American banks in Panama: branches and more

Read on to find out what US banks have branches in Panama and tips on banking in the country.

If you’re joining Berlin’s thriving startup scene; or taking your financial career further in Frankfurt — Europe’s very own Main-hattan — at some point you’re going to need a German bank account.

Germany’s strong and well organized banking sector means that opening a bank account should be a quick process; provided you have the correct documentation.

We’ll cover how to open a bank account in Germany — and also touch on Wise as an alternative for an euro account you can open from the US.

While some banks will need you to make an appointment and visit a branch in order to open a bank account, as a general rule you can make your application online.

That said, many banks’ websites (including those of major banks like Deutsche Bank®) only offer online account opening options in German, so making an online application will be a challenge if you don’t understand the language.

In any case, you’ll need to be physically present in Germany in order to apply for your account. This is because you can only obtain some of the required documents (and complete the account opening procedure) once you’re in the country.

In order to open a bank account in Germany, you’ll need paperwork to prove your ID, address and legal status in Germany.

To give an example, Berliner Sparkasse requires the following documents¹:

|

|---|

Some banks may also ask for a document to prove your income, such as payslips or a salary statement from your employer.

It’s best to check with your bank beforehand whether they’ll require these and any additional documents.

If you plan on residing in Germany permanently, you need to register your address with the local authority, called Bürgeramt. The process is called Meldebescheinigung, and you’ll need to do it every time you change your address.

In order to complete the process, you’ll need to fill out a form (you can print this off your local Bürgeramt’s website), and then go to the Bürgeramt office with the form and your passport or identity card.

This document is your official proof of address, so you’ll need to register before you can open your bank account. You’ll also need it for other things, including getting a job and registering for the national health insurance program.

As in most other countries around the world, German banks are required by law to verify your identity.

This isn’t a problem when you open your account in a branch, because a bank official will see your passport or national identity card and confirm your identity in person. However, if you decide to open your account online, you’ll need to verify your identity some other way.

In Germany, PostIdent® is a common way to verify your identity³, while many banks are also now offering various video identity checking services you can set up from your phone.

For PostIdent, you’ll need to download an identity verification sheet from your bank’s website and present it at your local post office together with your passport or national identity card. You’ll then be given another document to sign, which is sent to your bank. Your bank will usually pay the fee for this procedure.

Where VideoIdent is available the process is usually easier, and won’t require a trip to the post office. Your bank will let you know if this service is available for the account you’ve picked, based on their options and your personal situation.

Alternatively, you can often get your identity verified by a lawyer or notary. Again, you’ll need to download the identity verification sheet and take this to your lawyer together with your passport or national identity card.

Finally, depending on your nationality, a German bank might also accept verification carried out by your home bank. You can get in touch with a customer representative beforehand and they’ll guide you on how to go about this.

Looking for an alternative that lets you manage your money in euros before you leave?

Check out the Wise Account — you can get set up from the US before you move, so you’ll hit the ground running when you get to Germany to start your new life.

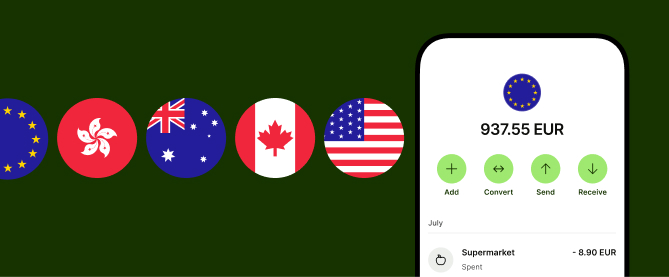

Open a Wise account online or in the Wise app, using your US proof of ID and address, to hold and exchange 50+ currencies including EUR and USD.

You can also get a Wise Multi-Currency Card to make spending and withdrawals easier, and local account details to get paid in 9 currencies including euros and dollars.

Whenever you need to switch between currencies you’ll get the mid-market exchange rate and low fees from 0.41%, with no ongoing changes, no minimum balance and no foreign transaction fee to worry about².

Banking has a long history in Germany. There are thousands of banks, sorted into three categories: private banks, cooperative banks and public access banks.

Despite these differences, most banks offer very similar products, including basic bank accounts, student accounts and business banking facilities.

