Substantial Presence Test

What is the substantial presence test?

If you’re a foreigner in the US without a green card - and you earn an income - you’ll need to know about the IRS Substantial Presence Test (SPT).

No matter whether you arrived to study, work or travel, the Substantial Presence Test determines if you’re considered a ‘Resident Alien’ for US tax purposes. That’s important when it comes to what income you’re taxed on in the US, and what deductions you can claim.

The test is based on the number of days you were present in the US over a 3-year period, and what visa you held during that time. You start with the current year and then also need to take into account the 2 previous years.

As with everything tax, the calculation is a little more complex than it sounds. That’s where our handy calculator comes in to help.

Wise is the cheaper way to send, receive and spend money abroad.

Been hit by hidden or high currency conversion fees while in the US? Use Wise instead.

Wise offers the world’s most international account. Get the convenience of converting over 40 currencies at the mid-market rate (exactly what you see on Google) - and avoid the sneaky markup fees charged by banks. You win.

You’ll also receive your own US routing number that you can share with others to receive or send money. Get paid by clients, receive money from friends, and set up direct debits to make it easier to manage your finances - no matter where you call home.

And with the Wise Multi-Currency Card, you can spend in the US with a better exchange rate and lower fees than a bank.

Register now and start saving.

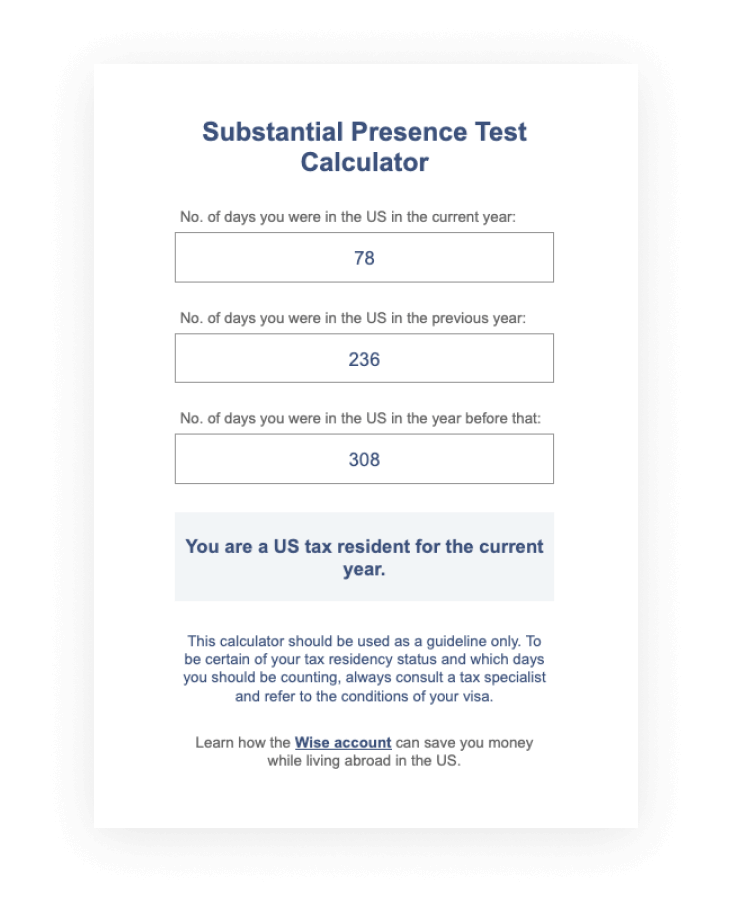

Substantial presence test calculator.

Meeting the Substantial Presence Test under immigration laws means you’re considered a resident alien in the US for tax purposes.

To meet the Substantial Presence Test you must be physically present in the US on at least:

- 31 days during the current year, and

- 183 days during the 3-year period including the current year and the 2 years immediately before that.

However, days in different years are given a different weighting, so you need to count as follows:

- Each day you were present in the current year counts as one

- Plus ⅓ of the days you were present in the previous year

- Plus ⅙ of the days you were present in the year before that

Sounds complicated? Don’t worry, we’ve created a handy calculator to do the hard work for you. Simply download, input your days and the calculator will let you know if you’re a US resident for tax purposes or not!

Download the Substantial presence test calculator→

Keep reading for a worked example, to find out exactly what a day of presence is (and is not) and to see who is exempt from the test.

This calculator should be used as a guideline only. To be certain of your tax residency status, you should always consult a tax specialist and refer to the conditions of your visa.

Substantial presence test example.

Maya enters the US on 08-20-2016 on a student F1 visa.

If you enter the US on this type of visa, you’re classified as an exempt individual for 5 calendar years (2016 through 2020).Days in the US as an exempt individual are not used in the SPT calculation.

Maya needs to determine whether she meets the Substantial Presence Test. She should start counting days on 01-01-2021 and should count these days as follows:

- Current year (2021): 108 days = 108

- Previous year (2020): 0 X ⅓ = 0

- Year before that (2019): 0 x ⅙ = 0

Maya doesn’t meet the substantial presence test yet, but will do on her 183rd day in the US in 2021.

What are days of presence in the US?

A day of presence in the US is any day that you were physically present in the country, at any time during that day.

There are however, exceptions to this rule. The following do not count as days of presence in the US, and you should therefore not include them in any substantial presence test calculations:

- Days you commute to work in the US from a residence in Canada or Mexico

- Days when you are in transit between 2 places outside of the US and are in the country for less than 24 hours

- Days you are in the US as a crew member of a foreign vessel

- Days you’re unable to leave the US because of a medical condition you developed while being in the country

- Days on which you fall into the category of ‘exempt individual’ - check out the list below

If you’re uncertain about which days to count, consult a tax specialist.

Exempt individuals.

There are also a few reasons you may discount days based on your visa status and activities in the US. Don’t use days during which your visa status means you’re an exempt individual in the Substantial Presence Test.

Exempt individual status does not mean you’re exempt from paying tax in the US, but instead applies to the following:

- A teacher or trainee temporarily present in the US under a J or Q visa

- A student temporarily present in the US under an F, J, M or Q visa

- A professional athlete temporarily present in the US to compete in a charity sports event

- A foreign government-related individual temporarily present in the US under an A or G visa (although not those holding an A-3 or G-5 visa

Don’t forget that you’ll need to comply fully with the requirements of your visa if you hold any of the above visa categories. If you’re not sure about how to complete the SPT due to your visa status, get professional advice.

Substantial presence test FAQ.

Save money on your next transfer home

Hold multiple currencies, send and receive money internationally quickly and conveniently, all while saving on sneaky bank fees.