How to open a bank account in Costa Rica as a foreigner: US guide

Learn all about opening a bank account in Costa Rica as an American, including costs, requirements, and alternatives.

If you have money on your PayPal balance, then you may be wondering: “Can I send money from PayPal to Cash App?” Right now, there is no direct way to do this.

But there is a solution - namely, sending the money via your linked bank account. So if you want to see how to send money from PayPal to Cash App, then stick around as the steps are covered in this article.

As already mentioned, there is currently no way to send money directly from PayPal to Cash App. If you want to do this, you’ll need to send the money to your linked bank account first, and from there send it to Cash App.

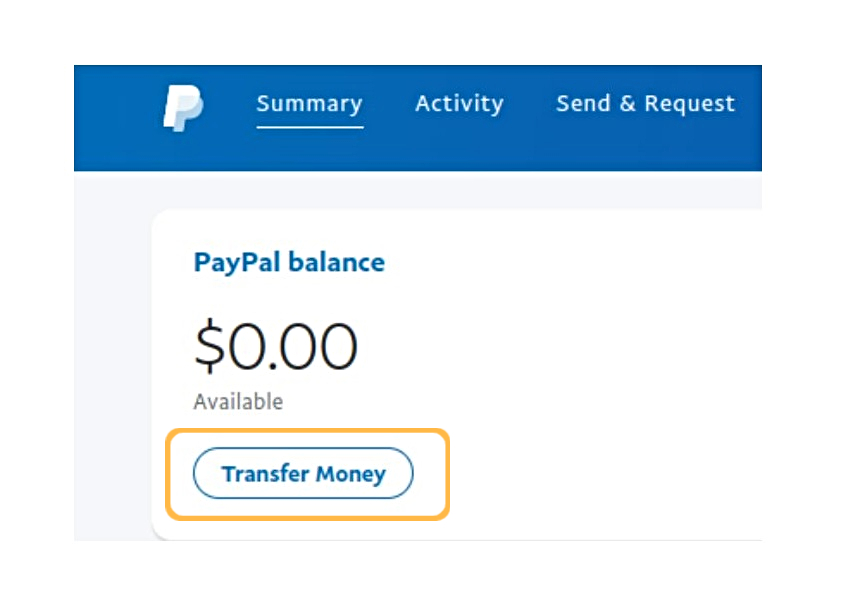

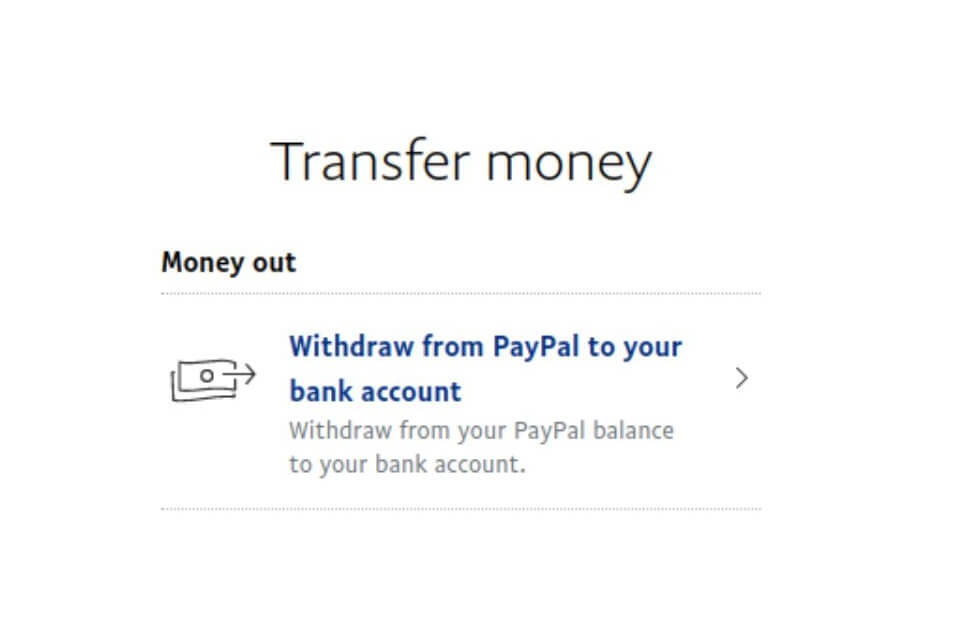

The first step you’ll need to complete is to send your money from PayPal to your bank account. To do this, all you need is:

Once you’ve done this, congratulations - you’re halfway there! The final step is transferring your money from your bank account to Cash App. To do this, all you need is:

And that’s it! Although it may not be as simple as just clicking a button, the process of sending money from PayPal to Cash App is still fairly straightforward.

| That being said, if you’re looking for an even easier way of sending money from PayPal to another peer-to-peer transfer service, then sending to Wise could be a great option for you. |

|---|

If your bank account is in a different currency to your PayPal account, you’ll have to pay conversion fees, as well as an additional mark-up fee, when transferring your money. If you do this on a regular basis, you could end up spending quite a bit extra in conversion fees. This is where linking your PayPal account to Wise can help you.

With Wise, you can open a multi-currency account, allowing you to hold money in the same currency as your PayPal account. This way you can easily and cheaply withdraw money from PayPal to your Wise account.

And if you need to convert money to another currency, Wise will convert it for you at the real mid-market exchange rate, with no hidden fees!

To link your PayPal to Wise, all you need to do is:

Open a Wise account for free

Add a currency in your Wise account - in the same currency as your PayPal account is in - and get account details

Sign into your PayPal account and go to the “Wallet” section

Select 'Link a new bank' in PayPal and enter your Wise account details for the desired currency - for example, if your PayPal is in USD, then enter the account details for your USD on Wise

Complete the remaining steps

And that’s it! Your Wise details should be added to PayPal so you can withdraw to this account whenever you need to.

This way, you’ll save your money for bigger and better things than conversion fees!

Open your Wise account, today 🚀

Sources:All sources checked 29 June 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn all about opening a bank account in Costa Rica as an American, including costs, requirements, and alternatives.

Learn all about opening a bank account in Monaco as an American, including costs, requirements, and alternatives.

Read on for a step-by-step guide to selling inherited property abroad, including fees, taxes, and timelines.

Thinking of moving to Spain or Portugal? Find out what tax programs they have for expats to decide which might be better for you.

Need to report the sale of an inherited property abroad? Read on to learn how to avoid capital gains tax and other tips.

Find out how to report foreign rental income on your US taxes for overseas property in this complete guide.