Commbank large amount transfers. How do they work

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Whether it be for travel, family overseas or international purchases, it’s almost inevitable that you’ll need to send money overseas at some point. For members of ME Bank, formerly known as Members Equity Bank, this is easier said than done — as the service is unavailable. We’re going to give you some ideas on how you can get around this issue, using your ME Bank account and Wise.

Unfortunately, ME Bank does not support international money transfers at all. Incoming or outgoing. Their users are limited to sending money locally to other bank accounts within Australia. You also can’t receive international payments into your ME Bank account¹. The main services the bank offers are loans, everyday banking within Australia and term deposits.

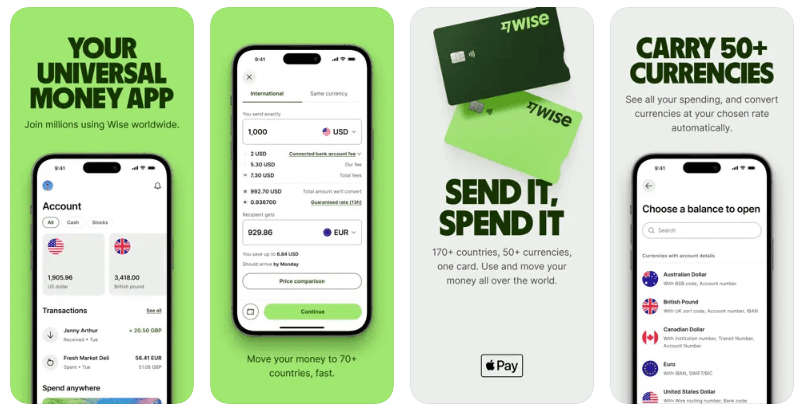

To save you money on SWIFT and correspondent bank fees, Wise uses a network of local bank accounts to send and receive money.

With a Wise account, you can set up a transfer to your recipient abroad, say the UK. You then make a local bank transfer of the payment amount to Wise's Australian bank account.

Once Wise receives, converts your money and sends the transfer, the person you’re sending money to receives GBP in their UK bank account, from a Wise bank account in the UK.

As you can see, money actually doesn’t cross borders. This is how Wise helps you send money cheaply, avoid intermediary bank fees and know upfront how much your recipient will receive into their account.

| 💰 Wise provides you the real exchange rate and low transparent transfer fees shown upfront. |

|---|

Learn more about Wise money transfers

ME Bank advises a way around not being able to send money internationally is to make a payment with your card. This obviously is not practical if you actually intended to send money to someone's account. It is also very expensive.

Like most banks, ME Bank charges fees for using your credit and debit cards to pay overseas vendors. The two standard ME Bank international payment fees are the international transaction fee and Mastercard cross-border fee².

Wise also offers a debit card linked to its Multi-Currency account. Let's see the difference in cost to use ME Bank vs Wise payment cards for an international payment online of 200 GBP from an AUD account balance.

| Fees | ME Bank + Mastercard fee³ (1.5% + 0.8%) | Wise Card |

|---|---|---|

| Paying for a 200GBP bill using your AUD account | 4.6 GBP $8.46 AUD* (keep in mind the exchange rate is MasterCards’) | $1.62 AUD** |

*Fees as shown on the Mastercard rate calculator. checked on 4th November 2021

** Wise card payment fee calculated here.

One of the benefits of using Wise is its commitment to offering customers the real exchange rate.

So it doesn’t matter whether you're sending money to a foreign bank or using your card to pay an overseas seller, you can count on your exchange rate matching the global markets.

You can contact ME Bank through:

If you’d rather not use your cards from ME Bank to make international payments or need to receive money from abroad, Wise might be the solution.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

Once you’re ready to start an international money transfer, you can use the Wise pricing calculator to check the transfer breakdown. The calculator shows you the real exchange rate and low fees for the transaction.

Open your Wise account in minutes 🚀

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with ANZ, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with Westpac, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Check out our overview of the international transfer limits you get with the top Australia banks.

Learn about Rabobank Australia international transfers. How they work, the fees, exchange rates and timeframes

These days, there's a whole range of ways to receive money. From cash exchange, bank transfers, to online remittance services, getting money from someone is a...