How to open a Hang Seng Bank account in Hong Kong?

Hang Seng Bank provides diversified banking services. This article explains the requirements, procedures, and account types for opening an account at Hang Seng.

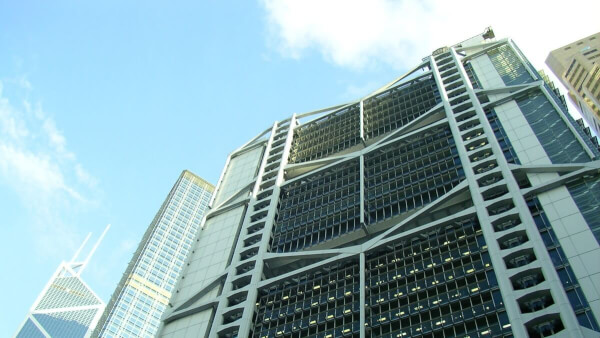

Given that Hong Kong is one of the most dynamic and largest financial hubs, it is no surprise that the city has many prominent banks. The city's banks offer a wide range of products and services to meet the needs of both residents and international investors. Whether you're a local, a frequent visitor, or an expat living in Hong Kong — you may want to consider choosing the best banks to house your money.

This guide will help you navigate the options available in Hong Kong's vibrant banking sector, including their main features, products, and associated fees. This guide also discusses Wise as a smart alternative to make international payments.

| Table of contents |

|---|

Before you look at the list of the best banks in Hong Kong, let’s first dive into how the banking sector operates in Hong Kong.

The banks are regulated by the Hong Kong Monetary Authority (HKMA). Based on the amount and term of deposits accepted and the nature of the business, HKMA divided these banks into a three-tier system such that:

Hong Kong and Shanghai Banking Corporation, commonly known as HSBC, is one of the largest international banks in Hong Kong, and you can access services locally and other countries and territories worldwide.

One of the best features at HSBC is the HSBC One account that you can easily open through the HSBC HK App. With this account, you can also easily access a wide range of services, including 24/7 online banking services, credit cards, insurance products, deposits, and investment banks in 12 major currencies.

Here are a few of the standard fees for personal banking services you need to know from HSBC:

| Service | Fee (HKD) |

|---|---|

| ATM cash withdrawal | Oversea: $20 - $50 depending on the network of the ATM. Local: HSBC Group’s ATM : Free Non-HSBC Group : $15 - $ 25 depending on the network of the ATM. |

| Telegraphic transfer fees | Via online banking: $50 Via branch: HK$120 - $240 |

*All fees are correct at time of research - 07 December 2023. For the most recent details, please check out HSBC's Wealth and Personal Banking Customers tariffs.

Standard Chartered is another bank with a robust international presence. Therefore, as expected from a large international bank, Standard Chartered Hong Kong offers a full range of personal, commercial, corporate and investment banking account products and services. You can access different service levels depending on how much money you keep in your account and the type of transactions you want to make.

You can also use the Standard Chartered international services, which give priority banking to customers and their families worldwide.

Here are a few of the standard fees from Standard Chartered you’ll want to know about:

| Service | Fee (HKD) |

|---|---|

| Telegraphic transfer fees | Priority Banking Customers Via Online or Mobile Banking: Free Via Branch: $120 per request Premium Banking Customers Via Online or Mobile Banking: $50 per request Via Branch: $170 per request Easy Banking and Non-relationship Banking Customers Via Online or Mobile Banking: $50 per request Via Branch: $200 per request |

| ATM Cash Withdrawal | ATM cards/ Other account card: JETCO Network Local: Free Overseas: $28 Visa/ Plus Network/Mastercard/ Cirrus Network: $28 UnionPay Network: Local: $15 Overseas: $15 and 0.5% cross-border transaction fee imposed by UnionPay Network (if applicable) Multi-Currency Mastercard Debit Card: JETCO Network/Mastercard/ Cirrus Network: Free |

| Surcharge on add currency telegraphic transfer (Fijian Dollar, South Korean Won, Macau Pataca, New Taiwan Dollar) | Priority Banking, Premium Banking, Easy Banking and Non relationship Banking Customers Cross Border Transfer via Online or Mobile Banking: Free Cross Border Transfer via Branch / Local Telegraphic Transfer: $200per request |

*All fees are correct at time of research - 07 December 2023. For the most recent details, please check out Standard Chartered Bank’s Service Charges.

