How to buy FIFA World Cup 26™ tickets: Step-by-step guide

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

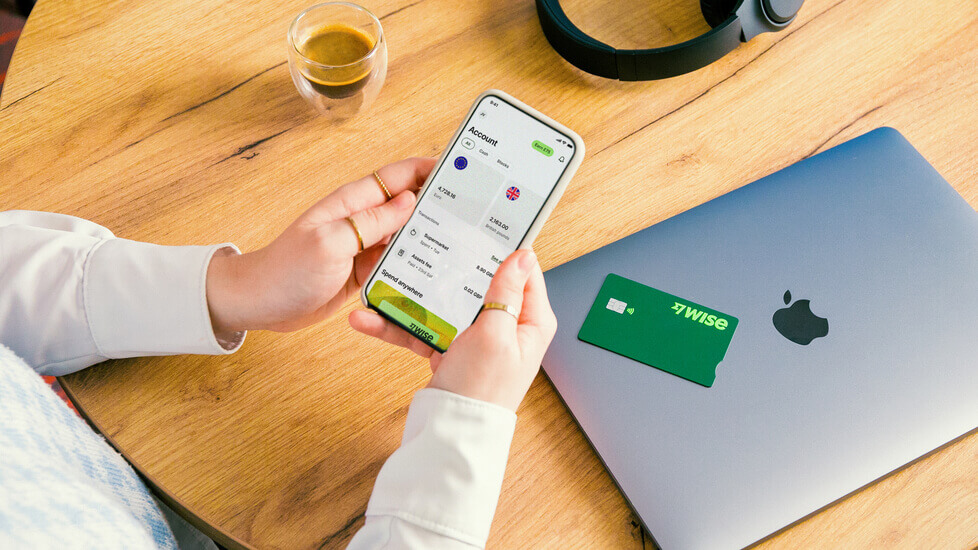

Wise is a money services provider that offers multi-currency accounts, cards and international transfers at a low fee, for personal and business customers in the US and around the world.

But does Wise have a credit card? This guide covers all you need to know.

The Wise card is a debit card, which is available as both a physical or virtual card.

You can use your Wise card to spend online and in stores, and you can make ATM withdrawals with your physical card in the US and abroad. When you transact, the funds are debited from your account immediately, so there’s no bill to pay at the end of the month and no interest to worry about.

If you don't have the currency available, Wise will apply its smart conversion feature from one of your available currencies.

The Wise virtual card, and has different card numbers to your physical Wise card. This adds an extra layer of security, particularly when shopping online with new retailers, as you can use your virtual card and then lock it, without compromising your physical card.

Wise does not offer a credit card. Instead, you can order a Wise card, which is a debit card, issued on either the Visa® or Mastercard® network. Both of these networks are very broadly accepted around the world.

If you want to get a credit card, you can apply to your bank, or directly to a network like American Express®. Eligibility criteria are likely to apply.

You can use your Wise account to hold and exchange 40+ currencies, receive payments in USD and foreign currencies, and to send money to 160+ countries with the mid-market exchange rate and low, transparent fees.

If you also choose to get a Wise card, you’ll get the following benefits:

- Free to spend in a currency you hold in your account

- Mid-market currency exchange rate and fees from 0.33%

- Some free cash withdrawals monthly before fees begin

- Virtual cards available for online and mobile spending

- Freeze your card in the Wise app to prevent spending

- Receive instant transaction notifications to your phone

If you live in the US, the Wise debit card is available for a one-time fee of just 9 USD when you open a Wise Account.

| You can use it to: |

|---|

|

To order your Wise card you’ll first need to open a Wise account. You can open your Wise account easily online or in the Wise app, by entering your personal information and uploading an image of your ID document for verification.

The process is simple to follow, and you’re guided throughout by on-screen prompts. If you ever have any problem opening your account you can reach out to Wise customer service at your preferred way.

| Once you have your Wise account, you can order your Wise card: |

|---|

|

Wise doesn’t offer a credit card. However Wise customers can order a physical or virtual debit card to spend and withdraw in 150+ countries, with mid-market exchange rates and low fees for currency conversion. Use this guide to decide if the Wise card is the right option for you.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Guide on how to buy world cup tickets 2026: official sales, signup tips & tricks, resale safety, and key dates to secure seats.

Interested in Remitly Flex? Find out everything you need to know, including key features, costs, and limits.

Read on for everything you need to know about sending and receiving international wire transfers with Abound.

Receiving a large international wire transfer in the US? Here's a guide on the fees, time, and what you should give to your sender overseas.

Read on for everything you need to know about sending and receiving international transfers with GCash.

Read on for everything you need to know about sending and receiving international wire transfers with Remit2Any.