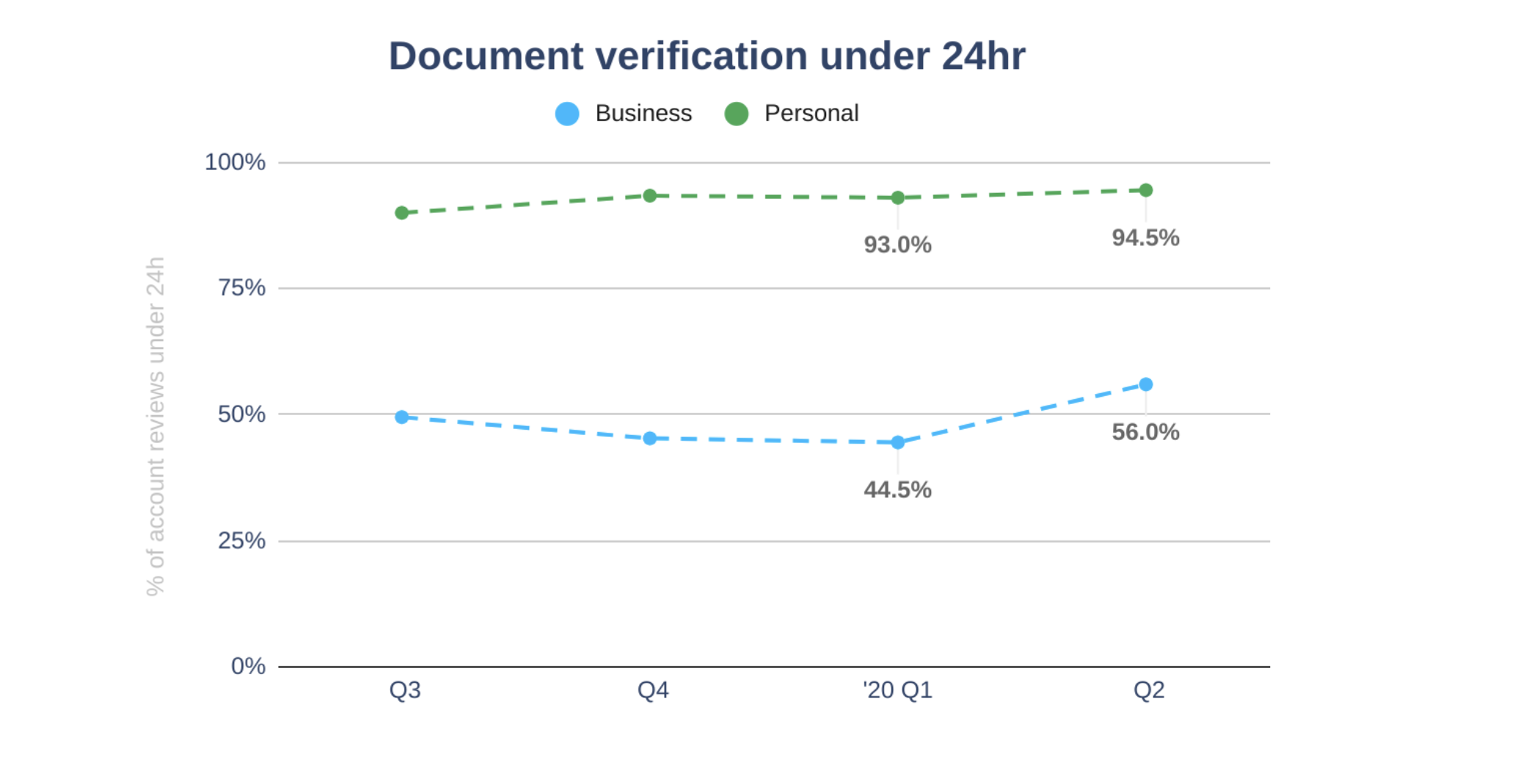

Most people and businesses have to submit their documents for review when they first start using the service. As their first experience, it matters a lot how fast we can get their documents reviewed and on the way with their first transfer.

