Hiring Independent Contractors in Canada: A Complete Guide for Businesses

Learn how to hire independent contractors in Canada. Understand legal rules, tax responsibilities, and how to avoid misclassification with this guide.

Invoices are one of the most important parts of the accounting process for businesses, helping them keep track of all the goods and services they buy. They can also be a bit confusing. In this article, we’ll discuss what are supplier invoices.

Trustpilot: 4.4/5 average rating¹

Over 300k+ businesses customers use Wise globally

| Table of Contents |

|---|

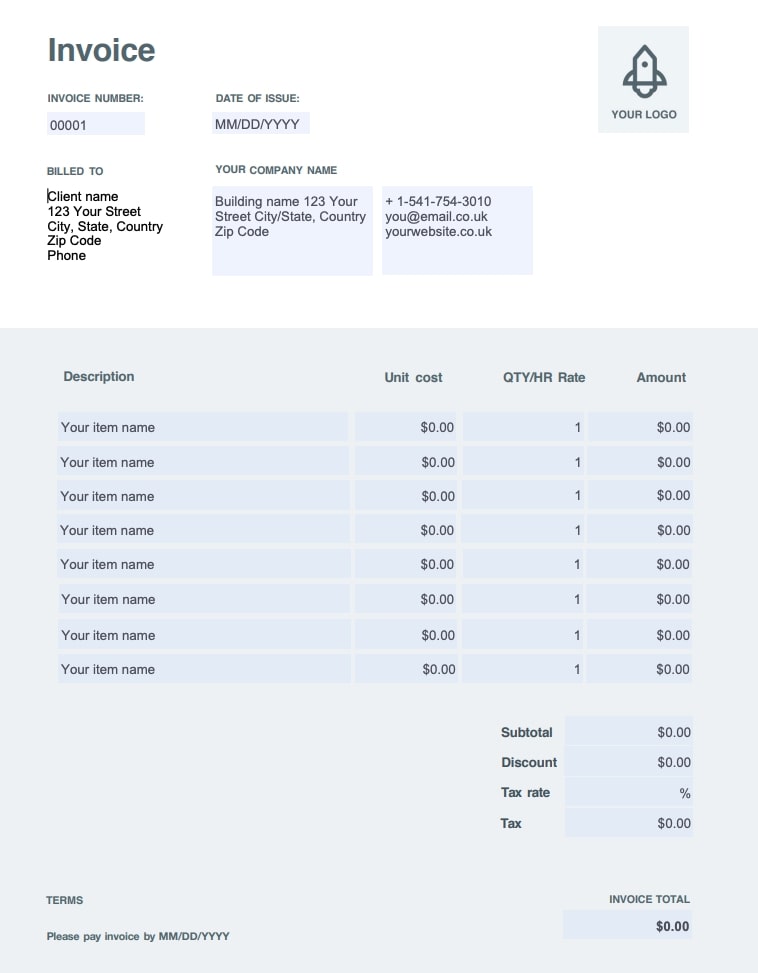

A supplier invoice (or vendor invoice) is a document sent by a vendor or supplier to a buyer requesting payment for goods or services that the business has provided.

These invoices are essential for businesses because they keep track of the money that the business owes to its suppliers. Without these invoices, it would be hard to keep track of expenses and payments, which can lead to confusion and mistakes.

Late payments can result in damaged relationships with suppliers and delayed deliveries, which can have a huge impact on the business.

In addition, keeping track of supplier invoices can help businesses better manage their cash flow and ensure that they have enough money to pay their suppliers on time.

To be legally considered as an invoice, a document should include the following²:

If you apply any tax exemptions, the invoice should then show which goods or services are exempted.²

In this example, let’s say that you own a coffee shop, and you purchase coffee beans from a supplier. When your supplier delivers the coffee beans, you’ll also get an invoice from the supplier.

The supplier invoice will include important information such as:

| Get this free invoice template >> |

|---|

If we break down these components a little further, we can see why they’re so crucial to have. Seeing when exactly the invoice was issued makes it easy to keep track of when you received the goods or services. Especially if you need to dispute any charges or reconcile your accounts, this is something you’ll need to have.

The name and address of your coffee shop and the supplier are important for record-keeping and communication purposes. If you have any questions or concerns about the invoice, you'll know who to contact.

The description of the products or services provided works to verify that you received what you ordered. In this example, the coffee beans should be the correct type and quantity that you requested.

The unit price and total cost of the products or services provided are important for obvious reasons. You'll want to make sure you're being charged the correct amount and that you're not overpaying.

Any applicable taxes or fees should also be clearly outlined on the invoice. You won’t want to have this omitted from the total cost, and it also helps you keep track of expenses for tax purposes.

And when it comes to payment terms, they’ll let you know when the invoice is due and what payment methods are accepted. Knowing all of this in advance means you can plan your cash flow and pay on time to avoid late fees or penalties.