In 1902, Citibank became the first foreign bank operating in Hong Kong. The bank now offers a holistic range of banking services: consumer banking, commercial banking, corporate and investment banking. The Hong Kong branch is also its regional office.

In recent years, Citibank Hong Kong launched Citi Plus, a fully digital experience with deposit, investment, protection and shopping rewards. This new category moves most of Citibank's traditional banking services to mobile apps. It also offers no minimum deposit and no monthly fees3.

Moreover, you can check out Citibank Global Wallet which allows you to make purchases overseas at point-of-sale or online and withdraw cash in multiple currencies without incurring additional foreign currency conversion fees and admin fees4.

Here are some of the example fees from Citibank you'll need to consider:

| Service | Fee (HKD) |

|---|---|

| Telegraphic transfer fees | Via Citibank online: $0 - $200, depending on the type of account Via other channels: $100 - $220, depending on the type of account Additional Telegraphic Transfer service fee will be charged for non-domicile currency. |

| ATM Cash Withdrawal | Local: Free Citibank ATM/JETCO ATM: Free Other Networks: Up to 2.4% per withdrawal in Hong Kong Dollar equivalent. |

*All fees are correct at time of research - 07 December 2023. For the most recent details, please check out Citibank’s Banking / Mortgages Services.

Often considered the largest independent bank in Hong Kong, BEA currently operates one of the largest branch networks, with 48 branches5. The bank provides comprehensive services such as wholesale and personal investment banking and wealth management services to its customers in Hong Kong and other major markets worldwide.

In the table below, you can see some examples of the standard fees:

| Service | Fee (HKD) |

|---|---|

| Telegraphic transfer fees | Via Branch: $200 + plus cable charge BEA Online / Corporate Cyberbanking / BEA Corporate Online: $20 (or its equivalent in other currencies) handling fee + $80 (or its equivalent in other currencies) cable charge. |

| ATM Cash Withdrawal | In Hong Kong, via a PLUS/CIRRUS or a UnionPay ATM: $15 - $30, depending on the ATM network. In Mainland China or Macau: $15 - $25, depending on the type of card and the ATM network. Overseas: $ 50 |

*All fees are correct at time of research - 07 December 2023. For the most recent details, please check out Bank Charges.

The Branch is a licensed bank registered under the Hong Kong Banking Ordinance. The functions of the branch include global investment, global funding, CNH trading centre, investment banking and asset management, as well as risk management and internal control & compliance.

| Service | Fee (HKD) |

|---|---|

| Telegraphic transfer fees | Other foreign banks: Via electronic channels: $65 Via branches: $260 per transaction Remittance to branches of Bank of China and Cooperative Banks in the Mainland and designated branches outside Hong Kong: Via electronic channels: Free Via branches: $260 per transaction |

| ATM Cash Withdrawal | $15 - $50, depending on the ATM networks and the location. |

*All fees are correct at time of research - 07 December 2023. For the most recent details, please check out BOC’s General Banking Service Charges.

Hang Seng is a subsidiary of the globally recognized HSBC group, and as such, it offers a wide range of rates and services that are comparable to those offered by HSBC.

Along with a range of prestige and wealth management services, Hang Seng also provides a comprehensive Preferred Banking package that caters to everyday banking needs. This package includes features such as transfers, debit and credit cards, access to credit facilities, and more.

