Pty Ltd: What It means for Australian businesses

Learn what does PTY LTD mean in Australia and how it compares to other business structures. What are theequirements to start a PTY LTD in AU? Find out more!

Owning a business brings with it its own set of challenges. One of these challenges is finding the most appropriate business account that allows you to manage your business finances how you want and need.

This article will compare two business account providers on the market, Airwallex and Wise Business.

| Table of contents |

|---|

Discover the Wise Business account! 🚀

Airwallex is a multinational fintech company that was established in 2015 in Melbourne, Australia. Although an Australian based company, Airwallex now has offices across 26 countries and offers customers online multi-currency business account and API software solutions.

| 👆Read more: Guide on Airwallex business account in Australia: Fees, features & more |

|---|

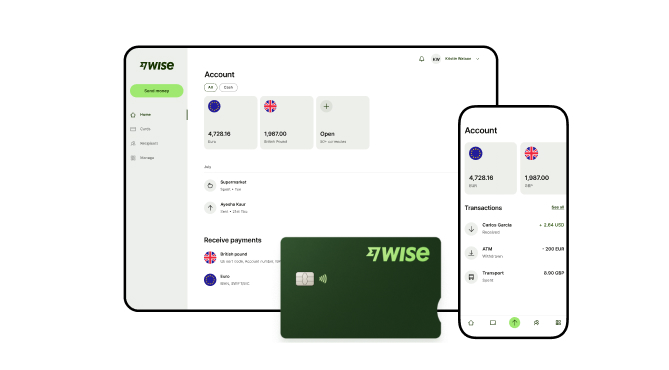

Wise, formerly known as TransferWise, is a global fintech company founded in 2011 that provides online money transfer services, particularly targeted to international transfers. Wise also offers customers online personal and business multi-currency accounts.

When you’re a business owner, it’s always good to look for business accounts that offer features that align with your specific business needs. Airwallex and Wise both offer several of their own associated account features. Let's compare below.

| Service | Airwallex1 | Wise |

|---|---|---|

| Ability to sign up online | Yes | Yes |

| Domestic account details | Yes account details in 20+ currencies | Yes account details in 8+ currencies |

| Foreign Exchange (FX) services | Yes | Yes |

| Physical and/or virtual business cards | Virtual company cards2 and physical employee cards can be created | Both a physical card and virtual cards |

| Make online payments | Yes | Yes |

| API integrations, accounting software, online financial management | Yes Access and linking capability to Xero3 Other API and management options accessible through separate platform product | Included in both account access options API integrations include N26, Monzo, Xero, QuickBooks, Zoho Books, FreeAgent, Bonsai, Odoo + others (region dependent) |

| Mobile/Web App | Yes | Yes |

| Direct debits, recurring payments, batch payments | Yes | Yes |

| As seen on 2nd February 2026 |

As these services both work with foreign currencies, we’ll now compare supported currencies that each company offers below.

| Currency services | Airwallex8 | Wise Business |

|---|---|---|

| Local currency account details (receive in local denominated currency) | AUD, EUR, USD, GBP, NZD, SGD, CAD,, HKD, DKK, IDR, ILS, MXN, PHP, PLN, AED | AUD, NZD, SGD, USD, CAD, EUR, GBP, HKD, HUF |

| Currencies supported to send and convert transfers in | 200+ countries in 60+ currencies3 | 140+ countries and in 40+ currencies |

| Add and hold supported currencies | Add in 90+ currencies9 Hold funds in 25+ currencies | Add money in 21 currencies and hold money in 40+ currencies. See list here |

As seen on 2nd February 2026

Now lets compare the different types of payment methods to receive and pay recipients with the Airwallex and Wise business accounts.

| Airwallex1 | Wise | |

|---|---|---|

| Pay in options |

|

|

| Payout options |

|

|

As seen on 2nd February 2026

Airwallex platform product allows business customers access to more pay in or pay out options.7

The ability to send money abroad is one of the key services offered by Airwallex and Wise. Here is how you set up an international transfer with each service.

Airwallex

To send money abroad with Airwallex, you must open an Airwallex account and be verified. You can create a new international transfer by following these steps.10

For Australian Airwallex account customers, this process may differ, so check with an Airwallex representative if you are having trouble setting up a transfer on your Australian account. .

Wise Business

Now we’ll go through the process of making an international transfer once you open a Wise business account and it is verified.

One of the main differences between Wise and Airwallex when it comes to sending money abroad is that with Wise, you can be a personal customer or a business customer to access international money transfer services.

Airwallex and Wise are not banks. However, this does not mean that having an account with either company means your money is less secure or safe. Let's see how these companies compare on safety for Australian businesses.