The difference between invoices and receipts is that an invoice is provided prior to purchase as a request for payment. It often outlines the pertinent information for the both parties involved.

A receipt is given as a proof of payment and is important to claim business expenses during tax season.

Manual vendor invoice processing can be a hefty task. 34% of businesses cited stress on accounts payable teams as a top challenge when it comes to managing these invoices.³ Another 25% reported late payments often result in damaged relationships with suppliers and delayed deliveries.³

To make the process easier, businesses can turn to various online invoicing services that can make payment a breeze. Automating supplier invoices can be a smart move for those looking to improve their payment processes and who want to start focusing more on strategic tasks. It can save your staff time, improve productivity, increase timeliness, and strengthen supplier relationships.

You can forget worrying about anomalies, delays, and other roadblocks to paying invoices. Automated services can also help reduce the risk of fraudulent invoices, as well as save on costs associated with manual processing and paper checks.

Let’s take a look at some services available to improve your invoice payment process.

Wise Business can help you save big time on international payments.

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in currencies.

Signing up to Wise Business allows access to BatchTransfer which you can use to pay up to 1000 invoices in one go. This is perfect for small businesses that are managing a global team, saving a ton of time and hassle when making payments.

Some key features of Wise Business include:

Mid-market rate: Get the mid-market exchange rate with no hidden fees on international transfers

Global Account: Send money to countries and hold multiple currencies, all in one place. You can also get major currency account details for a one-off fee to receive overseas payments like a local

Access to BatchTransfer: Pay up to 1000 invoices in one click. Save time, money, and stress when you make 1000 payments in one click with BatchTransfer payments. Access to BatchTransfer is free with a Wise Business account

Auto-conversions: Don't like the current currency exchange rate? Set your desired rate, and Wise sends the transfer the moment the rate is met

Free invoicing tool: Generate and send professional invoices

No minimum balance requirements or monthly fees: US-based businesses can open an account for free. Learn more about fees here

PayPal's invoicing platform allows businesses to create customized invoices that can be sent via email or a shared link.⁴ The invoices can include details such as due dates, payment terms, and itemized charges, making it easier for suppliers to track payments and for businesses to manage their accounts payable.

The platform is particularly known for its speed, as PayPal processes payments quickly, with 79% of invoices typically paid within one day of sending it.⁴ While PayPal is primarily focused on payment processing, Wise offers a wider range of international money transfer services, including currency exchange and borderless accounts.

PayPal’s fees are likely the least appealing part of the platform, with no monthly fees yet fixed and percentage fees that differ by the currency received. You’ll be set back 3.49% + $0.49 per USD transaction and for cards and alternative payment methods, 2.99% + $0.49 per USD transaction.⁴

Square is known for its range of financial and business tools for businesses to seamlessly manage their finances.⁵ One of their most popular products is their point-of-sale systems, but they also have an invoicing service that allows businesses to easily pay an invoice from the supplier for goods or services.

Just like our other aforementioned services, it offers useful features such as digital invoices and estimates, custom invoice templates, and invoice tracking. As well, Square allows you to create digital contracts and collect e-signatures and use their other payment processing tools for an effective financial management experience.

Wave is an all-in-one accounting, invoicing, and receipt scanning platform.⁶ This can be especially helpful for small businesses or freelancers who may not have the budget to invest in expensive accounting software. The platform lets businesses schedule recurring payments for regular expenses without the need for manual intervention. And what’s more, all your invoicing and payment information will automatically sync with the free Wave Accounting software.

They also boast a range of payment options, such as major credit cards like Mastercard and Visa, Apple Pay, and bank payments, to make it easier for businesses to pay a vendor invoice.

| 💡 For all you need to know about invoices, don't forget to read and bookmark the ultimate guide to invoicing from Wise! |

|---|

Learn more:

How to Find Wholesale Suppliers, Distributors, and Manufacturers

How to Find Overseas Suppliers in 5 Steps | Practical Advice

3PL Warehousing Guide: What is it? Do you need It?

11 Tips for Supplier Payments: What you need to know

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to hire independent contractors in Canada. Understand legal rules, tax responsibilities, and how to avoid misclassification with this guide.

Learn how to hire independent contractors in Brazil. Understand tax rules, compliance, contracts, and how to avoid misclassification risks.

Learn how to hire and pay independent contractors in Mexico. This article also includes an FAQ and best practices about working with contractors in Mexico.

Learn how to navigate the overseas worker recruitment. Discover legal requirements, sourcing strategies, visa compliance, and tips for international hiring.

Paying overseas vendors is common, but the hidden costs of B2B cross-border payments aren’t. Learn how to simplify international business payments today.

B2B payment processing doesn’t have to be hard. Learn how growing businesses can simplify cross-border transactions, streamline invoicing and get paid faster.