Venmo doesn’t work in Japan: Find alternatives

Venmo is not yet available in Japan - learn more, and find an alternative way to make your international payment, here.

MoneyGram is a global service which allows customers to send and receive international payments in cash, to mobile wallets or direct to their recipient’s bank account.¹

This guide walks through all you need to know about MoneyGram in Japan. We’ll also look at a smart alternative when sending money from Japan - Wise, which uses the real mid-market exchange rate and low, transparent transfer fees.

MoneyGram’s fees and exchange rates can vary depending on where you’re sending money, the delivery method you choose and the amount you want to transfer. You’ll be able to estimate the fees and exchange rates which will apply to your particular payment by going to the MoneyGram page and using the MoneyGram calculator there.

Example: Sending from JPY to a BDO bank account in Peso¹

| Send amount | Transfer fee (pay cash at location) |

|---|---|

| 1 - 10,000 JPY | 480 JPY |

| 10,001 JPY - 20,000 JPY | 720 JPY |

| 20,001 JPY - 30,000 JPY | 800 JPY |

| 30,001 JPY - 50,000 JPY | 1,000 JPY |

| 50,001 JPY - 200,000 JPY | 1,400 JPY |

| 200,001 JPY - 1,050,101 JPY | 1,500 JPY |

It’s also worth noting that not all payment delivery methods are available in all countries, so you’ll need to make sure your preferred payment type is possible before you proceed.

When you look at the costs quoted by any international payment provider it’s important to look at both the transfer fees and the exchange rates which will be used. That’s because it’s common for banks and currency services to add an extra fee in the exchange rate they offer. This makes it tricky to work out the full cost of your payment - and can mean you spend more than you need to.

Compare the MoneyGram exchange rate for your currency against the mid-market exchange rate which you can find on Google or Wise online currency converter. If there’s a difference it’s likely to mean a markup has been added.

Let’s look at an example, based on sending a payment from Japan to the Philippines. Here’s the MoneyGram exchange rate, compared with the ‘real’ rate used by Wise:

*Rate taken from the MoneyGram and Wise calculators at 17:06, 23 November 2020.²⁺³

What does this difference mean to you?

If you convert and send 100,00 JPY with MoneyGram, it is converted into 45,900 PHP. But with the mid-market rate at that time, 100,000 JPY should be worth 46,370 PHP.

So the real cost you’re paying for MoneyGram in this case is not just their transfer fee but also an extra charge of 470 PHP, due to a markup in the exchange rate.

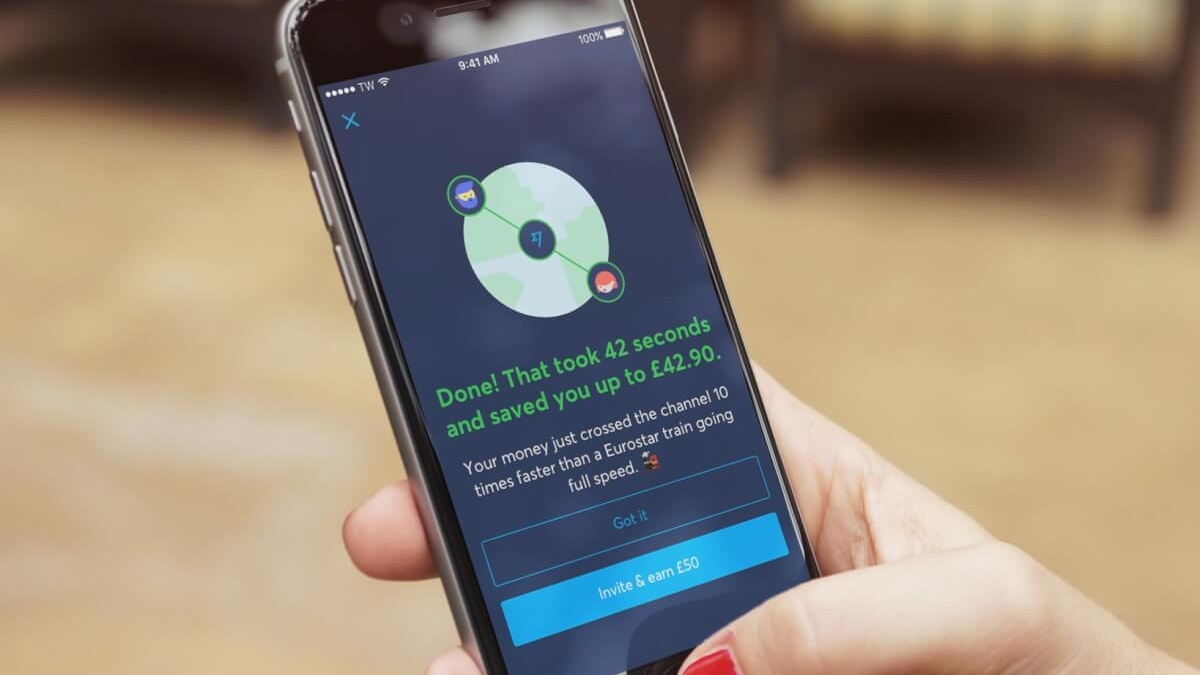

The good news is that you can send money without any markups or hidden fees with an international transfer service such as Wise. You can clearly see how much you’re paying, unlike most banks and providers.

Wise also offers a multi-currency account where you can hold 50+ currencies at one place and receive money for free from the USA, UK, Europe, and more!

If you want to use MoneyGram Japan to send an international payment you’ll have a few options. Here’s what you need to know.⁴

If you want to send money without going to an agent location, you can send money online thanks to MoneyGram’s partnership with SBI remit. This means you could still have your recipient collect their money in cash at a MoneyGram agent location near them, if you choose to.⁵

To make a payment you’ll need to provide:⁴

You must also take along the money you want to send plus the applicable fees.

You can search for your closest MoneyGram location online by simply searching on GoogleMap or using MoneyGram location finder.

When you set up a MoneyGram transfer, an 8 digit reference number is generated. If you’re the sender, you’ll need to pass this to the recipient so they can get their cash payment. You can also use this reference number to track your MoneyGram transfer. Here’s how;⁶

MoneyGram can be a useful way to send international payments if you want to pay in cash and have the money collected in local currency in another country. However, it’s important to check out the full range of fees for this service, including any markup added to the exchange rate. A marked up exchange rate can mean you’re paying more than you think.

If you’re sending a payment direct to someone's bank account, you might find there are more convenient - and cheaper - alternatives. Choosing Wise means you access the real mid-market exchange rate with no markup, and only ever pay an upfront transparent fee. This may work out much cheaper than using your bank or even an alternative provider. Do your research before you set up your payment, to see if you can save.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Venmo is not yet available in Japan - learn more, and find an alternative way to make your international payment, here.

All you need to know about Smiles Remit, right here. Learn more about Smile Remit fees and rates, the documents required and processes involved.

All there is to know about Kyodai Remittance Japan, including the Kyodai Remittance rate and how to use the Kyodai Remittance card.

Read before you send a GoRemit international transfer - all you need to know about GoRemit fees and the Shinsei Bank exchange rate.

Sending money abroad with Western Union from Japan? Here’s what you should know about the WU exchange rate and fees to avoid unexpected costs.

Read this if you’re thinking of sending a payment with Japan Remit Finance (JRF) - all you need to know about rates, fees and payment options.