How to get mortgage for overseas property as an American

Learn all about different ways to get an overseas property mortgage as an American and gain unique insights to prepare yourself for the whole process.

Getting a mortgage in Canada as a non-resident can be a tricky process. You’ll need to look into the best mortgage rate for you – and make sure to meet your bank’s legal and financial requirements.

We’ve put together everything you need to know, including a guide to mortgage fees, interest rates, and exactly how to get your mortgage in Canada.

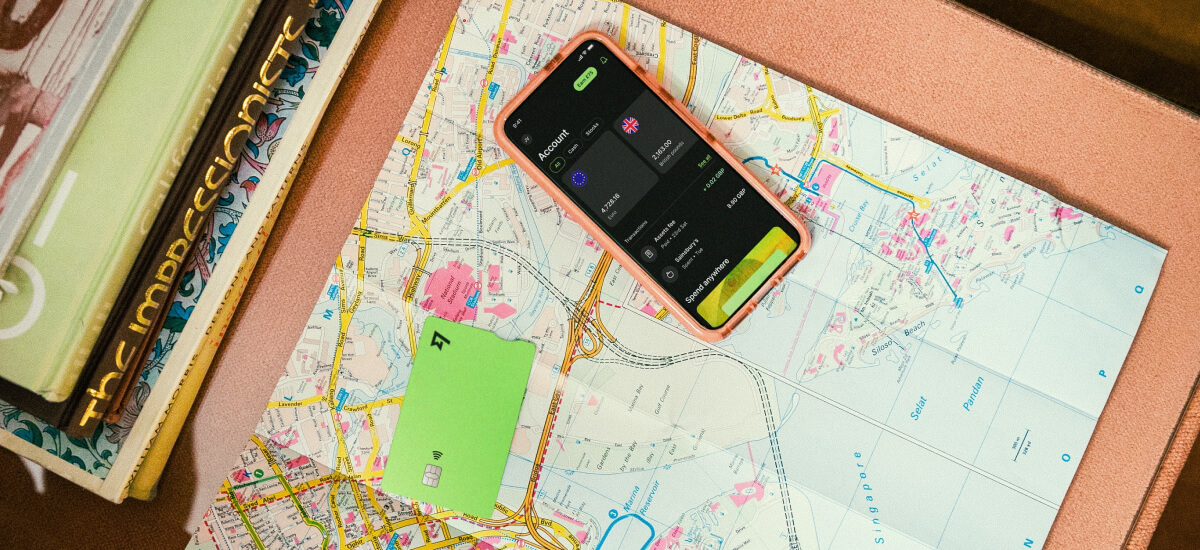

Heading abroad? Use Wise to send money to over 160 countries, including the US and Canada – all at the mid-market exchange rate. Let’s take a look!

So, can an American get a mortgage in Canada? The simple answer is yes, but there are some things to consider.

You’ll typically need a larger down payment than a Canadian resident – and you won’t qualify for government support, such as a first-time buyer program or land tax rebate.

You may also need to provide additional documentation to support your application, such as proof of good credit in the US and Canada.¹

As a non-resident, you’ll need to follow your bank’s specific requirements to qualify for a mortgage in Canada.

It’s worth noting that the Canadian government recently brought in a bill to ban foreigners from buying property in Canada.

However, that doesn’t mean it’s not possible to move to Canada. You can still buy certain types of property – and locations with a population under 10,000 people remain unaffected.²

Make sure to consult a real estate professional before going ahead with your Canadian mortgage application or property purchase.

You can get a traditional loan through a Canadian bank, as you would in the US. However, you’ll need to meet the bank’s strict eligibility criteria.

You can also get a mortgage through a credit union or lender. These providers may offer more flexible requirements and mortgage rates.³

Make sure to choose the right mortgage term for you. A term is the length of your mortgage before you need to renew it. It typically ranges from a few months to 5 years or longer – and your contract will have multiple terms.⁴

You’ll also need to look into what type of interest rate you can get. Fixed interest rates stay the same throughout your mortgage term, whereas variable or adjustable interest rates can be subject to change.⁴

There are some similarities between US and Canadian mortgages – but there are also a few key differences to understand.

In particular, you’ll need to carefully consider the length of your mortgage. In the US, your mortgage term is typically equal to the full amortization period. This is the duration of time it takes to pay off your debt in full.

