Closing a US Bank account: Everything you need to know

Need to close US bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

In this handy guide, we’ll walk you through how to open a bank account in Denmark. This includes the best Danish bank for foreigners, the documents you’ll need for your application, and any fees you need to know about.

Plus, info on a money-saving alternative for managing your money internationally - the Wise multi-currency account. Open a Wise account online to send, spend and receive money across borders for low and transparent fees¹.

You don’t need to be a Danish citizen to open a bank account in Denmark, but you do need to be a resident. You could be renting in Copenhagen or own a property in the countryside - all that matters is that you have the valid documentation.

For Danish banks, this means a CPR (Centrale Personregister) number. This is issued by the Borgerservice once you register as a Danish resident. It’s unique to the person and is used as an ID number.

Therefore, you can not open an account as a non-resident. If you’re about to move to Denmark and want to get started before you arrive, you may be able to start the application process online and then show your CPR card in person once you arrive.

There is another important thing to know about the Danish banking system as an expat. Anti-money laundering laws introduced in 2013 instructed banks to take extra steps to confirm the identity of new customers. But the laws didn’t necessarily lay out guidelines on how banks should do this, leading to inconsistency in application procedures between banks.

For you as a new applicant from overseas, it could mean that you’ll be asked for additional documentation. For example, some banks are asking for health insurance cards (which can take a while to arrive), while others are requesting a Danish address. So, it’s important to check with the bank in advance what you’ll need to provide.

Here’s the full list of documents you’re likely to need to open your new Denmark bank account²:

You may also need to provide a yellow health insurance card (Den gule Sygesikringskort) and proof of address, depending on the bank’s requirements.

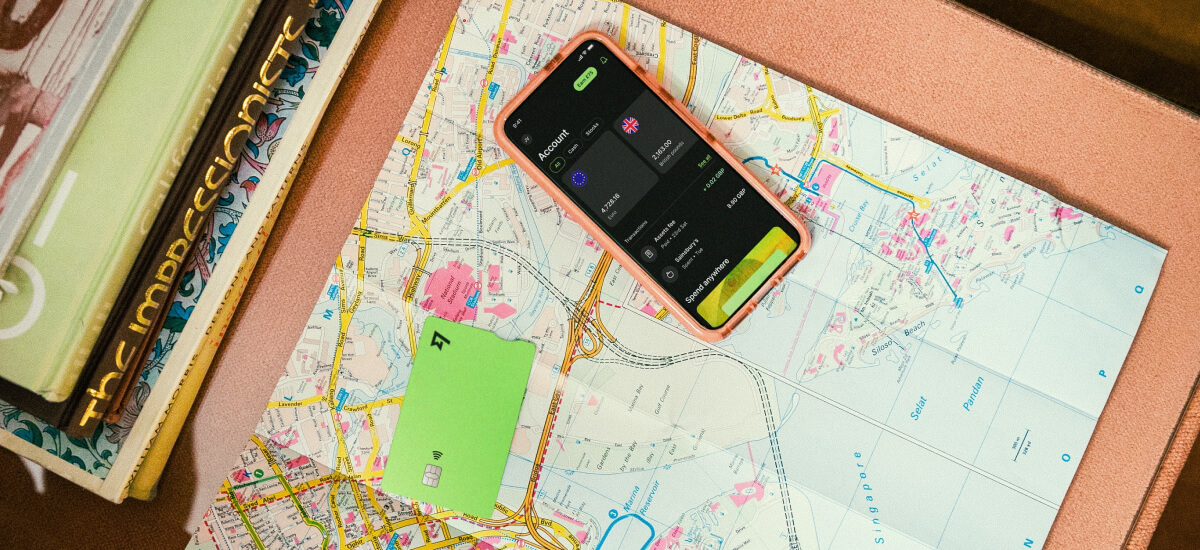

Want an international account you can apply for online and use almost right away? Save time and hassle with a Wise account.

It offers the convenience of one account for all your international banking needs. You can manage 40+ currencies at once, receive money for using local bank details (USD, GBP, EUR, AUD, NZD, CAD, HUF, SGD, TRY, RON) – and even set up direct debits.

Plus, it’s cheap, fast and easy to send money worldwide. You can send money to 140+ countries all over the world for low fees¹.

And for low-cost spending in 150+ countries, including Denmark and the US, you can order a Wise Multi-Currency Card for a fee¹.

It takes just minutes to open a Wise account for free¹.

New customers will usually need to visit a branch or call the bank in order to open an account.

However, some banks like Nordea will let you at least start the process online³, completing an online form before a customer service representative gets in touch to discuss banking options.

Many bank accounts in Denmark come with regular maintenance fees. For example, choose Danske Bank to open an account, and you’ll pay 18-30 DKK (approx. $2.50-$4 USD) a quarter⁴.

You may also pay an annual debit card fee, which is between 60-150 DKK (approx. $8-$20 USD)⁴ at Danske Bank.

Before opening an account, it’s also a good idea to check the fees for international transfers and for using out-of-network ATMs.

Here’s a quick list of some of the biggest banks in Denmark for new arrivals:

And remember, banks aren’t your only option - especially for international payments. Open a Wise account online for free, and you can manage your money in 50+ currencies, which is handy if you’ll be travelling between the US and Denmark.

All sources checked on 19-Jul-2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Need to close US bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Read on to find out what US banks have branches in Panama and tips on banking in the country.

Read on to find out what US banks have branches in Portugal and tips on banking in the country.

Read on to find out what US banks have branches in Italy and tips on banking in the country.

Read on to find out what US banks have branches in Germany and tips on banking in the country.

Find out what Remitly's global membership program, Remitly One, offers, and the fees and requirements to be aware of.