How to open a Virgin Money Australia account. The steps, fees and requirements.

Looking for how to open a bank account with Virgin Money in Australia? We’ve got you covered. Here’s the process, fees and what you need to know.

Westpac Banking Corporation, generally called Westpac, is one of the ‘Big Four’ banks in Australia. There are many factors that may make you want to close your Westpac account. Maybe you’re moving overseas, you want cheaper fees or you’re looking to try a more flexible account that can be used internationally — don’t worry we’ll get to that later.

This guide is here to help you close your Westpac account the right way — whether you're in Australia or abroad.

| 💸 Looking for a stress-free international account, with your very own local AUD account details? |

|---|

Learn more about the

Wise Multi-Currency account

Before you go ahead and close your Westpac account, you’ll need to make sure you’ve taken care of anything that relies on it being open. Some ideas are:

When you’re ready, you have two options for closing your Westpac bank account — over the phone or in person at the branch.

You can close your Westpac bank account over the phone by calling 132 032. Before you start the call, make sure you have your banking information and IDs on hand.

Once you’re connected to an agent they’ll go through their ID verification processes. When they’ve verified that you own the account, you’ll be able to get their assistance with closing it.

It’s possible to close your Westpac account at any of their Australian branches. You’ll need to bring your ID and the bank cards, unused cheques and passbooks associated with the accounts you’re closing¹.

The teller will be able to help you disburse any remaining funds, then close the account.

A Westpac everyday account or savings account can be closed over the phone or in a branch. This includes the DIY Super Working account and DIY Super Savings account¹.

A joint account can be closed the same way as a transaction account. Just be aware that it’ll require the consent of all account holders.

Westpac offers a few options for closing your credit card. You can do it over the phone, in a branch, online or using the app.

If you’re still using the classic Westpac App you can close the card by selecting it, tapping on “Services”, selecting “Close credit card account” and then following the prompts².

When you close your credit card there may be an amount left over which you’ll need to pay off. This can include the outstanding balance, fees, interest and charges.

Until your balance is fully paid, you’ll continue getting statements and being charged interest².

If you have a positive balance, request to close your credit card account in a branch or by calling 1300 651 089.

If you can’t get to a bank branch you can still close your account by calling Westpac on 132 032.

If you’re overseas you can call their international number which is +61 2 9155 7700. Keep in mind that the phone line hours are listed in AEST/AEDT.

You’ll need all your bank account details and identification.

Westpac states that you must provide them with any cards, unused cheques or passbooks associated with the account you’re closing¹. If you're using a method to close your account that doesn’t involve visiting a branch, you may want to clarify with a Westpac support agent how to go about doing this.

You can contact Westpac for assistance using one of these methods:

There are no fees for closing a Westpac Bank account mentioned in their fee schedule, but other fees related to transferring your money may apply.

When you close your Westpac account you’ll need to make sure you have something different to use that suits your needs and lifestyle. One option is to go with another traditional bank like one of the other Big Four — NAB, ANZ or Commbank.

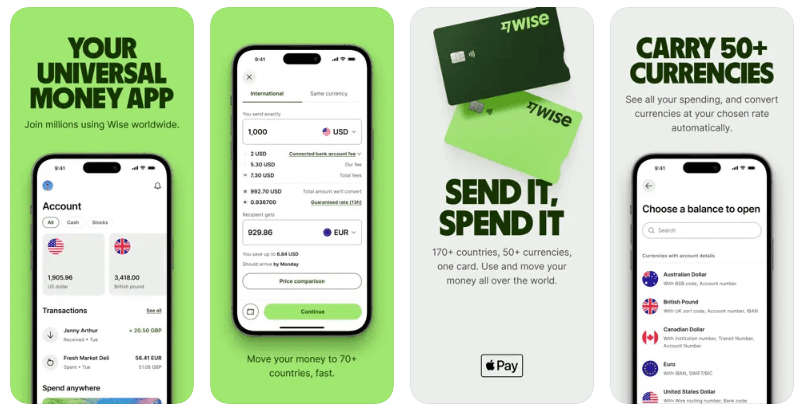

Alternatively, you might want to skip those and try Wise — a new way of banking that is flexible, efficient and stress-free.

Wise has a Multi-Currency account that is cheap and easy to use. You’ll get your very own AUD account details that can be used to transfer money directly from your closing NAB account with just a simple local bank transfer. You can also get a Wise debit card linked to this account that can be used at home or abroad.

Open your Wise account in minutes 🚀

Plus, if you’re moving overseas, already living abroad or are planning some international travel, Wise can be used to transfer AUD to your new location using the real exchange rate and small fees.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

If you know you’ll be travelling or living overseas, you can use the pricing calculator to see how much you would save with Wise.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for how to open a bank account with Virgin Money in Australia? We’ve got you covered. Here’s the process, fees and what you need to know.

Learn how to close your Revolut Australia account. The steps, options and important need-to-knows before your begin.

If you’re a student juggling study alongside work and social commitments, ensuring you have reliable and easy access to your money is essential. Choosing a...

Coming into student life something you might not think to address straight away is your banking. Many Australian banks offer accounts designed for students,...

Depending on the bank, student bank accounts might have extra features or slightly better conditions for those studying, when compared to a standard account....

Here’s how to close your ME Bank account and options to move your money out correctly