Transferring your international driver's license to the US: step-by-step

Your full guide to updating your foreign driver's license to the US.

“Non resident alien” might sound like something out of a science fiction movie, but it’s actually a legally recognized term in the United States, especially relevant when it comes to filling your taxes with the IRS (Internal Revenue Service).

But for now, let’s start with the basics – what does the term actually mean?

A US nonresident alien is anyone at all who isn’t a US national or a US resident, and therefore doesn’t have a green card or hasn’t lived in the US for a substantial amount of time recently.¹

Technically, of course, that applies to most of the world’s population. But it’s of most relevance to people who – despite not falling into the categories mentioned above – have been doing business in the US. And that’s because of tax obligations, because nonresident aliens have to pay taxes on income earned in the US.

Let’s break the phrase apart into its two words. An alien is anyone who is not a US citizen or national – someone who can’t claim a US passport. And a nonresident is more complex to define. The name suggests it means anyone who doesn’t live in the US, but it’s a little bit more subtle than that.

Firstly, you’re a nonresident alien if you just don’t live in the US at all and have nothing to do with it. But, most importantly, you’re a nonresident alien:

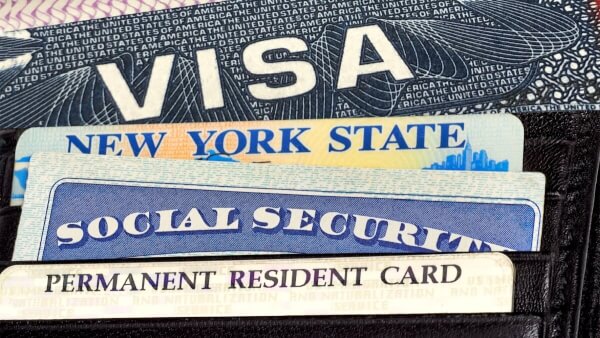

If you don’t meet the “green card test”

The green card test is simply whether or not you have a “green card” – otherwise known as an alien registration card, issued by the US Citizenship and Immigration Services. This is the card that grants you the right to reside permanently in the US – it grants you permanent residence.²

Or if you don’t meet the “substantial presence test”¹

The substantial presence test assesses how much time you’ve spent in the US recently. You’ll pass the test if you’ve been physically present in the country for 31 days this year, and 183 days during the current year and the previous two years combined. But the days in the previous years count for less – days last year are worth 1/3 of a day each, and days in the previous year are worth 1/6.³

You’re only likely to count as a nonresident alien if you travel or have been traveling between the US and other places. Some examples could include:

But you should note that residency status may change over time. For example, a teacher returning to teach for several years in a row might end up qualifying as a resident alien, because they may eventually pass the substantial presence test.

Your first year may be especially complex, as it’s possible to be both a nonresident alien and a resident alien during that year – your status will change depending on when your residency starts (or ends).⁴ That may make you a Dual Status Alien and you may have to fill out a different tax form.⁵

The reason it matters whether you’re a nonresident alien or a resident alien – or a US national, of course – can be summed up in one word: tax.

US nationals and resident aliens alike have to file yearly tax returns and pay tax on all their income worldwide. For them, it doesn’t matter whether you live in the US or abroad – you still have basically the same tax obligations.⁶

nonresident aliens have different tax obligations, though. Those who have some involvement with a US trade or business do have to file a tax return, and should expect to pay tax on their US income at the same rate as residents.1 Generally, a nonresident alien will only have to pay US tax on US-source income – not on income from other countries.⁷

“If you are engaged in a U.S. trade or business, all income, gain, or loss for the tax year that you get from sources within the United States (other than certain investment income) is treated as effectively connected income”⁸.

So, then: what do you have to do?

After you’ve determined your alien status, you’ll have to determine your income. As mentioned before, nonresident aliens are taxed only on their income earned in the US, if it’s connected with a trade or business in the country.

If that’s the case and if you have no dependants, you’ll need to file your taxes as a nonresident with the Form 1040-NR, or possibly Form 1040-NR-EZ (but not for years since 2020⁹). You’ll usually have to file by April 15, although not always - for example, the 2020 federal tax deadline for individuals has been extended by the IRS until May 17 2021.¹⁰

And if you don’t qualify for a SSN (Social Security Number), you can file your taxes under your own ITIN (Individual Taxpayer Identification Number).

There is an exception: a resident alien or US citizen married to a nonresident alien can choose to have their spouse to be treated as a US resident for tax purposes, using the standard tax return Form 1040.⁹ In that case the spouse can be filed as “married filing jointly.”

This also includes cases when one of them is a nonresident alien at the beginning of the tax year, but later becomes a resident alien in the same year, and yet the other spouse is a nonresident alien at the end of the year.

If this choice is made, then both spouses will be treated for income tax purposes as residents for the entire tax year⁸.

All aliens (except those listed under Aliens Not Required To Obtain Sailing or Departure Permits) must obtain a certificate of compliance, also known by “sailing permit” or “departure permit”⁸.

So - if you fall into those - you can obtain this certificate after confirming that you’ve paid all your taxes by filling out the Form 1040-C (U.S. Departing Alien Income Tax Return) or the Form 2063 (2063 U.S. Departing Alien Income Tax Statement). You also have to pay all the tax due on Form 1040-C and any other obligations due for previous years.

If you need to send money between different countries, you might want to know Wise's international transfers. They're fast, they're cheap, and you know exactly how much you pay and how much you receive.

Unlike traditional banks, Wise doesn't charge a mark-up fee on the exchange rate, and you don’t get unpleasant surprises because of intermediary banks or Swift fees. You pay an upfront fee, and that’s all. You only have to:

See how much you can save with Wise

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Your full guide to updating your foreign driver's license to the US.

Whatever your reason is for moving to the US, this guide aims to help you figure out the most important costs you'll face when you live there.

Find all you need to know about getting a personal loan for H-1B visa holders in this guide.

Everything you need to know about the US certificate of naturalization.

The US welcomes large numbers of new arrivals every year — and getting a great job to both gain experience and set down roots is a core part of the American...

Find everything you need to know about the US citizenship test, including the USCIS questions and answers.