As more people and businesses sign up to every month, we need to get more efficient to provide the same experience with Wise at scale.

New business customers benefited from more efficiency, as new prioritisation algorithms freed up some of our capacity to do their onboarding better. Now, 56% of businesses get started with their international banking in under 24 hours.

In some countries, we can do identity verification in the background, without customers needing to upload their documents manually. We added Italy, Spain, and Norway to the list of countries eligible for such automated verification. More than 11,000 customers in these countries enjoyed successful automated verification in Q2. Another 10,000 people have automatically onboarded in the rest of Europe thanks to a 10% increased efficiency of the automation.

We also made our machine learning algorithms more precise. The new models are better at stopping the bad guys and we now stop fewer transfers from “good” users for further manual review. With the new processes, we have avoided stopping over 20,000 good users, speeding up their payments by an average of 11 hours.

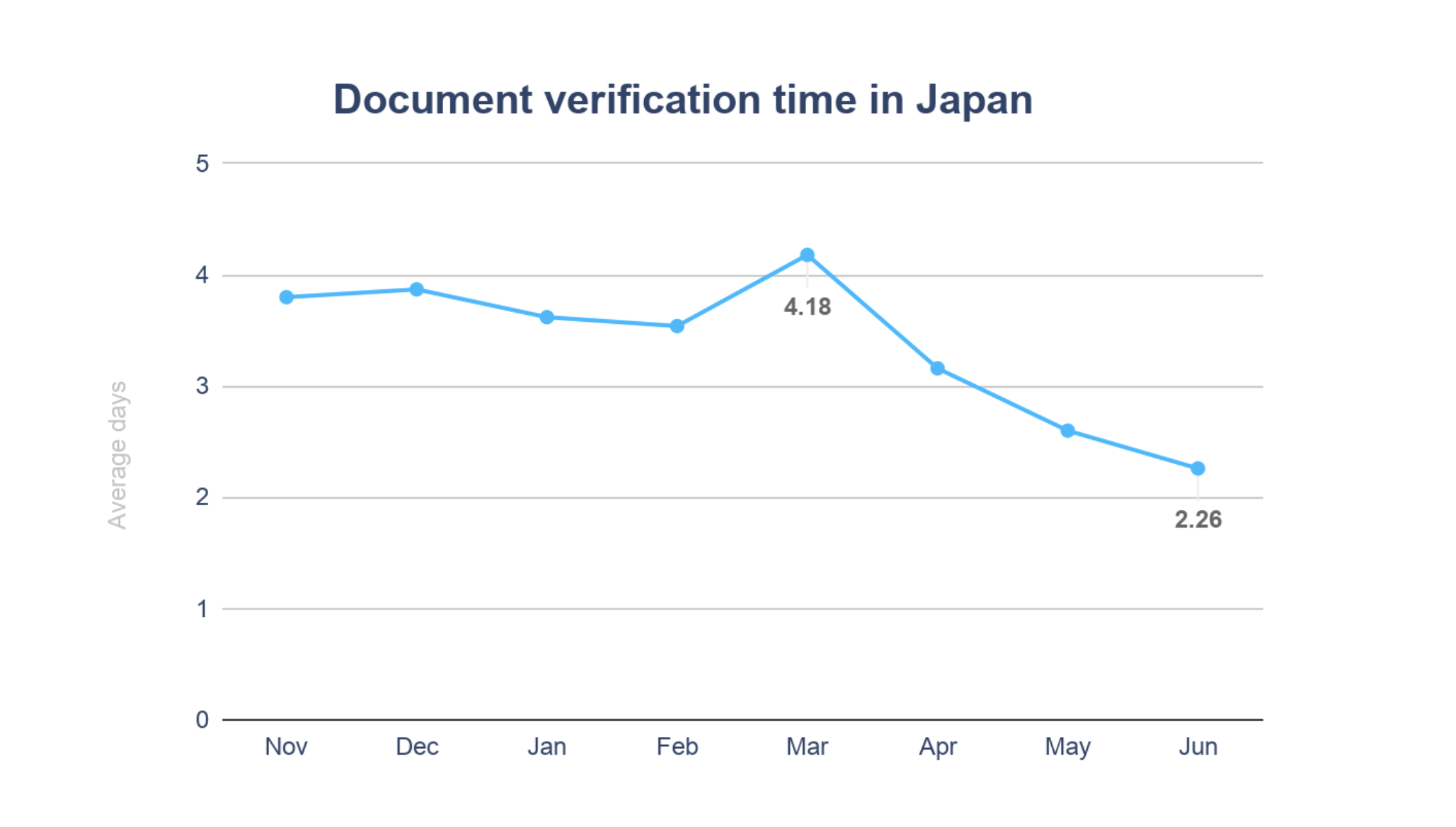

In March we launched electronic identity verification for our users in Japan. Previously if you wanted to use Wise in Japan, you had to visit our website, get a verification code sent to you through physical mail, and then go back to complete the creation of your account online. With a rule change to the regulations, we’re now able to fully verify personal users online - without snail mail.

In Q1, it took an average of 4 days for Japanese customers to make their first transfer. This quarter we have iterated on the verification process making it easier and faster for our customers to get it right on their first try. By today we've halved the time taken, letting customers start transferring in 2 days.

Over the past year, we’ve been investing in improving the experience of the customers that need our team’s support. As a result, we now solve 67% of our customer issues within 24 hours – up from a little over 40% this time in 2019.

We did two things to speed up the improvement this quarter.

