How to Open an Account With Mizuho Bank: A Guide for Foreigners

Learn how to open a Mizuho Bank account for foreigners. Discover account types, requirements, and steps, plus save on international transfers with Wise.

With Shinsei PowerDirect - the Shinsei online banking service - customers can access and manage their accounts any time, using their smartphone or computer.[1]

This guide walks through how to access Shinsei Bank online and on mobile devices - including getting set up, and which services you can and cannot use in English. We’ll also introduce Wise and the Wise multi-currency account as smart ways to save on international transactions - using the mid-market exchange rate and transparent, low fees.

Shinsei PowerDirect is the Shinsei bank online and mobile banking service. If you’re a Shinsei Bank customer you can use this service to view and manage any of your accounts.

Here’s the full list of services you can access through Shinsei PowerDirect[2]. It’s worth knowing that a few services are available in Japanese only - we’ll cover this in more detail later.

Before you set up PowerDirect it’s worth checking you have a compatible operating system or browser on your computer or phone. The accepted operating environments may change from time to time - but you can always get the most up to date requirements on the Shinsei Bank website[3].

You can log into Shinsei PowerDirect for the first time from either a computer or a mobile device. Before you start, make sure you have your cash card and security code card handy. The view of PowerDirect you see may be slightly different depending on the device you’re using to log in. However, the steps you need to take are the same.[4]

Let’s look in more detail at how to access services through Shinsei PowerDirect. It’s also possible to get a broad range of How To guides online on the Shinsei Bank website.[5]

When you log into PowerDirect on a PC or smartphone you’ll see your account balance on the top page automatically.

You can make local bank transfers online or using your mobile device, through PowerDirect. Here’s how.

Online transfers between Shinsei Bank accounts are always free. Depending on your customer stage you’ll get a set number of free online domestic transfers to accounts held with other banks, per month. There is then a fee for any additional transfers you make in excess of this amount. Here’s what you need to know:[6]

| Customer stage | Number of free domestic transfers/month | PowerDirect domestic transfer fee for excess transfers |

|---|---|---|

| Standard | 1 | JPY314 |

| Gold | 5 | JPY210 |

| Platinum | 10 | JPY105 |

To make a Shinsei Bank international transfer you’ll want to download the GoRemit app[7]. Shinsei GoRemit lets you check exchange rates, arrange transfers and manage your money across currencies on your mobile device. Register for Shinsei GoRemit online by completing your personal details and uploading photos of your My Number card and Residence card. You’ll then need to download and print a hard copy of the application form to accept the GoRemit terms and conditions, and post this to the bank.[8]

Once your account is registered you can create new beneficiaries and make international transfers in 170+ currencies.

Shinsei Platinum level customers can make one GoRemit overseas transfer a month for free. The regular fees for this service are as follows:

| International transfer type | Shinsei GoRemit fee[9,10] |

|---|---|

| Remittances made by withdrawing from a Shinsei PowerFlex account via GoRemit App |

|

| Remittances made by depositing funds to Shinsei designated collection account (JPY) |

|

When you use GoRemit to send an international transfer you’ll pay a fee for the service, plus a markup in the exchange rate used.

Shinsei Bank states ‘the exchange rate which the Bank applies to Overseas Remittance Transactions shall include an exchange handling charge determined by the Bank’.

Compare the cost of making your international transfer with GoRemit against the price of low cost payments with Wise. Wise international transfers use the real mid-market exchange rate with low transparent fees - which may mean you can send money abroad up to 14x cheaper with Wise compared to Japanese banks.

And with Wise, you can set up your account and make an international transfer completely online - you don’t need to send an application form or anything via post.

