Startup Fundraising: How to Fund Your Startup

Navigate the complexities of startup financing with our guide. Explore funding options, tips, and expert advice designed to help your business succeed.

As your business grows, so do the piles of financial admin. Whether your inbox is overflowing with invoices or your accountant is chasing you for monthly reports, managing your business finances takes valuable time away from your clients and customers.

And the challenge is even greater when you’re managing multiple accounts, software providers and currencies, which can make keeping track of metrics like cash flow and expenses a constant battle.

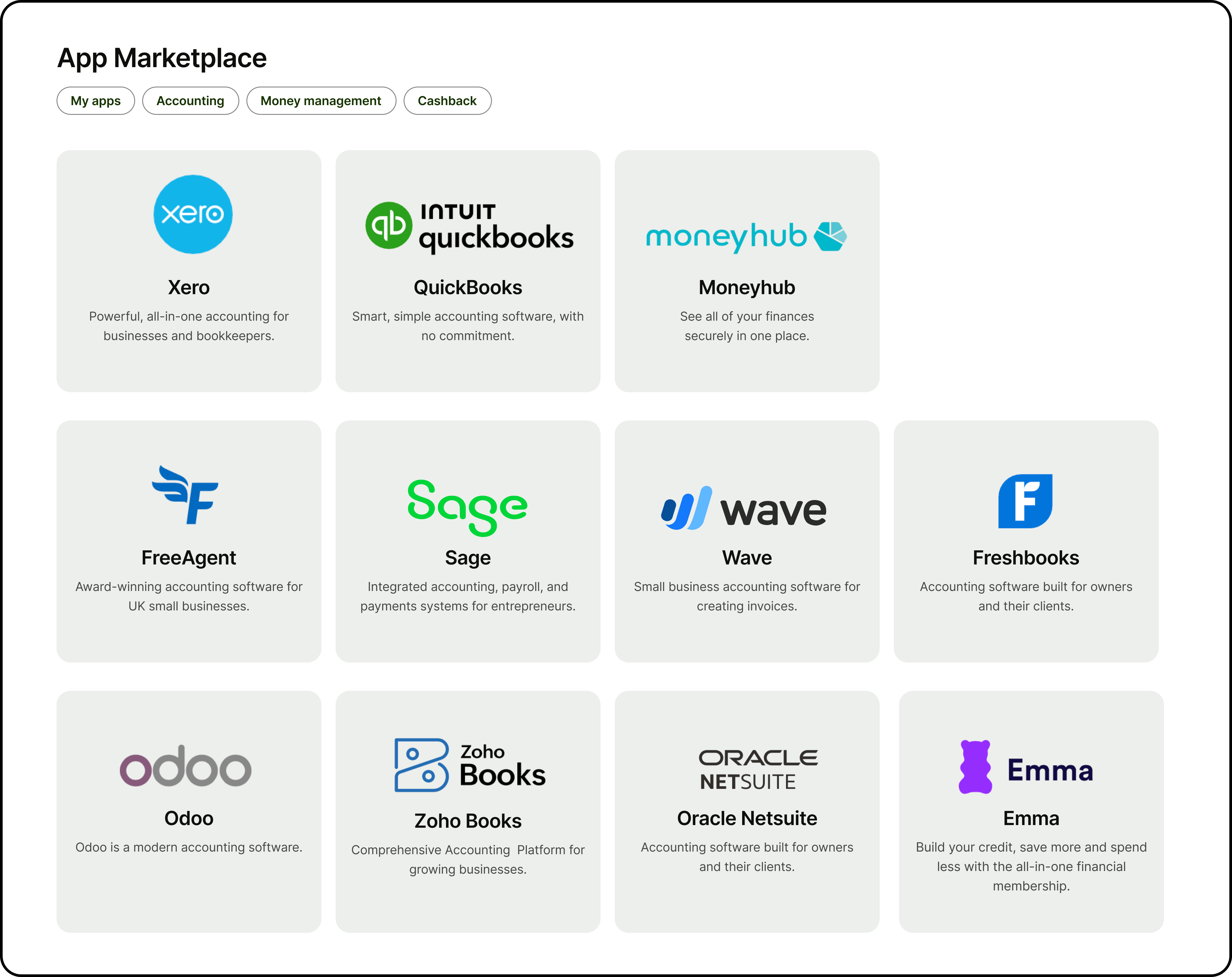

But as business accounting processes have become more digitised, connecting up your accounting software with your financial tools is easier than ever before. Syncing up your business account can help to save time, improve accuracy and enhance decision making. That’s why we’ve made it possible for Wise Business customers to sync with popular accounting software such as Sage, FreeAgent, Odoo and Zoho Books.