Airwallex

Airwallex is regulated globally by meeting the specific requirements set out by governing bodies for each country they hold legal entities in. In Australia, Airwallex meets the requirements set out by the Australia Securities and Investment Commission (ASIC) and holds a valid Australian financial service licence (AFSL licence number 487221). Airwallex is also registered with the Australian Transactions Report & Analysis Centre (AUSTRAC).13

Wise Business

Similarly, Wise is globally regulated and meets the specific requirements set out by each country Wise has operations. In Australia, Wise holds an Australian Financial Services licence (AFSL licence number 513764) and authorised as a Purchased Payment Facility (PPF) provider by the Australian Prudential Regulation Authority (APRA).

It is important to know and understand the fees associated with having and managing your business account with any given provider. Let’s compare the fees of an Airwallex Business vs Wise Business account below as an Australian customer.

| Fees* in AUD | Airwallex Business3 | Wise Business |

|---|---|---|

| Sign up fee | Free | Two options: Free account option for sending money or one time $65 AUD set up fee to get local account details |

| Account maintenance fee | None | None |

| Domestic transfer fee | Free | Flat fee of $0.57 AUD |

| International transfer fees | Free using Airwallex payment network or $10 to $30 AUD using SWIFT network | From 0.63% for sending Fixed fees for receiving. Find out here) |

| Foreign currency exchange rate fees | 0.5% or 1% above the interbank rate (currency dependent) | Mid-market rate |

| Card management fees | Virtual Company card: Free 2 free cards per month ; Physical Employee cards: $15 AUD per month, per additional cardholder | First card on account is Free. $6 AUD per additional cardholder thereafter (No monthly subscription) |

| ATM fees | Physical employee cards do not currently work in ATMS5 | Free for two withdrawals collectively up to $350 AUD per month each card 1.75% + $1.50 AUD per withdrawal over the $350 per month limit |

| Accounts fees for holding large amounts | Undisclosed | Annual fee of 1.6% once account surpasses threshold of $23,000 AUD (limit varies by currency held) and is charged on the amount over the limit. |

| As seen on 2nd February 2026 |

If you need to make payments in other currencies, another type of fee can come from a margin or commission included in FX rate conversions. Let’s look more closely at how Airwallex and Wise compare here.

| Airwallex3 | Wise |

|---|---|

| Interbank rate with a margin of 0.5% to 1% depending on currency being converted. Keep an eye on this margin as it adds up based on how much you send. | No margin, FX rate based on the mid-market rate like the one you see on Google. |

As seen on 2nd February 2026

Knowing the pros and cons of using these services will also influence whether it's suitable for your Australian business. We’ll do this now.

Pros

Cons

Pros

Cons

Online reviews are important to gauge the experience other people have had with companies or services. Here are the current Airwallex and Wise Trustpilot ratings for existing and past customers.

| Airwallex reviews14 | Wise reviews15 |

|---|---|

| AU Trustpilot rating: 4.1./5 from 381 reviews | Trustpilot rating: Excellent 4.3 out of 5 stars from +230,000 reviews |

| As seen on 2nd February 2026 |

As you can see, Wise has a higher average rating, with significantly more reviews. One reason for this will be from Wise being in operation for longer. Nonetheless, both ratings are derived from their global customer base.

After this review, Airwallex is a great service for business customers in Australia looking for an alternative business account option with better rates for currency conversion, free to low costs international bank transfers than business accounts offered through traditional banks.

Wise is a comparable service but with more options to pay international transfers and more supported currencies to hold and convert funds at the real exchange rates with low fees shown upfront. Wise also offers account options for personal use, and the ability for non-account holders to send international transfers.

So there you go, with the details and numbers presented to you, the choice is yours to make. Both companies offer solid features and services and based on your needs, the choice shouldn’t be that difficult to make.

Expanding a business internationally often introduces complexities with foreign exchange and multiple account management.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

**Capital at risk, growth not guaranteed. Interest is the name of a custody and nominee service provided by Wise Australia Investments Pty Ltd in partnership with Franklin Templeton.

Sources:

Sources checked on: 02 February 2026

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what does PTY LTD mean in Australia and how it compares to other business structures. What are theequirements to start a PTY LTD in AU? Find out more!

If you’re on the hunt for a suitable business credit card in Australia, there are several offerings available. A mutual or ‘customer-owned’ bank, Heritage...

If you’re a business owner in Victoria seeking a low-rate business credit card solution, Bank of Melbourne (BOM) may be worth considering. Existing...

If you run a business that deals with international trade, you know the importance of finding a service provider that makes international payments and foreign...

If you’re the owner of a business or run the finances of one, you might be considering business debit cards. These cards are usually connected to the...

Whether you have your own business already, or are looking to start one, there might be a time where you may need to seek out overseas suppliers to fulfil...