How to open an HSBC One account in Hong Kong?

If you're interested in opening an HSBC One account in Hong Kong, this article will give you all the requirements, processes, and fees for the HSBC One account.

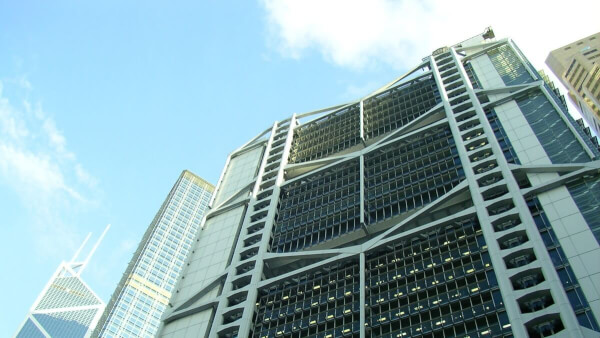

Hang Seng is a subsidiary of the globally recognized HSBC group and one of the most commonly used banks in Hong Kong. It offers a wide range of rates and services comparable to HSBC's, but it tends to focus on serving customers currently living in Hong Kong. You can find Hang Seng ATMs easily everywhere around the city.

To meet the needs of different customers, Hang Seng Bank provides diversified banking services, such as foreign exchange remittances, securities trading, loans, etc. This article will introduce the requirements, procedures, and account types for opening an account at Hang Seng Bank so you can easily understand the key points.

Being one of the best banks in Hong Kong, Hang Seng offers a wide range of bank accounts that are tailored to your needs. From simple daily money withdrawals to receiving investment solutions and wealth strategies, you will be in good hands with an account from Hang Seng.

You can start your journey with just a Preferred Banking account from Hang Seng, and you can easily manage your everyday finances in just one app. With this account, you can enjoy a quick money transfer service with FPS. This account also supports you with Foreign Currency Exchange Service. Best, you do not need to maintain any relationship balance to receive monthly fee waivers!

If you're ready to take your banking experience to the next level, consider upgrading to Private or Prestige Banking. These accounts offer a wealth of investment services, including investment solutions and wealth strategies. As a Prestige Banking customer, you can even apply for a Hang Seng Prestige World Mastercard®. Keep in mind, maintaining a relationship balance is required for monthly fee waivers. More details on this later!

| Service | Fee¹ |

|---|---|

| Telegraphic transfer fees |

|

| ATM cash withdrawal |

|

| Outward remittances cable enquiry | Min 250 HKD |

| Outward remittances amendment or cancellation | 200 HKD plus cable charges of HK$100 and foreign bank charges (if any) |

You can apply for a Hang Seng Bank account at the branch or online. To enjoy the comfort of opening your account, you must be aged 18 or above and residing in Hong Kong.²

However, if you are not meeting those requirements, you might still apply for an account. You should go to the nearest branch to know more about the eligibility. Moreover, if you have already held a joint-named Integrated Accounts, or owning a sole-named for Prestige Banking account, you will also need to go to the physical branch to apply for an account

The documents are different depending where you are from.³

| Where are you from? | What document do you need to submit? |

|---|---|

| Hong Kong Residents | Either one of those:

|

| Mainland China Residents |

|

| Others | Valid passport or Seaman's Identity Book with valid record of entry to Hong Kong |

If you are a foreigner working in Hong Kong, you might need to submit extra document such as:

Please note that you also need a mobile phone that is able to receive “One-Time Password” via SMS).

If you are looking for a way to waive your monthly fees, you should have the minimum balance in your account. Your account might need to maintain these certain amount:

| Account type | Minimum balance |

|---|---|

| Preferred Banking | 0 HKD |

| Prestige Banking | 1,000,000 HKD |

| Prestige Private | 8,000,000 HKD |

After reading through information about Hang Seng, you now decide you want a bank account with Hang Seng. Then you can follow these steps through the app:²

If you are new to Hang Seng or only holding Hang Seng credit cards:

If you are already holding a Hang Seng bank account (Not applicable if you only hold credit card accounts):

If you are looking to open an account in the physical branch, you can book an eAppointment for Account Opening at Branch. Remember to bring every document mentioned above in case of further validation from the bank.

If you haven’t had a Hang Seng account before, you will receive full banking services after three working days from the day that you applied. If you already have an existing integrated Account or Preferred Banking account, you will receive application results after 2 to 3 working days. You will receive an SMS message if the account is opened or upgraded.

So make sure you check your phone constantly to see if the bank requires any additional information!

So here you have it: the short introduction to opening a Hang Seng bank account in Hong Kong. Hang Seng offers convenient electronic banking services, such as making money transfers online without having to go to a branch in person. Although certain levels of accounts will waive remittance fees, you still need to pay attention to whether there are hidden costs in the exchange rate used by the bank, such as using an exchange rate that is more expensive than the mid-market exchange rate for conversion.

So if you often need to make overseas remittances (such as sending to your home country if you are an expat), it is recommended to compare with remittance services on the market and choose a suitable method based on your remittance currency and needs. Wise uses mid-market rates and can remit money to more than 70 countries, which may help you save more on remittances!

Sources:

Sources last checked on 20 Apr 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you're interested in opening an HSBC One account in Hong Kong, this article will give you all the requirements, processes, and fees for the HSBC One account.

Our guide covers everything you need to know about opening a bank account with HSBC in Hong Kong, including the procedures, requirements, and benefits.

What are the best banks in Hong Kong? This guide will help you navigate the options, including their main features, products, and associated fees.

Standard Chartered is one of the banks in Hong Kong. The article will introduce the requirements, process, and types of accounts for opening an account with SC.

DBS is one of the commonly used banks in Hong Kong. The article will introduce the requirements, process, and types of accounts for opening an account with DBS.

This guide runs through the key features of the Mox account including benefits and fees.