How to open a Hang Seng Bank account in Hong Kong?

Hang Seng Bank provides diversified banking services. This article explains the requirements, procedures, and account types for opening an account at Hang Seng.

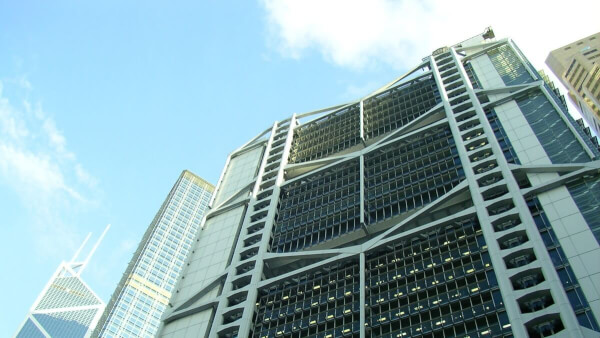

As a vibrant financial hub, it is no surprise that Hong Kong has nearly 200 banks. When planning to open a bank account here, the abundance of options might leave you feeling overwhelmed. This article will help you navigate Hong Kong's banking landscape and keep up with the fast-paced lifestyle. This comprehensive guide will provide information on the different types of bank accounts available, associated fees, required documents, and other essential requirements.

Are you still feeling unsure about which bank account to choose for sending money abroad even after reading this guide? Don't worry, there are third-party providers like Wise that offer alternatives to traditional bank accounts. Wise is an international account that allows you to send multiple currencies worldwide. More on that later!

There are many different bank accounts available in Hong Kong to suit your personal banking needs. You will mostly see these types of bank accounts such as checking savings, current, time deposits, foreign currency, integrated and investment accounts.

Some types are for you to spend or pay bills, while others are intended for short- or long-term savings. For example, a checking account would be perfect if you need a bank account for everyday withdrawals. On the other hand, if you don’t need immediate access to your funds and are looking for a higher interest rate on your savings, you might want to consider opening fixed or time deposits.

There are nearly 200 banks in Hong Kong, and each offers different types of bank accounts, making it extremely difficult to choose the right one. For many busy residents and expatriates, integrated accounts—a perfect combination of current and savings accounts—are the most popular choice nowadays. Some banks also offer multi-currency current and savings accounts to make these types of bank accounts even more convenient.

When comparing banks in Hong Kong, it is crucial to take into account the fees associated with your account. These fees can vary considerably from bank to bank and depend on the type of account you have. To give you an idea, here are a few examples of the fees you might encounter.

Banks may charge an annual fee to cover the cost of maintaining your account each year. The amount of the annual fee can vary depending on the policy of the bank you choose. Some banks will charge very little for these fees, while others may cost you a couple of thousand dollars to maintain your account. However, some banks will waive these fees if you maintain a certain balance in your account. Therefore, before opening a bank account in Hong Kong, it's best to ask your bank if they charge an annual fee and what their conditions are for waiving it.

Most banks offer free ATM withdrawals from their own - and sometimes partner banks' - ATMs.

However, it's important to be aware that if you use an ATM from outside your dedicated network or while you travel, you could face substantial fees. Local charges may be a few HKD per transaction, while international fees can escalate to HK$50 + 1% - 1.95% currency conversion charge per transaction.

If you're new to Hong Kong and don't have access to a local account yet, you may choose to use the bank card attached to your home country account for ATM withdrawals. However, keep in mind that you may have to pay an overseas withdrawal fee as well as a foreign transaction fee associated with it. These charges could be either a fixed amount or a percentage of the amount you withdraw, so weighing the potential costs is important.

Sometimes banks might waive these fees if you maintain a minimum deposit in your account or meet other requirements. Check with your bank for requirements and remember your bank's network of partnerships, you might be able to skip this fee altogether!

In an international hub like Hong Kong, whether you're a local or an expat, there is a high chance you'll need to send and receive international payments.

Cross-border transfers with your bank can be expensive! You’ll definitely want to check out before you select a banking account. In a couple of Hong Kong’s biggest banks, the fees might be found under some titles such as:

In addition, when sending money in a foreign currency, you’ll also often pay an extra fee which is rolled up into the exchange rate used. Take a look at the telegraphic transfer rate offered by your chosen bank, compared to the mid-market exchange rate. If there’s a difference, this probably means you’re paying a markup - an extra charge which is not transparent, and can push up costs even further. You might also find a range of different charges piling up on your international transfers. So, make sure you understand which of these costs are payable for your normal transfers so there are no surprises.

