手数料変更についてのお知らせ

このブログ記事は、手数料の変更についてお知らせするものであり、マーケティング関連のお知らせではありません。 Wiseは海外送金のコストを節約していただけるよう、常にサービスの改善に努めています。...

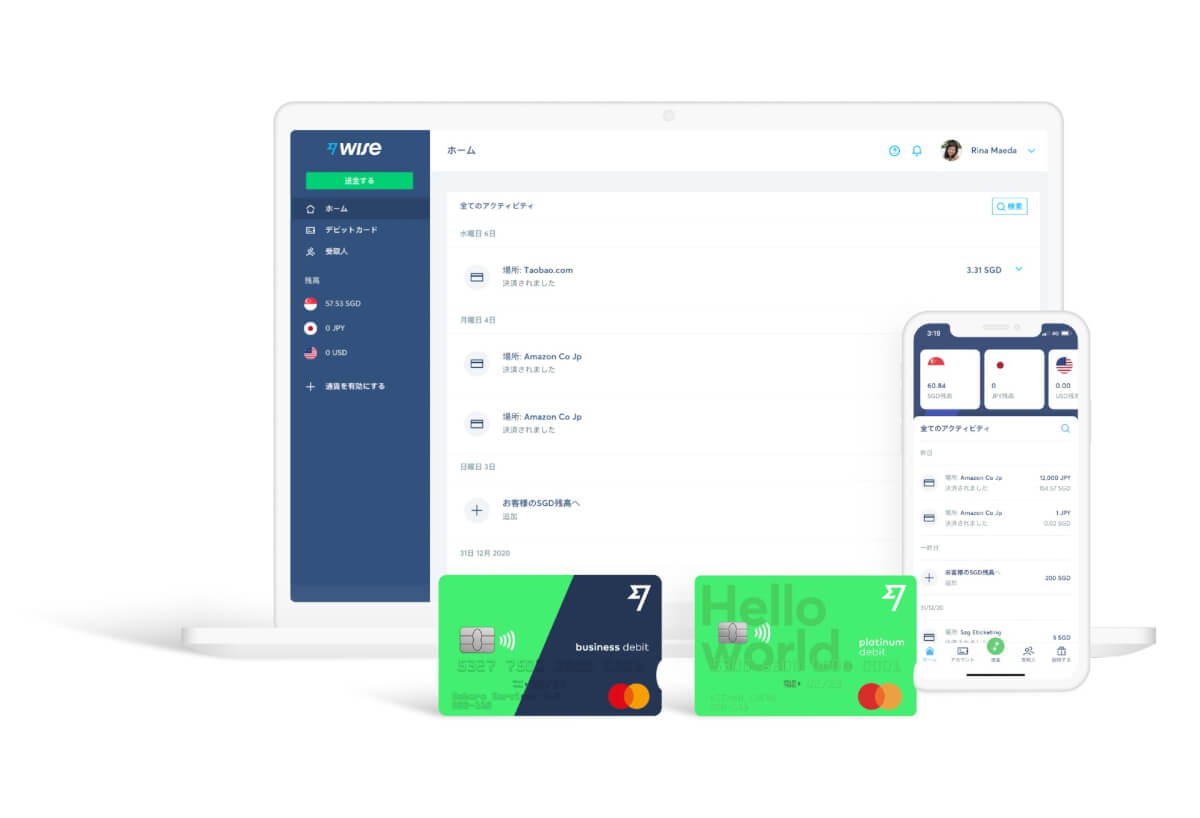

We’re excited to announce the launch of our debit card to help the people of Japan defeat monstrous foreign transaction fees.

Traditional bank cards weren’t built for overseas spending. You’re charged foreign transaction fees every time you make an online purchase, or swipe your card abroad - on top of the bad exchange rates your bank might give you.

We don’t think that’s fair. So we’re proud to launch the Wise Platinum debit Mastercard® for people and businesses in Japan. It’s time to say goodbye to foreign transaction fees and crazy exchange rates for good.

For people shopping online from overseas, going on holiday, or relocating abroad, the Wise multi-currency debit card is up to 3x cheaper than bank cards in Japan.

It’s already helping over 1 million people in Australia, New Zealand, Singapore, the UK, US and Europe avoid hidden bank fees when they spend in foreign currencies. And now people in Japan can benefit from it too.

Send, spend and receive money for less

Our debit card is part of the Wise account — a multi-currency account that lets you send money with the real exchange rate, receive money for free, and convert currencies with low fees.

Both the Wise personal and business accounts let you add, hold and convert over 40+ currencies instantly and on the go. All conversions and card transactions are made with the real exchange rate.

You can get your own bank details for Australia, New Zealand, Singapore, the UK, Eurozone, and the US, to receive money for free from those places. Unlike other accounts, there are no monthly charges.

With the debit card, you get the real exchange rate on every purchase, and free overseas cash withdrawals up to ¥30,000 every month. You pay no foreign transaction fees or annual fees.

“One of the key goals was making sure that exchange rates were not only transparent but also executed in real time within the authorisation flow,” said Ilya Leyrikh, Senior Product Director who led the technical rollout of the multi-currency card. “This meant building infrastructure that could react to market changes instantly, without introducing delay or complexity for the user.”

We know everyone’s different. We’ve designed the account so that you sign up only for what you need.

| Individuals | Businesses | |

|---|---|---|

| Open a Wise account to start sending money | Free | Free |

| Get bank details to receive AUD, NZD, SGD, USD, GBP, EUR for free | Free | One-time fee of 3,000 JPY. After that, it’s free to receive money in these currencies. |

| Get a multi-currency debit card to spend at the real exchange rate | One time fee of 1,200 JPY | Free. If you don’t need international bank details, you’ll be asked to add 3,000 JPY to your account to complete your card order. This money will be in your account for use. It isn’t a fee. |

We always give you the real exchange rate, with 100% transparent pricing. You can see how we charge here.

An easier and smarter way to manage your money

If you already have a personal or business Wise account, just log in to order your card. If you don’t have an account, it’s free and easy to get started. Say bye bye to complicated forms, as you can easily sign up for an account online. And if you need to get in touch, our multilingual customer support team is happy to help.

You can manage everything from your phone or computer, and keep track of all your spending with push notifications and emails. If you leave your card at home and need to make an online payment, you can get your card details on our website or app. And if you leave your card at a cafe or metro, not to worry — you can freeze and unfreeze your card with the click of a button.

Wherever you are, whatever you’re doing, the Wise card is your weapon to defeat high bank fees. Get your card today.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

このブログ記事は、手数料の変更についてお知らせするものであり、マーケティング関連のお知らせではありません。 Wiseは海外送金のコストを節約していただけるよう、常にサービスの改善に努めています。...

Wiseは透明性を徹底しており、常に無駄のない手数料でサービスをご利用いただけるよう、送金にかかる実際のコストを定期的に見直しています。 送金手数料は以下に基づいて計算されます: 送金元の通貨 受取人が受け取る通貨 入金方法 直近のコストの見直しの結果、一部の通貨ペアの送金手数料を値下げさせていただくことをお知らせ...

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.

Discover how Wise outperforms 5 major New Zealand banks, PayPal, and Western Union, offering savings of up to 6x on international transactions.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.

Today, we’re introducing big changes to the way Wise shows up to the world. It’s inspired by what makes us different: you. The people who shape us today — our...