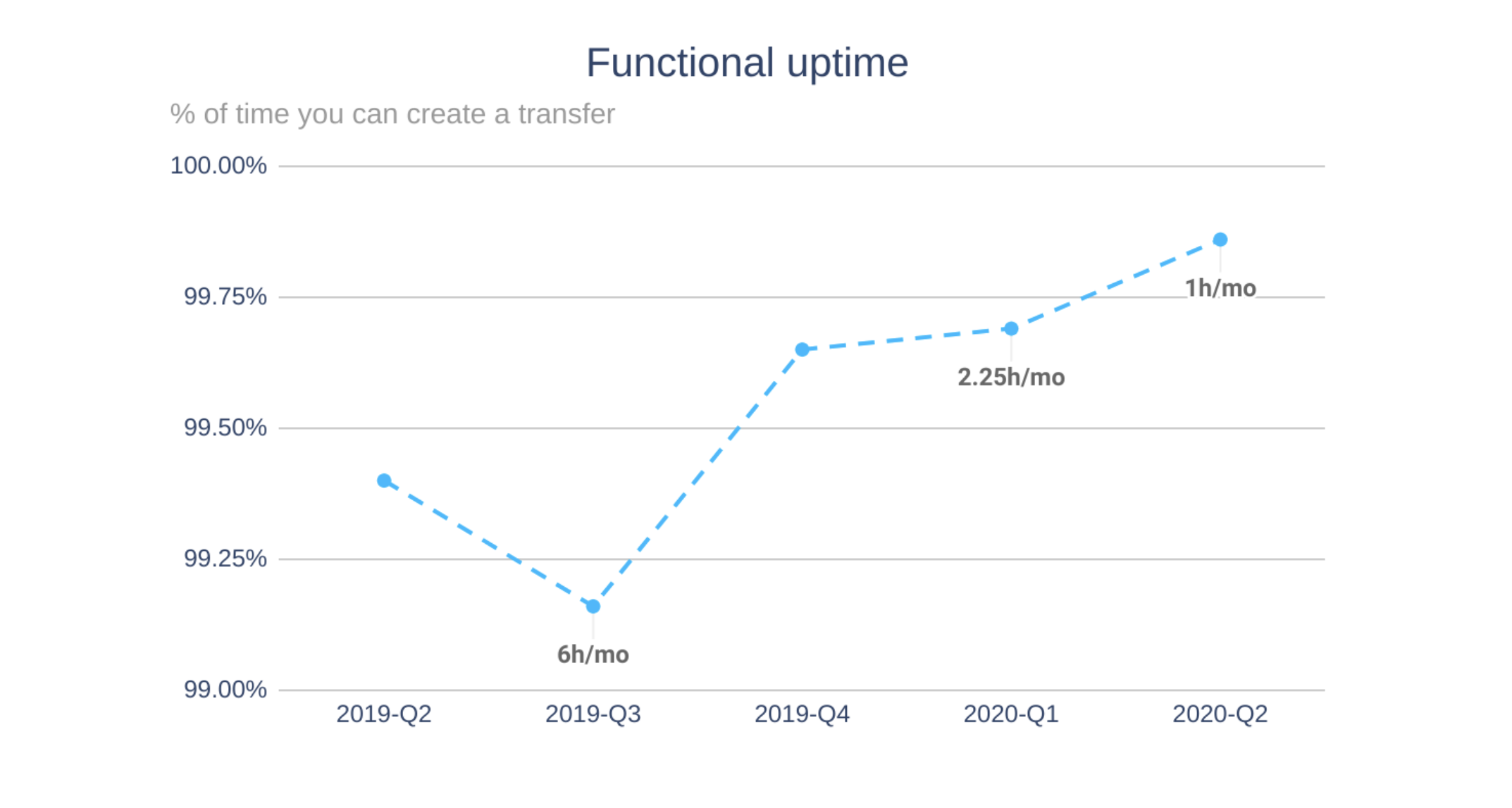

Our uptime through Q2 was 99.86% - during the entire quarter, there were 3 hours when customers couldn’t complete transfers. A great improvement over the last quarter yet short of our 99.95% availability goal.

The migration from our legacy datacenter to AWS is substantially complete and the microservices architecture is paying off in making us more resilient to technical incidents. This quarter we improved monitoring a lot which means we catch issues when still small before they become bigger issues. Fun fact: our systems produce 6 billion metrics every hour for our monitoring tools.

This quarter we brought Wise to the expats in Dubai, Abu Dhabi and the other united emirates. Sending from AED has been one of the top 3 most requested routes. It is reflected in the demand, as the senders in Emirates already saved Dhs 4.2M (£900k) with Wise compared to other providers in Q2. About 60% of our AED transfers are delivered the same day.

