Maximizing Your Small Business Profits During the Holiday Season

The holiday season is often hailed as the most wonderful time of the year, but for small businesses or e-commerce stores, it can also be the busiest and most...

PayPal fees can be complicated. This guide will help clear up the costs of withdrawing funds from PayPal to your card or bank account.

You can also find out about Wise Business. Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The business account from Wise can save you money on international transfers.

Find out more about Wise Business

Standard PayPal withdrawals: There is no PayPal withdrawal fee for merchant accounts with an eligible linked bank account or debit card when no currency conversion is involved.

Instant PayPal withdrawals: Instant USD withdrawals cost 1.5% of the amount being transferred.¹ The mimimum fee for instant withdrawals is 0.50 USD.

If the collected funds in your PayPal account is in a different currency, the fee to convert it to USD is 3.00%, or such other amount as may be disclosed to you during the transaction. To avoid this fee, you can use Wise to withdraw and convert the funds to your local currency.

Standard transfers to linked bank accounts get delivered in 1- 2 business days. Instant Transfer offers a faster delivery to eligible bank accounts or debit cards which are usually completed in minutes. Visa and MasterCard debit that supports instant transfers are eligible. You can get in touch with your card issuer to check if your card supports instant debit.

Eligible banks include those participating in The Clearing House Real Time Payments program. Most US banks use this payment system to expedite local transfers but it's best to check with your bank first it to avoid bounce backs or payment rejection which could lengthen the process of withdrawing your funds.

It's also important to keep in mind the following withdrawal limits:

Instant Transfer Withdrawal Limits for Business Accounts:

Instant Transfer Withdrawal Limits for Bank:

It’s important to remember that the account details you’ll need and the process of adding it to PayPal vary according to currency. For example, if you’re withdrawing EUR, you’ll need an IBAN number and BIC and for GBP, you’ll need the account number and sort code. Wise will generate these details for you once you’ve set up the account.

Here’s how you can connect your Wise account with PayPal

|

|---|

Using the Wise Business account, you can collect payments from your local and international customers in USD, EUR, GBP, NZD, AUD and more for free. You can also download a free invoice template and add your company profile including your local account details with Wise to easily collect payments.

You can integrate the account with accounting software Xero and QuickBooks to help ease your tax reconciliation and take advantage of all other features the tool offers including automated invoicing, billing and multi-currency accounting.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

The holiday season is often hailed as the most wonderful time of the year, but for small businesses or e-commerce stores, it can also be the busiest and most...

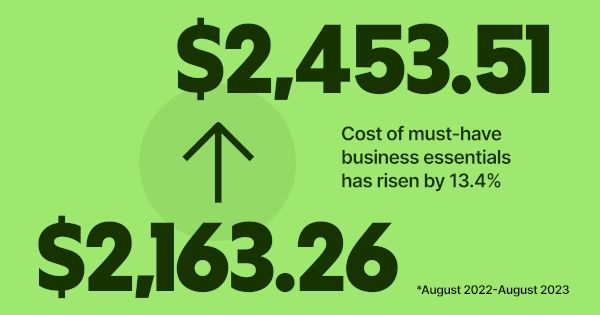

At Wise Business, we're focused on building a multi-currency account helping businesses grow internationally while tackling the rising costs of doing business

Getting paid is a key moment for your business - it means that your product fit and marketing strategy has hit the mark and customers are happy to exchange...

Explore how to get investors for small business to raise the capital you need to succeed. 1. Friends and Family 2. Small Business Loans and more

Handling finances manually is slow, repetitive, and full of errors. From chasing invoices to approving expenses, finance teams spend too much time on admin...

As the holiday season approaches, managing cash flow effectively becomes critical for business owners. The final months of the year can be make-or-break, with...