Outsourcing to Romania: Clear Guide & Top Tips for US Businesses

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

Payment processing is crucial for receiving payments from your customers. Third-party merchant service providers are processing more small business sales than ever. They processed a total of 65% of annual US sales revenue in 2025, up from 62% in 2024.¹

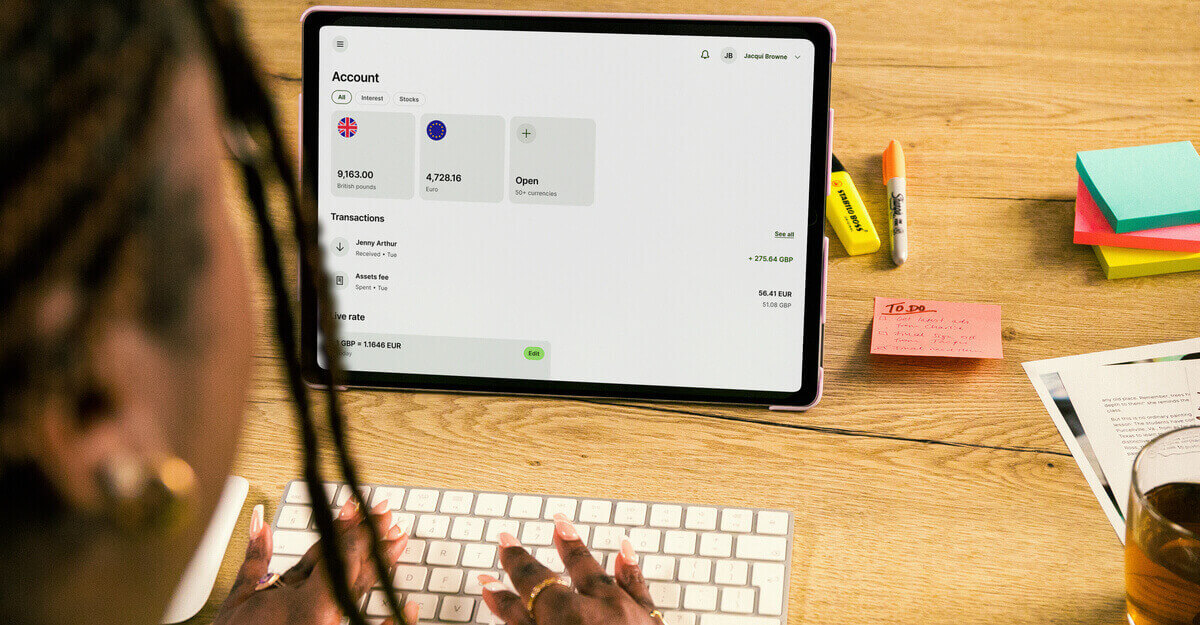

Wise is a money services provider that provides a Wise Business account with multiple currencies. Wise Business can be used to receive payments from customers. But is Wise a third-party payment processor?

This guide will give you the answers, and explain how you can use Wise Business to receive international payments and save money on processing charges.

Find out more about Wise Business

Wise is not a payment processor. As such, you cannot use Wise as a payment processor. A payment processor is a service provider that handles debit and credit card transactions. It also manages other digital payments from customers.

A full-service payment processor can make it easier to accept payments through your ecommerce store. It may simplify the process compared to setting up a payment gateway and merchant account separately.

You can use Wise Business to withdraw funds received through a payment processor. This includes PayPal, Square, or Stripe. You can transfer the funds received through these platforms to your Wise account. Wise Business also supports withdrawing funds directly to your account from various ecommerce platforms and payment getaways. These include Amazon, Etsy and Shopify.

Wise Business gives you local account details for 40+ different currencies. This means that you can save money when withdrawing international payments, as you won’t have to pay any conversion or cross-border fees when withdrawing in the same currency as one of your balances.

What is the difference between Wise Business and a payment processor?

A payment processor facilitates the transfer of money from customers to merchants in a single currency. It usually supports various payment methods. Payment processors are used to take payments and process online transactions. You need to connect a business account to receive the payments.

