International money transfers

Join over 10 million people who choose Wise for fast and secure online money transfers. We are up to 5x cheaper than banks.

Should arrive by Wednesday, 3 July

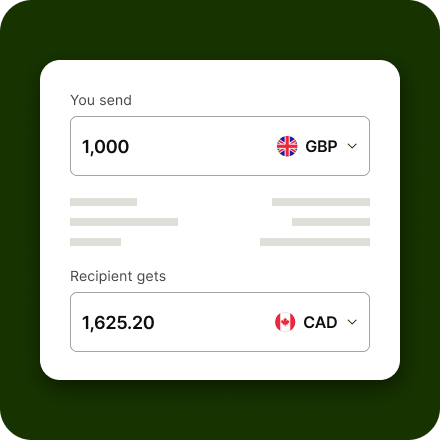

Find out how much it costs to transfer money internationally

| Sending 2,000 CAD with | Recipient gets(Total after fees) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 84,793.25 PHP | ||||||||||

Transfer fee 0 CAD Exchange rate(1 CAD PHP) 42.3966 Exchange rate markup 15.99 CAD Cost of transfer 15.99 CAD | |||||||||||

| 84,754.95 PHP- 38.30 PHP | ||||||||||

Transfer fee 16.89 CAD Exchange rate(1 CAD PHP) 42.7384 Exchange rate markup 0 CAD Cost of transfer 16.89 CAD | |||||||||||

| 84,622.15 PHP- 171.10 PHP | ||||||||||

Transfer fee 3.99 CAD Exchange rate(1 CAD PHP) 42.3957 Exchange rate markup 16.04 CAD Cost of transfer 20.03 CAD | |||||||||||

| 84,614.33 PHP- 178.92 PHP | ||||||||||

Transfer fee 0 CAD Exchange rate(1 CAD PHP) 42.3072 Exchange rate markup 20.18 CAD Cost of transfer 20.18 CAD | |||||||||||

| 83,448.45 PHP- 1,344.80 PHP | ||||||||||

Transfer fee 2.99 CAD Exchange rate(1 CAD PHP) 41.7867 Exchange rate markup 44.54 CAD Cost of transfer 47.53 CAD | |||||||||||

| 82,040.91 PHP- 2,752.34 PHP | ||||||||||

Transfer fee 4.99 CAD Exchange rate(1 CAD PHP) 41.1231 Exchange rate markup 75.59 CAD Cost of transfer 80.58 CAD | |||||||||||

| 81,772.15 PHP- 3,021.10 PHP | ||||||||||

Transfer fee 15 CAD Exchange rate(1 CAD PHP) 41.1950 Exchange rate markup 72.22 CAD Cost of transfer 87.22 CAD | |||||||||||

| 81,451.06 PHP- 3,342.19 PHP | ||||||||||

Transfer fee 25 CAD Exchange rate(1 CAD PHP) 41.2410 Exchange rate markup 70.07 CAD Cost of transfer 95.07 CAD | |||||||||||

Send money abroad from Australia in 3 easy steps

Enter amount to send in CAD.

Pay in CAD with your debit card or credit card, or send the money from your online banking.

Choose recipient.

Select who you want to send money to and which pay-out method to use.

Send CAD, receive PHP.

The recipient gets money in PHP directly from Wise’s local bank account.

Get dedicated support for large transfers

Moving big money? Get our how to guide and start a chat with our team of large-amount experts.

Get started with large transfersHow to send money abroad from Australia

How to send money abroad from Australia

- Just tap in how much, and where to.

- Then make a local payment to Wise, whether it's with a bank transfer, Swift or your debit or credit card.

- And that's it.

Wise converts your money at the 'inter-bank' rate – the real rate – so you save big time (even versus the guys saying there's 'zero' commission). On Wise, there's no room for sneaky bank surcharges or creeping hidden charges.

How much does it cost to send money abroad?

Pay a small, flat fee and percentage

To send money in CAD to PHP, you pay a small, flat fee of 2.40 CAD + 0.73% of the amount that's converted (you'll always see the total cost upfront). See our transfer calculator.

Fee depends on your chosen transfer type

Some transfer types have different fees which are usually tiny.

No hidden fees

No big fees, hidden or otherwise. So it's cheaper than what you're used to.

How long will a money transfer take?

On many popular routes, Wise can send your money within one day, as a same day transfer, or even an instant money transfer.

Sometimes, different payment methods or routine checks may affect the transfer delivery time. We’ll always keep you updated, and you can track each step in your account.

Your transfer route

Should arrive

by Wednesday, 3 JulyHow to send money with Wise

Register for free.

Sign up online or in our app for free. All you need is an email address, or a Google or Facebook account.

Choose an amount to send.

Tell us how much you want to send. We’ll show you our fees upfront, and tell you when your money should arrive.

Add recipient’s bank details.

Fill in the details of your recipient’s bank account.

Verify your identity.

For some currencies, or for large transfers, we need a photo of your ID. This helps us keep your money safe.

Pay for your transfer.

Send your money from Direct debit, wire transfer, Bill payment, or a debit or credit card.

That’s it.

We’ll handle the rest. You can track your transfer in your account, and we'll tell your recipient it's coming.

Best ways to send money internationally

Bank Transfer

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option.Direct Debit

Direct Debit is a convenient option that lets us take money from your account once you have authorised the payment on our site. It takes a little more time for your money to reach Wise, and it can be more expensive than a bank transfer.Debit Card

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process. Read more about how to pay for your money transfer with a debit card.Credit Card

Paying for your transfer with a credit card is easy and fast. Wise accepts Visa, Mastercard and some Maestro cards. Read more about how to pay for your money transfer with a credit card.Apple Pay

If you’ve enabled Apple Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Apple Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.Google Pay

If you’ve enabled Google Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Google Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.

Protecting you and your money

Safeguarded with leading banks

We hold your money with established financial institutions, so it's separate from our own accounts and in our normal course of business not accessible to our partners. Read more here.

Extra-secure transactions

We use 2-factor authentication to protect your account and transactions. That means you — and only you — can get to your money.

Data protection

We’re committed to keeping your personal data safe, and we’re transparent in how we collect, process, and store it.

Dedicated anti-fraud team

We work round the clock to keep your account and money protected from even the most sophisticated fraud.

Send money abroad with the Wise app

Looking for an app to send money abroad? Send money, receive payments from abroad, check exchange rates – all in one app.

- Cheaper transfers abroad - free from hidden fees and exchange rate markups.

- Check exchange rates - see on the app how exchange rates have changed over time.

- Repeat your previous transfers - save the details, and make your monthly payments easier.

Wise works nearly everywhere

See why customers choose Wise for their international money transfers

It’s your money. You can trust us to get it where it needs to be, but don’t take our word for it. Read our reviews at Trustpilot.com.