Four of the largest banks in Germany are Deutsche Bank, Commerzbank, Postbank and Hypovereinsbank. Together, they cooperate as the Cash Group (more on this later).

Here’s what they each have to offer.

Deutsche Bank is probably the most well known German bank.

Its two main bank accounts BestKonto and AktivKonto⁴, both come with a linked payment card as standard and can be opened online. A word of warning though: the online application process is entirely in German.

The main difference between the two accounts is that BestKonto has a more expensive monthly fee (it costs €13.90 a month, while AktivKonto costs €6.90 a month) and comes with more perks.

The student account, called Das Junge Konto, is free and offers a linked card with free cash withdrawals in select countries.

There’s also a range of services for businesses and freelance professionals. These include corporate treasury services, institutional client services, and options for businesses which are delivered through Deutsche Bank, Postbank® and digital bank FYRST.

Commerzbank® accounts include a free, basic bank account and a premium account, called PremiumKonto, that offers free overseas ATM withdrawals⁵.

The Commerzbank student account options⁶ include various different accounts aimed at different customer needs, from individuals completing an internship, to new graduates.

If you’re a business owner, Commerzbank also offers a range of business services⁷, including tailored bank accounts and point of sale systems. You’ll also benefit from advice on managing your finances.

Commerzbank’s website has an excellent English translation. However, you cannot apply for a bank account online.

Postbank's checking account options include accounts which come with a monthly fee from €0 to €5.90, depending on the features you need, and the account balance you hold⁸.

The student account, Giro start direkt⁹, is free if you’re under 22. You can apply online using video verification, and there are extras like bonuses for referring friends, too.

Postbank’s business account, Business Giro¹⁰, also comes with a number of benefits included in the monthly fee from €5.90. The final fee you pay monthly will depend on your account balance, so do read the terms and conditions carefully before you sign up.

HypoVereinsbank® has a range of bank accounts you can apply for online. However, the website is in German, so it may be a challenge if you don’t understand the language.

HypoVereinsbank checking accounts include the Plus account which has no monthly fees for 2 years, and comes with a free debit card¹¹.

The bank also offers business accounts including the HVB BusinessAccount 4You¹² which is a modular account you can tailor to your own specific needs by adding extra features as required.

Most banks in Germany offer free bank accounts which include a free debit card and free online banking as standard.

A basic account should be more than enough for most of your everyday banking needs. However, it won’t have much in the way of perks.

If you’re looking for additional benefits, such as free travel insurance, you’ll need to choose a premium account and pay a monthly fee.

Germany’s four major banks and their subsidiaries cooperate as the Cash Group®¹³. What this means for you is that ATM withdrawals are free if you bank with one of Germany’s four major banks and use any of their ATMs.

Use another ATM, however, and you risk paying very high fees (up to €5 per withdrawal).

Some banks offer free withdrawals in some foreign ATMs if you have a premium bank account. However, while you won’t be charged a fee for making the withdrawal, you may be faced with an unfavorable exchange rate.

As a general rule, you should avoid withdrawing foreign money from an ATM. If this isn’t possible, you should at least make the withdrawal in the local currency so as to minimize costs.

German banks often charge fees for international money transfers outside of the eurozone.

However, you should also beware when a bank says international transfers are commission-free, as it may simply mean the bank’s costs are rolled up into the exchange rate instead.

You’ll also need to consider whether the foreign bank will charge a fee for the incoming transfer, as this will further increase the cost.

Opening a bank account in Germany is pretty straightforward if you’re already in the country and have a full set of the required documents. You may even be able to get all set up online or through a bank’s app.

However, if you’re not yet in Germany and want to open an account ahead of time, you might find it is bit trickier. In this case, you may consider an alternative Money Service Business like Wise.

With a Wise Account you can get started from the US before you move, to hold and exchange euros, and get local EUR bank details even before you arrive in Germany. That can make it easier to settle in — and cut your costs too.

Sources:

Sources checked on 05.15.2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read on to find out what US banks have branches in Panama and tips on banking in the country.

Read on to find out what US banks have branches in Portugal and tips on banking in the country.

Read on to find out what US banks have branches in Italy and tips on banking in the country.

Read on to find out what US banks have branches in Germany and tips on banking in the country.

Find out what Remitly's global membership program, Remitly One, offers, and the fees and requirements to be aware of.

Read on to find out what US banks have branches in India and tips on banking in the country.