How Virtual Coworker saves around USD $60,000+ a year on global payments

Case study on how Virtual Coworker addressed their cross-currency challenges with Wise Business and how they played a part in testing batch payments.

B2B payments are transactions made from one business to another for goods or services. Unlike customer (B2C) payments, which involve individuals buying directly from a company, B2B payments form the backbone of business operations, from purchasing supplies to outsourcing services.

These payments occur locally, such as paying a vendor or distributor, or internationally, such as paying an overseas manufacturer or client. They are larger and more structured, often involving contracts, purchase orders, invoices, and approval steps before the money is sent.

For instance, a SaaS company in Sydney that works with clients across the Asia-Pacific uses one B2B payment platform to pay developers in India, a design team in Melbourne, and a cloud provider in Singapore. By managing everything from invoices to payments in one place, it avoids hidden FX fees and keeps cash flow steady. Efficient B2B payments like this help businesses stay organised, build trust, and maintain predictable expenses.

| Table of contents |

|---|

Wondering what the different types of B2B payment solutions are? Check out our comprehensive list below to discover all you need to know.

Digital payments refer to electronic fund transfers made through online systems such as PayID or the New Payments Platform (NPP). These transactions occur in real time, making them faster and more transparent than paper-based methods.

They suit small to medium-sized businesses that want to streamline vendor payments and improve cash flow, such as accounting firms, marketing agencies, and e-commerce retailers. Digital payments are also ideal for companies managing frequent local or interstate supplier transactions.

Wire transfers enable funds to move electronically between banks across borders. Traditional methods use the SWIFT network, while modern systems route payments through local rails to improve speed and reduce conversion costs.

They suit Australian exporters, importers, and professional service firms that pay overseas vendors or receive funds from global clients. Manufacturing, logistics, and consulting businesses often rely on wire transfers for high-value or international transactions.

Bank transfers move money securely between Australian accounts. The NPP allows near-instant payments, PayID simplifies account details, and BPAY supports invoice and bill settlements with unique references.

They suit construction companies, wholesalers, and utilities that make regular supplier or contractor payments within Australia. This method also works well for payroll and rent, offering a reliable and low-cost way to settle recurring expenses.

Direct debit allows an authorised supplier or service provider to withdraw funds from a customer’s account at agreed intervals. It automates collections and reduces manual effort for both payer and receiver.

It suits subscription-based businesses, telecommunications providers, and SaaS platforms that charge clients on a fixed schedule. It’s also effective for landlords, maintenance services, and energy companies that need consistent, on-time payments.

Corporate cards are company-issued payment tools that employees or departments use for approved business expenses. Every purchase gets recorded and sorted automatically, which makes tracking and reconciling spending a lot easier.

These cards work well for startups, creative agencies, and consulting firms. They suit any team that handles regular travel, project costs, or marketing buys. They’re also a solid choice for companies that want tighter control over budgets and better visibility into how departments spend money.

Digital wallets keep payment details safe and let businesses send or receive money through mobile or online platforms. Transactions happen instantly, so you’re not stuck waiting for banks to open. While “digital payments” means any transfer done online, digital wallets are the secure layer that stores payment info and simplifies the process of sending money.

They’re a great fit for online retailers, tech startups, and service firms that pay remote staff or freelancers. If you’ve got international clients, digital wallets help you move money fast and skip the usual hold-ups with middleman banks.

Credit and debit cards process payments electronically through card networks and give you instant confirmation. They offer a bit of short-term credit and make expense tracking simple.

These cards work especially well for professional services firms, healthcare clinics, and small retail chains, and anyone who needs the convenience and flexibility to pay suppliers or clients quickly. If fast transactions and clear records matter to your business, this is a good option.

With eInvoicing, invoices go straight from one accounting system to another using standard formats like Peppol. You do not have to do manual data entry, plus you get more accurate records and faster approvals.

This setup suits government contractors, wholesale distributors, and big companies that deal with lots of suppliers and tons of invoices. eInvoicing helps you stay compliant and speeds up B2B payments.

Cheques are paper-based instruments that authorise banks to transfer funds between businesses. They provide a clear record but involve longer clearing times and higher processing effort.

They still suit small family-run businesses, local councils, or associations that follow traditional payment practices. However, cheque use continues to decline in Australia as real-time and digital payment options become standard.

Cash is the most direct payment method, offering instant settlement without intermediaries. It remains convenient for face-to-face transactions.

It suits microbusinesses, small traders, and local service providers like cafés, florists, and repair shops. For larger organisations, cash is rarely practical due to security concerns and limited traceability.

B2B payment solutions follow a step-by-step process that keeps transactions organised, transparent, and compliant. Each step is crucial for helping businesses manage cash flow, maintain supplier trust, and meet financial reporting and ATO requirements.

The right B2B payment solution keeps business transactions smooth, secure, and compliant. Here’s what to look for before choosing one:

B2B payments don’t always run smoothly when it comes to transactions across borders. High transfer fees, slow international transactions, manual reconciliations, and scattered accounts can hold businesses back. For teams managing multiple suppliers or currencies, fluctuating exchange rates and complex compliance rules only make things trickier, often creating delays and unpredictable cash flow.

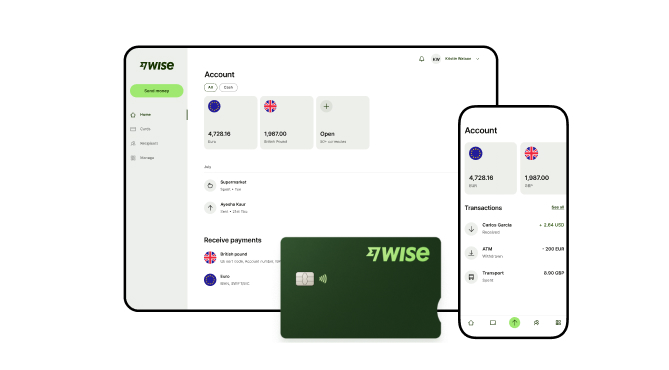

Wise Business cuts through that complexity. It brings everything into one transparent, easy-to-use platform built for global payments. With faster transfers, real-time visibility, and transparent fees, businesses can move money across borders confidently while staying in control of every transaction.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

**Capital at risk, growth not guaranteed. Interest is the name of a custody and nominee service provided by Wise Australia Investments Pty Ltd in partnership with Franklin Templeton.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Case study on how Virtual Coworker addressed their cross-currency challenges with Wise Business and how they played a part in testing batch payments.

Looking for the best credit card for small business in Australia? Compare top business credit cards and debit alternatives like Wise Business.

A complete guide to Stripe fees in Australia. We explain standard pricing, transaction costs, GST, handling surcharges, and saving on global transfers.

Learn how to take payments over the phone in Australia, including details about card machines, the benefits and risks, and how Wise Business can help.

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Learn about Zoho Books, it's key features, pricing plans, GST handling, and how Zoho Books compares with Xero and QuickBooks for business accounting.