What is Bank account money transfer?

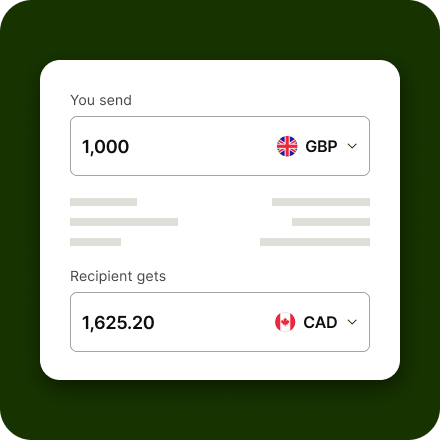

Sending an international bank account money transfer is often one of the most convenient ways for your recipient to get their money. Once you initiate the transfer, your recipient doesn’t need to do anything at all - the funds will be automatically deposited into their bank account as soon as they’re processed. That could even mean their money is available instantly, depending on the details of the payment.

All you’ll need from your recipient is their personal contact and bank account details. The exact bank details required varies a bit based on the country you're sending money to, but you’ll be guided through the Wise bank account money transfer process step by step as you arrange your payment.

Add your recipient’s email address, and they’ll get a message when the money is on the way, and when it’s available for spending, too.

Learn more about using bank account transfers.