You can check out some standard fees from Hang Seng Bank below:

| Service | Fee (HKD) |

|---|---|

| Telegraphic transfer fees | Hang Seng account in Mainland China/ Macau SAR Hang Seng Personal e-Banking: $65 Branch/Other Channels: $190 Other bank account in Hong Kong SAR/ Mainland China/Taiwan/Macau SAR Hang Seng Personal e-Banking: $65 Branch/Other Channels: $230 Other countries/territories Hang Seng Personal e-Banking: $65 Branch/Other Channels: $230 (HKD or domicile Currency) or $270 (Non-domicile Currency) |

| ATM Cash Withdrawal | Local: Free, except for withdrawing via UnionPay ATM network in Hong Kong which would incur a fee of $20 per withdrawal. Overseas: $20 - $ 60, depending on the ATM networks and total withdrawn amounts. |

*All fees are correct at time of research - 07 December 2023. For the most recent details, please check out the Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers.

Initially founded in Singapore, DBS now operates in 18 global markets, including Hong Kong. DBS is one of the most commonly used banks in Hong Kong, with branches in various districts across the city.

One of the key services offered by DBS is fast overseas transfers through DBS iBanking online banking or the DBS Digibank HK app. Customers can transfer funds in 12 different currencies for remittances. Additionally, DBS offers unlimited fee-free local currency transfers to 40+ destinations worldwide6 on the same day for its customers.

However, it is important to note that DBS Remit does not support countries such as South Korea, Malaysia, or non-Eurozone European countries. DBS Remit also doesn’t accept transfers of US dollars to countries outside the United States.

Here are some fees charged by DBS Hong Kong:

| Service | Fee (HKD) |

|---|---|

| Telegraphic transfer Fee | Handling charge per telegraphic transfer Via DBS iBanking: $100, waived for DBS Treasures account holders. Via branches: $100 - $200, depending on the type of account. Cable charges General/DBS Account: $100 per cable DBS Treasures: Free Correspondnet bank charges RMB (to mainland China): at cost RMB (to overseas): $250 EUR / GBP: $400 HKD / USD & other currencies: $250 |

| ATM Cash Withdrawal | DBS Treasures: Free General / DBS Account: $15-$25, depending on the ATM networks and locations. |

*All fees are correct at time of research - 07 December 2023. For the most recent details, please check out Bank Charges Schedule (DBS Account and Treasures customers).

As you can see, bank fees can sometimes be confusing. Also, most of the banks in Hong Kong still convert foreign currency at markup exchange rates. So, if you're looking for a better alternative to traditional banks to transfer your money, check out Wise, which is a cheap, fast, and transparent alternative.

Unlike most of the traditional banks, Wise uses the mid-market exchange rate with no hidden fees or markups for currency conversions. You just pay a low, transparent fee: you can see the cost and the total amount your recipient will receive before you confirm your Wise payment.

For a simple, secure international payment service in 50+ different currencies, check out the options available from Wise.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Sources:

1 Hong Kong Monetary Authority: The Three-tier Banking System

2 HSBC HK: Fees and Charges

3 Standard Chartered HK: Service Charges

4 Citibank Hong Kong: Fees & Charges

5 The Bank of East Asia: Bank Charges

6 Bank of China (Hong Kong): General Banking Service Charges

7 Hang Seng Bank: Bank Tariff Guide for Hang Seng Wealth and Personal Banking Customers

8 DBS Personal Hong Kong: Rates/Fees

Sources last checked on 13 Dec 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Hang Seng Bank provides diversified banking services. This article explains the requirements, procedures, and account types for opening an account at Hang Seng.

If you're interested in opening an HSBC One account in Hong Kong, this article will give you all the requirements, processes, and fees for the HSBC One account.

Our guide covers everything you need to know about opening a bank account with HSBC in Hong Kong, including the procedures, requirements, and benefits.

DBS is one of the commonly used banks in Hong Kong. The article will introduce the requirements, process, and types of accounts for opening an account with DBS.

Standard Chartered is one of the banks in Hong Kong. The article will introduce the requirements, process, and types of accounts for opening an account with SC.

This guide runs through the key features of the Mox account including benefits and fees.