We launched instant payouts to MasterCard and Visa card numbers in Georgia, Croatia, Turkey, Vietnam, and Israel this quarter, taking the total to 11 countries where this feature is enabled. Customers sent 110,000 transfers to card numbers in this quarter alone.

But it’s not all good news. In April we closed transfers to Uganda and Tanzania which we just opened earlier this year. Our local delivery integration wasn’t reliable enough. We’re working on a better local setup - the routes should reopen later this year.

We also paused issuing Polish account numbers. We have to make improvements to the integration of this feature to become sustainable. Issued PLN account numbers work as normal and we hope to resume issuing new numbers soon.

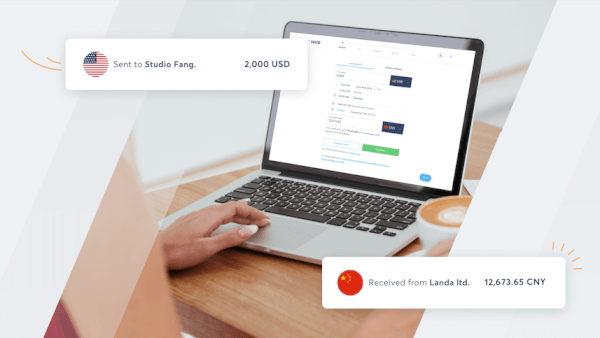

You can now connect your Wise business multi-currency account with QuickBooks, the most requested accounting tool integration. This means your business activity in Wise will automatically sync with QuickBooks. Thousands of businesses have already done so.