To help you on your path to financial zen, we’ve put together the key advantages of syncing your business account with your accounting software - as well as some of the ways Wise Business can help to streamline your finances as you grow.

Let’s check out the key advantages of integrating your software, and how it can add real value to your business (while keeping your accountant happy!)

Manual data entry is a familiar and often tedious task for finance managers and business owners globally. By automating the process of reconciling payments, expenses and bank statements, you can drastically reduce the time and resource required to balance your company’s books. And the good news is it’s a straightforward process - thanks to API (Application Programming Interfaces) you can sync the bank feeds from your chosen balances in just a few clicks. This is particularly helpful in multi-currency accounting, where you need to understand incoming and outgoing payments in the various currencies your business operates in.

Automation can also help to improve productivity while reducing the risk of human error and ensure your finance managers or accountants have accurate data to report on. Having organised information is particularly important when it comes to tax compliance if you operate in multiple countries, as your reporting requirements may be different across jurisdictions. Syncing your business account and accounting software can also be a game-changer in tax season, as all of your transactions are in one place, ready to upload into your filing documents.

You can also drive efficiencies and identify opportunities for growth by consolidating multiple financial platforms into a single source of truth. By integrating your accounting software with other business tools, such as the Wise Business account or an Enterprise Resource Planning platform, you can achieve a 360 view of your business finances and ensure seamless data flow between platforms. The combined view will also allow you to run analytics on your transactions in your accounting software on key financial metrics. This can guide you towards making more informed strategic decisions on how to grow your business.

The ability to understand your cash flow position (the balance of payments in and out) is crucial to ensuring you are able to meet obligations to pay suppliers, payroll and investors on time. By integrating the systems that manage payments, invoicing and accounting, you can ensure you’re able to monitor cash flow more accurately and forecast your financial position effectively.

As you expand operations and grow your team, you’ll also benefit from integrating with platforms that are adding new apps and tools on a regular basis. These opportunities for deeper integration can help you to better manage your finances and support better collaboration and data sharing between teams and external stakeholders (such as accountants and auditors) as you scale. For example, at Wise Business we’re always looking for ways to improve our app marketplace to enable our customers to control their business finances in their app or on desktop. Most recently, we added Zoho Books, an end to end accounting platform offering invoicing, VAT and expenses management for growing businesses.

And with growth and collaboration comes the need to share your financial data in a secure and tested way. By syncing your accounting software with your Wise Business account, you can ensure your team and accountants are able to access all the information they need to do their jobs - while giving you more control over who's able to access this information. With Wise Business, our multi-user access

means you can allow your team to view, prepare and action payments with 5 custom roles and different levels of approvals.. Employees who have access to your accounting software can also easily sync the bank feed from your selected Wise balances to compile their reports.

We’ve heard about the advantages of syncing your software with your business account, now let’s learn more about how you can simplify your business admin with Wise.

In the US, you can sync your Wise Business account with a range of accounting software and FinTech apps, including Quickbooks, Oracle, Sage, Odoo Zoho Books.

Check out how to connect to your favourite software below.

Once your Wise Business account is set up, click here and choose the accounting software that you would like to sync with. If you can't see the software you're looking for, click on** Discover more great tools in the Marketplace** to open up a new window where you're able to see the tools available.

Alternatively, you can go to Settings' from your profile and click on 'Connected Accounts'. Here you can connect with a range of apps including accounting softwares, bank accounts, or allow data sharing, for example through Stripe, to make your businesses processes more seamless.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Navigate the complexities of startup financing with our guide. Explore funding options, tips, and expert advice designed to help your business succeed.

Learn how to accurately calculate the foreign exchange (FX) impact on your revenue.

Wondering about the cost of an accountant for your small business? Find out what to expect and how to budget for professional services.

Discover the purpose of global treasury management, its key components, challenges, and effective strategies for you to navigate global transactions with ease.

How can you manage FX risk? Different types of exposure exist due to foreign exchange fluctuations, and this article discusses how to mitigate them.

As the holiday season approaches, managing cash flow effectively becomes critical for business owners. The final months of the year can be make-or-break, with...