AMP business account: Guide on features and benefits

Learn about AMB business account, their features and fees for transactions. More on how to open an AMP account online. Read here

Opening a separate business account for your business finances is always considered “good practice.” Commonwealth Bank (often shortened to CommBank) is the biggest bank in Australia, so you’ll find no shortage of accounts for business use. These will help you manage everyday transactions and keep on top of your cash flow.

In this guide, we’ll outline what a CommBank business account actually is, and go through a few of the different account types available and how you can open one. There’s also an introduction to Wise Business — a handy account if you want lower fees on overseas transactions.

| Table of contents |

|---|

A CommBank business account is a dedicated account for business-related transactions. You can use this for things like paying business bills and expenses, managing your payroll and staff wages, and integrating it with your accounting software for easier bookkeeping. Basically, it can act as the financial hub for your business.

Key benefits with CommBank include:

Because CommBank is one of the “big four” banks in Australia, it offers nationwide access to 700+ branches and a large network of ATMs. This is useful if you still rely on cash (or need to from time to time).

CommBank currently has six business bank accounts, but four of these are geared more towards savings and term deposits. The main account for day-to-day business banking is the Business Transaction Account, which is available with a monthly fee of $0 or $10. The features and allowances are slightly different.

Let’s take a look at each one in more detail.

CommBank’s Business Transaction Account is built for everyday business. The version with no fees is designed for businesses that complete most of their transactions online and are happy to manage everything themselves without any assistance from CommBank staff.

Key features of the BTA account include:

Fees²:

The Business Transaction Account's $10 monthly fee option is branded as “In-branch.” If you prefer to do face-to-face banking with staff, this might be a better option. You also get 5 assisted monthly transactions, with the same $5 fee (or $10 for QuickCash deposits) outside the allowance.

The features are exactly the same as the waived fee account, so you’ll get a debit card and the option to apply for a terminal to take payments on the go, plus overdraft and savings account facilities.

Fees²:

Here’s an overview of the fees for the two main everyday account types:

| Service | BTA - $0 Monthly Fee | BTA - $10 Monthly Fee |

|---|---|---|

| Assisted transactions | $5 per assisted transaction | 5 free, then $5 per assisted transaction |

| Overseas ATM | $2 per withdrawal | $2 per withdrawal |

| international transaction fee | 3.5%³ | 3.5%³ |

| International money transfers | $30 when issued at a branch, waived via app and Netbank when debited from AUD and converted to foreign currency, up to $11 per transfer to receive foreign currency⁴ | $30 when issued at a branch, waived via app and Netbank when debited from AUD and converted to foreign currency, up to $11 per transfer to receive foreign currency⁴ |

CommBank’s Online Saver account pays a single variable interest rate across your entire balance, depending on how much you hold in the account. This starts at a 0.01% standard variable rate for balances below $50,000, and tops out at 0.65% for balances over $1 million (AUD). Interest is calculated daily and paid each month.

While the rates aren’t ultra-competitive, this account is designed for businesses that want easy access to savings. You can deposit and move money back and forth between two accounts quickly, either online or by phone. If you don’t want to open a Business Online Saver straight away, you can link your Business Transaction Account at a later date.

Features and fees:

CommBank has just launched a new “Flexi” account for business term deposits, alongside its standard account type. With Flexi, you get flexible 3 to 12 month terms and the option to withdraw up to 20% of your balance before it ends. The standard account locks away funds for the full term, from as little as 8 days to 5 years.

Both accounts may be useful if you want better interest rates on funds you don’t plan on using for everyday business.

Features and fees:

Finally, there's the Capital Growth Account if you want a middle ground between flexible savings and term deposits. You can still earn interest here, but you can dip in and out when needed, as long as you give a brief notice period from 48 hours.

Features and fees:

Opening a business account with CommBank is quite straightforward. But the exact process depends on your business structure and the account type. Most sole traders, partnerships, and Pty Ltd companies can complete the whole process online, but other structures like public companies will need to visit a branch to get started and verify their identity.

Here’s a step-by-step guide for the Business Transaction Account — the easiest to set up¹.

CommBank says you can open an account online in as little as 8 minutes.

You can also open a business account by visiting a CommBank branch and taking your documents to a “small business specialist”⁸.

In order to get your account, you’ll need to submit a few personal and business documents. This is the same for both accounts opened online or at a branch.

Here’s what personal details you’ll need:

You’ll then need to provide different documents depending on what sort of business you have. For some business structures, CommBank will require you and at least one director, partner, etc., to visit a branch with ID.

For sole traders¹⁰:

For private companies (Pty Ltd)¹¹:

For public companies¹²:

For partnerships or trusts¹³:

After getting a business transaction account, you can then use it to open an investment or savings account. All you need to do is inform CommBank which account you’ll use to fund it, and they will open it (usually overnight).

With CommBank’s Business Transaction Account, you don’t get any multi-currency features. It’s not designed for trading with suppliers or paying freelancers overseas; the 3.5% international transaction fee can be a real financial burden.

If you regularly do cross-border business, you need a business bank account that reduces the cost of paying for and receiving international transfers while providing tools to manage your daily finances.

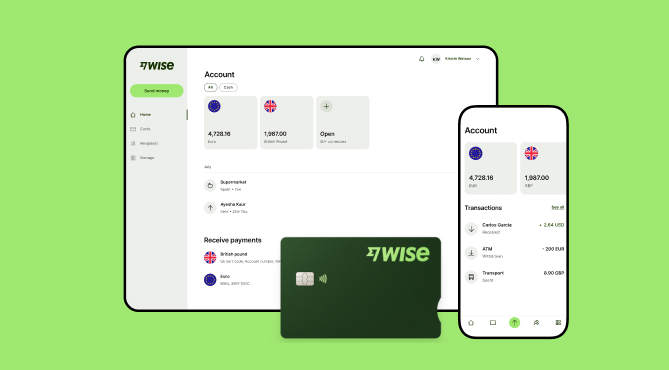

Wise Business offers just that. Instead of being limited to a single currency, you can hold and manage money in dozens of currencies at once from one account. Plus, fees for sending and converting money start from just 0.63%.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

**Capital at risk, growth not guaranteed. Interest is the name of a custody and nominee service provided by Wise Australia Investments Pty Ltd in partnership with Franklin Templeton.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about AMB business account, their features and fees for transactions. More on how to open an AMP account online. Read here

Explore all of BankSA’s business account and finance solutions with a full run down of features, fees, and what you’ll need to do to sign up.

Check out our guide on the top business foreign currency accounts if you’re an Australian business looking to expand overseas.

Learn more about the requirements to open a Wise Business account in Australia. Discover what documents you need and how to set up your own account online.

Learn how the OFX business account works, its features, and how it compares to other international payments solutions. Find out more here!

Discover the best small business bank accounts in Australia for 2025. Compare fees, features, and benefits to find the perfect solution for your business.