Connecting your currency balances to QuickBooks is simple and works just like our integration with Xero.

Users can control which currency accounts you sync, keep track of international transactions in multiple currencies, and enable or disable sync of any QuickBooks bank accounts. The integration removes the need to manually export or upload your balance statements. They’ll sync with QuickBooks daily.

The QuickBooks integration is based on our Open Banking API which we launched last quarter.

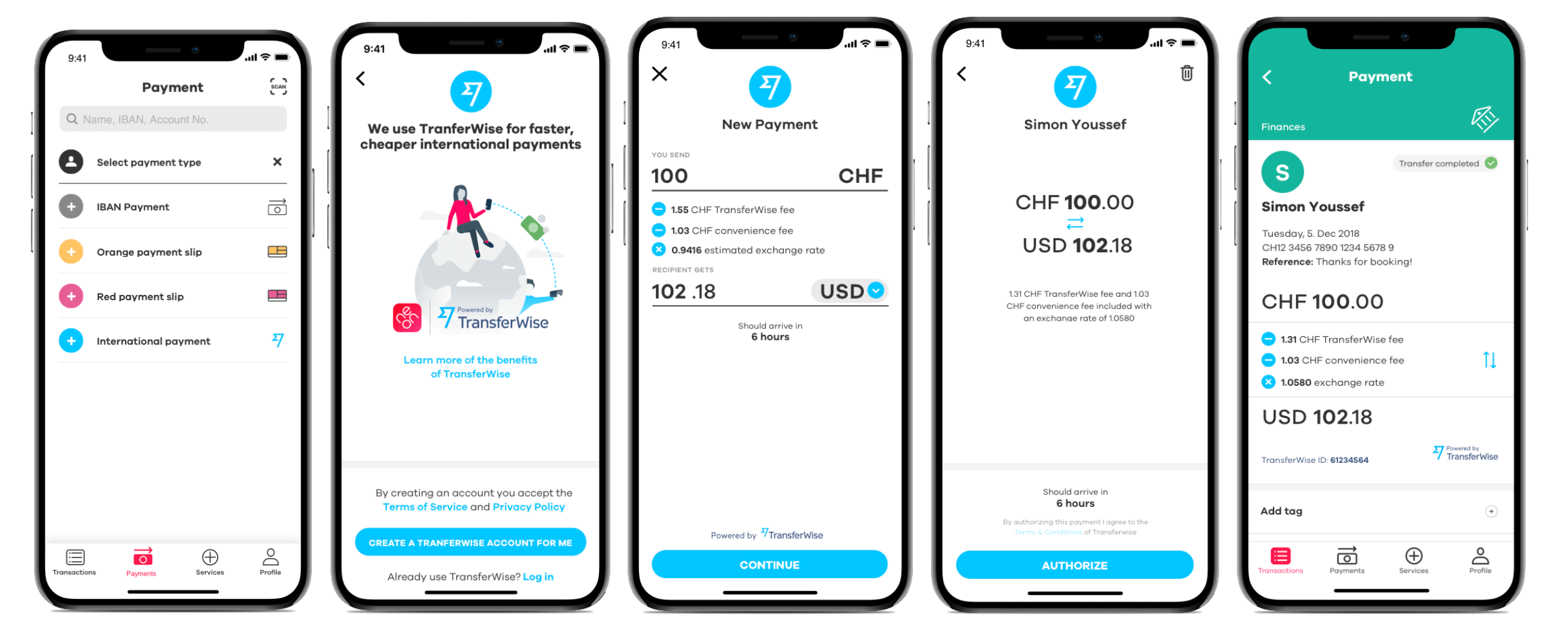

Banking startup neon is challenging the Swiss banking market with its first fully digital account offering - and now their 30,000 customers can send money abroad through Wise, straight from the neon app. This is powered by our public API, which lets banks and businesses all over the world offer their customers cheap, fast transfers through Wise.