If you're frustrated with the high fees for bank telegraphic transfers, you'll be glad to know that there are third-party providers, making your international payments easier and more affordable. More on that coming right up!

When you're opening a bank account in Hong Kong, you might as well come across certain other fees frequently. Some of these fees include:

These charges can vary widely among banks and different types of associated accounts. It's important to read the small print in advance to make sure you get the right account for your needs, as charges can vary widely between banks and account products.

Different banks have slightly different account opening processes. You may even have to present some extra documents depending on your situation.

You can refer to the example of the required documents to open an account from HSBC3 - one of Hong Kong’s largest banks.

Depending on the type of account you’re applying for you might also be asked for:

Make sure that you check your own preferred bank for the paperwork and information needed.

The minimum deposit amount needed to open a bank account in Hong Kong may vary depending on the bank and the type of account you wish to open. Some banks offer to open an account with no minimum deposit requirement, while others may require a minimum initial deposit.

For example, if you are looking to open a HSBC Foreign Currency Savings Account, you will need to maintain a minimum deposit of an equivalent of 1,000 USD4 in your chosen currency. But with a HSBC One account, you can start to use the bank account immediately without any deposit5. If you open a Foreign Currency Savings Account with Standard Chartered, the bank will require you to deposit 200 in any currency (except for Yen)2.

The examples mentioned above are from two of the largest banks in Hong Kong- HSBC and Standard Chartered, and they relate to specific types of bank accounts.. If you want to know the minimum deposit requirements for other types of bank accounts and banks, the best way is to directly check with your preferred bank for accurate and up-to-date information.

If you are a resident of Hong Kong, some banks offer the convenience of an online application to open a bank account.

For expats, opening a bank account in Hong Kong typically requires making an appointment and visiting a bank branch in person. Some banks have specific branches dedicated to assisting expat applications. The staff at these branches are experienced in helping newcomers to Hong Kong and can provide comprehensive English-language support.

If you’re planning on staying in Hong Kong for more than 180 days1, you’ll need to register for a Hong Kong ID card (HKID) within your first 30 days in the country. It’s free to apply, and you’ll usually get your card within 7 days. If you already have your HKID when you’re applying for your bank account, you should take it along with you. Alternatively, banks may allow you to present a valid passport and visa if necessary when setting up your bank account and then bring your HKID for verification later.

Here’s how to approach opening an account in Hong Kong:

Research and choose your preferred banking institutions:

You can choose from some of the top banks in Hong Kong such as HSBC, Standard Chartered Bank, Citibank, DBS, and so on. Hong Kong also has some of the best virtual banks if that is something you want to look at.

Research the eligibility and collect all the required documents.

Book an appointment and visit a local bank branch in person for identity verification and application.

If you’re eligible to open an account online, the process can usually be done anywhere with the bank’s app in just a few minutes. However, the specific requirements and eligibility criteria - as well as the process you need to follow - might vary between one bank and another.

Choose the type of account you want to open.

Wait for the approval

You may need to present additional documents requested by the bank.

Get the account details and access your account.

In general, opening a bank account in Hong Kong might take up to 2 weeks, but the exact timeframe can vary depending on various factors such as the bank's procedures, your documentation, and any additional due diligence measures required.

Having a bank account in Hong Kong is convenient. Whether you're a local, a frequent visitor, or an expat living in Hong Kong, you may want to consider choosing the best bank account to house your money. Spend a bit of time thinking about how you'll use your new account and comparing the service fees for different products to make sure you get the best possible value!

After opening a bank account in Hong Kong, if you wish to look for better alternatives to send money abroad, you can explore third-party providers like Wise, which offers a cheap, fast, and transparent alternative. You'll be able to send money to more than 70 countries, using the mid-market rate with the Wise app!

Sources:

Sources last checked on 5 Apr 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Hang Seng Bank provides diversified banking services. This article explains the requirements, procedures, and account types for opening an account at Hang Seng.

If you're interested in opening an HSBC One account in Hong Kong, this article will give you all the requirements, processes, and fees for the HSBC One account.

Our guide covers everything you need to know about opening a bank account with HSBC in Hong Kong, including the procedures, requirements, and benefits.

What are the best banks in Hong Kong? This guide will help you navigate the options, including their main features, products, and associated fees.

DBS is one of the commonly used banks in Hong Kong. The article will introduce the requirements, process, and types of accounts for opening an account with DBS.

Standard Chartered is one of the banks in Hong Kong. The article will introduce the requirements, process, and types of accounts for opening an account with SC.