To send money with Wise,

You can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

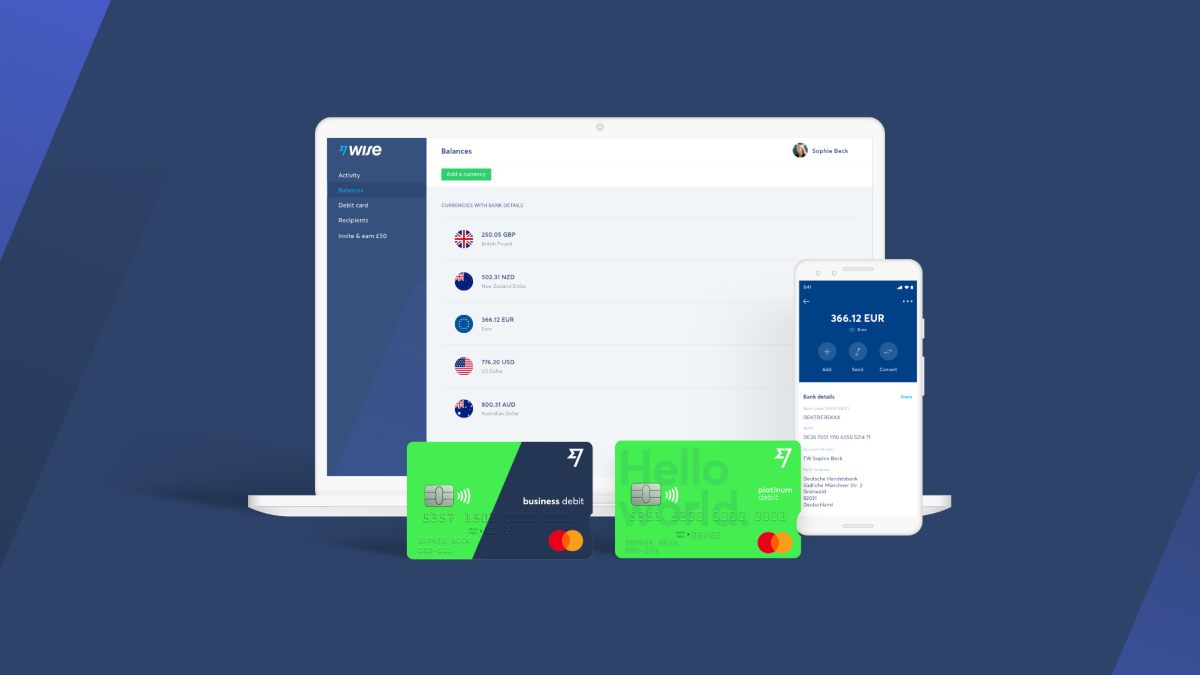

With Wise, you can not just send but also receive and spend money internationally - always with the mid-market exchange rate and transparent, low fees. You can get bank details for 10 currencies, including USD, EUR, GBP, SGD, AUD and more, to receive these currencies for free, as if you had a local bank account. What’s more, Wise debit card allows you to spend with the mid-market exchange rate and low conversion fees, too.

You’ll be able to make deposits into your different Shinsei Bank accounts through PowerDirect. Open up PowerDirect online or in the app and select either the yen deposit or foreign currency deposit tab. Here you’ll see the options available to you, including opening time deposit accounts and managing your pre-existing accounts.

Depending on the type of account you want to open, you may need to complete legally required documents which check your investment goals and understanding of risk. It’s really important to read the small print and fees for any new account. As an example, if you’re opening a foreign currency deposit account, you may want to understand the currency exchange fees applied for conversion as well as the risk of exchange rate fluctuations. Understanding the full picture in advance is essential.

Manage your ATM and card limits online or in the PowerDirect app by opening up the registered information tab which is at the top of the page when you log in. Here click on the option ATM - J-debit Account Limit - Change.

You’ll be taken to a page which shows your current limits and can adjust them as necessary. Simply submit your preferences, and confirm using the push notification you’ll be sent.

It’s useful to know that some specialist services are only available in Japanese through Shinsei PowerDirect. That means you’ll need to be comfortable reading and responding in Japanese to interact with these services online. Specifically, the services which are not yet available in English include:

With the Wise multi-currency account you can hold 55 currencies in just one account. And when you want to switch between them, you’ll get low cost currency conversion which uses the real mid-market rate every time.

Wise accounts come with local bank details for major global currencies so you can receive payments for free from all around the world. Use your linked debit card to spend and withdraw your funds when you’re at home or abroad - and manage your money on the go through the Wise app.

All international payments with Wise use the mid-market exchange rate with low, transparent fees which can work out far cheaper than your regular bank. Transfers are available 24/7 from your phone or computer - with responsive support around the clock, in English, Japanese and a range of other languages.

See how much you can save today, with Wise.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a Mizuho Bank account for foreigners. Discover account types, requirements, and steps, plus save on international transfers with Wise.

Learn how to open a Japan Post Bank account as a foreigner in Japan.

Check eligibility for opening a MUFG Bank account. What are he required documents, standard fees, ATM fees, International transfer fees?

Sony Bank account: eligibility, required documents, standard fees, ATM fees, International transfer fees, etc. Wise is explained in the article as well.

Open a Rakuten Bank account online by checking eligibility, required documents, standard fees, ATM fees, International transfer fees.

Open a bank account with Resona Bank following these easy steps! Standard fees including ATM fees, International transfer fees, required documents explained