We also plugged directly into Finstar, the Swiss core banking system developed by Hypothekarbank Lenzburg, to help other Swiss banks easily offer their customers the same experience.

This quarter we also launched an integration with Mambu, a German cloud banking platform.

Mambu helps financial institutions build new banking and lending experiences with their cloud banking platform.

Now Mambu’s customers, who are both challenger and traditional banks, can seamlessly access Wise’s technology infrastructure directly through the Mambu platform. This will let their banking customers use an out-of-the-box integration to bring the Wise experience into their native banking apps.

We've expanded our partnership with N26 - one of our oldest partnerships - to offer an improved Wise experience in their banking app. N26 customers were already able to send 16 currencies and now we added 19 more to the integration, including BRL, MXN, SGD or TRY by popular demand.

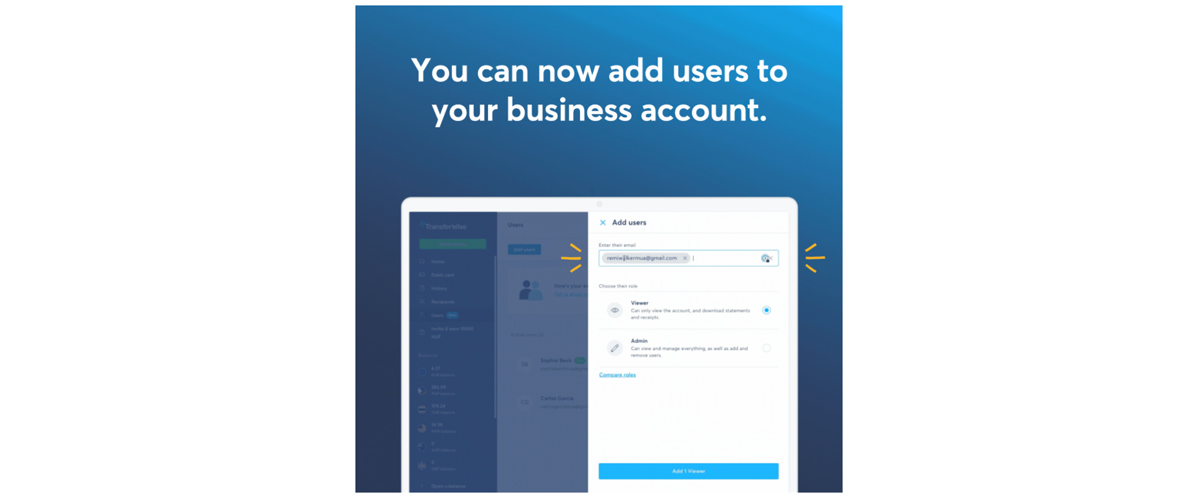

You can now add your team members to your business account as ‘admins’. Admins can help manage all aspects of the account including making payments on behalf of your business. With multiple admin support live, we will be moving on to working on multi-user approvals, which will let businesses add extra security to their payments by having one person set them up and another approve.

We continued to work fully remote this quarter and are only now returning to offices in Tallinn, Singapore, Budapest. Yet we shipped more releases than ever.

Through the lockdown we’ve been actively hiring, some roles more than others and we have onboarded 197 new Wisers since we started working remotely. We have 41 open roles right now, including many in software engineering and product.

Onwards!

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...

We're excited to announce that Wise is launching a transfer service to help expats to send money from China.* Wise now supports Chinese Yuan (CNY) transfers...

We have some exciting news to share with you - sending money from HKD via bank transfer to our new bank account can now be instant! Yes, you read that right,...

Doing business with vendors or suppliers in China? You can now pay them in Chinese Yuan (CNY), also known as Renminbi (RMB). Instead of having your vendors...

FPS: Simpler and quicker transfers to HKD Say goodbye to complicated bank details and hello to FPS ID! This month, we’ve made sending money to HKD a whole lot...