Expats in China, welcome to Wise!

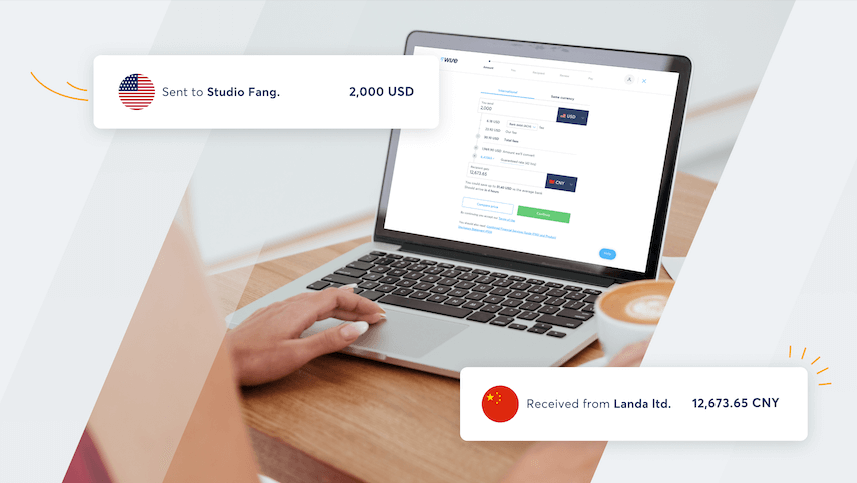

We're excited to announce that Wise is launching a transfer service to help expats to send money from China.* Wise now supports Chinese Yuan (CNY) transfers...

Doing business with vendors or suppliers in China? You can now pay them in Chinese Yuan (CNY), also known as Renminbi (RMB).

Instead of having your vendors bill you in currencies like USD, and losing money to high conversion fees, they can now bill you in, and get paid in, CNY.

You can now send money from your home currency – USD, GBP, AUD, JPY, SGD, NZD, CAD and HKD, and your recipient gets CNY. And we always convert your money at the real exchange rate, for a low, transparent fee.

| Now you can check the latest rate with this currency converter to send RMB. |

|---|

Once the money’s on its way, , your recipient’s bank will contact them to complete a declaration process confirming the business transaction.

We always give you the real exchange rate, with a low, transparent fee, and you save money compared to PayPal, Western Union, or most banks.

Check out our rates below.

Fees for paying 30,000 CNY to a business in China:

| Send from | Fee |

|---|---|

| HKD 🇭🇰 | 396.74 HKD |

| USD 🇺🇸 | 55.35 USD |

Fees as of 14 December 2021, 10:55 AM. You can log in to our pricing calculator, or check our pricing page to see how much you can save.

Your vendors and suppliers in China can now invoice you in CNY and you can pay them using Wise. However, if they prefer to be paid in USD, you can do so with Wise.

With Wise, you can send US dollars to bank accounts that are denominated in USD outside the US. This way, businesses who need to pay USD invoices or send money to an account outside the US can do so without using their bank. Check the currency conversion rate for USD to RMB.

USD is sent to bank accounts outside the US via the SWIFT payment network . This is different from a regular Wise transfer and might take a day or 2 longer. It also costs a bit more, but is still cheaper than more traditional methods of sending money overseas. Learn more.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We're excited to announce that Wise is launching a transfer service to help expats to send money from China.* Wise now supports Chinese Yuan (CNY) transfers...

We have some exciting news to share with you - sending money from HKD via bank transfer to our new bank account can now be instant! Yes, you read that right,...

FPS: Simpler and quicker transfers to HKD Say goodbye to complicated bank details and hello to FPS ID! This month, we’ve made sending money to HKD a whole lot...

Today, we’re changing our name from TransferWise to Wise. Our customers now need us for more than money transfers. Sending, spending, and receiving money...

The COVID-19 pandemic has quickly become one of the biggest global health issues we’ve seen in our lifetimes. Four months on from initial responses, we’re in...

The year’s 2020. You need to pay a colleague back for a dinner you shared in London. But she’s in Spain. And you haven’t got her bank details, let alone an...