Wise offers a business account that you can use to receive payments in multiple currencies. It also offers much more than this. Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in 40+ currencies. You can get major currency account details for a one-off fee to receive overseas payments like a local. You can also send money to 140+ countries.

| 🔍 Read the guide on how to open a Wise Business account |

|---|

You can sign up for a Wise Business account online or through the mobile app in just a few minutes. You’ll need to provide some details about your business. This includes your company verification. You may also need to verify your account before you can receive payments.

Once your account is open, you can get local account details for a one-off fee for multiple countries. This includes account number and sort code, IBAN, or BIC code - without the need for a local address in each country. This means that you can have UK account details, even as a US resident.

In addition, you can get paid in 19+ currencies via the Swift network, using global account details. This allows you to receive payments from customers in more countries in their preferred currency. Customers can use your account details to set up direct debits for one-off transfers or recurring payments.

To set up account details for multiple currencies:

There are several other ways to receive payments in Wise.

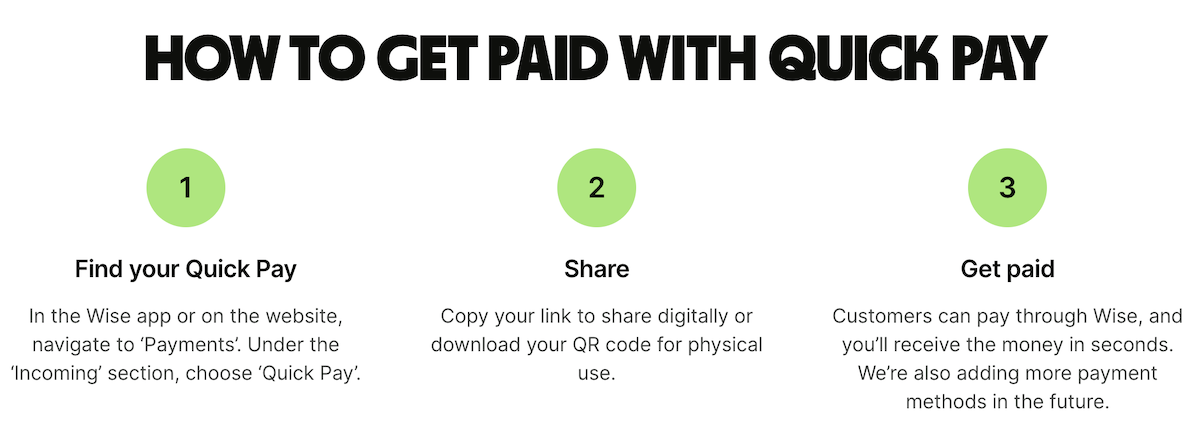

If your business has a website, you can add Quick Pay as a link or button on your website for an easy, direct payment path through Wise. You can also use Quick Pay to create a unique Quick Pay link and QR code to receive repeat payments.

You can create professional invoices in various currencies with the free invoicing tool and send them to clients. You can download your invoices as PDF files or email them directly to the customer with a pay button. This makes payment fast and convenient, helping you get paid on time.

Wise also offers a request payment feature, which allows you to send customers a payment link. This way customers can transfer funds without having to enter your specific account details.

Customers don’t need a Wise account to pay you, but things get even easier when they do. Wise can automatically detect when a customer you request payment from has a Wise account. This allows them to pay you from their account balance in 40+ currencies free of charge.

Once you receive payments, you can convert them into another currency at the mid-market exchange rate, saving you on conversion costs. Any fees are displayed upfront, so there are no unexpected charges.

Wise for ecommerce

Payment gateway coming soon.

Learn more

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. It helps save time and money for businesses that need to send and receive transfers in multiple currencies.

With a Wise Business account, there are no monthly fees, and you can handle international payments at the mid-market rate. You can receive payments like a local and manage over 40+ currencies all in one place.

| 🔍 Read the guide on how to open a Wise Business account |

|---|

All sources checked February 2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Outsource to Romania with confidence. Discover the benefits, costs, and practical steps for US businesses.

In this US guide to buying commercial property in Singapore, navigate the process, costs, and unlock foreign investment opportunities with expert insights.

Discover the most secure and convenient online payment methods for your business.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Compare Mollie vs Stripe to find the best payment gateway for your business. Our guide covers fees, features, and integrations to help make the right choice.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.