In Canada, however, a mortgage is split into shorter terms within your amortization period. This means your interest rate and mortgage conditions may change term-by-term.⁵

Let’s take a closer look at some of the big differences between Canadian vs US mortgages.

| US mortgages | Canadian mortgages |

|---|---|

| Longer approval process – US mortgages typically take 45 to 60 days to complete⁵ | It can be quicker to get a Canadian mortgage – around 2 to 10 days⁶ |

| You may need to re-apply if you want to change to a different type of mortgage⁵ | You may be able to switch to a different mortgage type without submitting a new application⁵ |

| US mortgage rates are typically fixed (interest stays the same) or adjustable (rate stays the same for the first 3 to 10 years, then it may adjust based on market interest changes)⁵ | Canada’s mortgage terms are usually fixed or variable (rate changes in line with the prime interest rate – this is the rate your bank pays to borrow its money)⁵ |

| US mortgage amortization periods are typically 15 to 30 years⁵ | Mortgage amortization periods are usually around 25 years⁵ |

| You’ll need to be aged 62 or older to access a reverse mortgage loan – this allows you to borrow money against the equity of your home⁷ | You can apply for a reverse mortgage loan in Canada from the age of 55⁸ |

If you want to get a Canadian mortgage, you’ll pay interest on the money you borrow from your bank or lender. The interest rate used for your loan will be communicated to you before you take out your mortgage.

If you have a fixed-rate mortgage, your interest rate won’t change, whereas your interest will fluctuate if you have a variable rate.

As a non-resident, you should get the same interest rate as a Canadian resident – and mortgage rates in Canada can depend on a number of different factors.¹ Your bank will consider the current market, your financial history, and what type of mortgage you want.

Different providers will also offer different rates. For example, BMO® offers a 2-year fixed rate mortgage at 6.99%. You can get a 5-year variable rate on a closed mortgage at 6.60% from TD Bank®.⁹

As an American, you’ll typically need to put down at least 20% of the house price for your down payment, as you may only be able to borrow up to 80% loan-to-value from your Canadian banking provider.

However, non-residents from other countries may need as much as 35% to secure a mortgage in Canada.¹⁰

There are a few things to think about before applying for your mortgage in Canada:

- Check your credit history

- Look into Canada’s mortgage rates

- Save for your down payment

- Find the right lender or bank for you

- Open a Canadian bank account

You may want to work with a mortgage broker to help you navigate the market. A broker has access to a network of lenders who can pre-approve you based on your financial history – and this can speed up the mortgage process.

There may also be some additional fees and costs to consider, such as:

- Non-Resident Speculation Tax – this is typically 25%

- land transfer taxes

- mortgage broker or legal fees¹

- life and property insurance

- how much it costs to live in Canada

You may need to pay a deposit for your property. This usually costs around 5% of the property price – and it will form part of your down payment later down the line.¹

If you pay for your deposit or down payment in Canadian dollars from a US dollar bank account, make sure to look out for exchange rate costs or foreign transaction fees.

Many banks add hefty charges to foreign currency payments, so you may end up paying more than expected. Look out for the mid-market rate. This is the standard exchange rate, with no added markups or hidden fees.

Now that we covered all the basics of getting a mortgage in Canada, the only question left is: how to send money to pay for your property overseas?

Wise offers you a quick, secure and transparent way of sending money to Canada. You get the mid-market exchange rate for your payments and see how much it’s charged for the transfer before sending the money from your bank.

With the Wise Account you can also hold 40+ currencies, spend money in 150+ countries, and receive like a local in 9 different currencies.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

There are some documents you’ll need for your Canadian mortgage application, including:

- proof of identity, such as a valid form of government ID

- immigration documents, if applicable³

- bank statements to show that you’re financially stable

- property documents, such as your purchase agreement, property appraisal, proof of expenses, and homeowner’s insurance policy

- proof of income, such as a letter from your employer and pay stubs¹¹

You may also need to get a reference letter from your bank in the US and complete a Canadian credit check to qualify for your mortgage.¹

Let’s take a look at how to apply for a mortgage in Canada – your step-by-step guide.

Step 1. Check your credit score.

You’ll need to ensure you have a good score in the US – and you may also need to complete a Canadian credit check. If you have a low credit score, take some time to boost it

Step 2. Look into your options.

Getting a mortgage takes a lot of research – and even more so in a foreign country. Look into the different types of mortgages and calculate your mortgage interest rate to work out how much you can afford

Step 3. Compare mortgage lenders.

Look at traditional banks and lenders to consider what works best for you, including repayment schedules, interest rates, and term lengths. A mortgage broker can do this comparison for you

Step 4. Apply for pre-approval.

You’ll need to prepare a few documents for your application – and you may want to negotiate the best deal for you. Getting pre-approved will give you an idea of how much you can borrow

Step 5. Apply for your mortgage.

Once you’ve put an offer on a property – and it’s been accepted – it’s time to apply for your mortgage. If you’re already pre-approved, the application process is very similar⁴

These steps may differ depending on your individual circumstances and requirements. Speak to a lawyer or Canadian real estate agent for help with your application.

Your Canadian mortgage approval time may depend on whether you borrow money through your bank or an independent lender.

Mortgage approvals in Canada tend to take from 2 to 10 days to complete, but mortgages through banks can take longer, as you may need to meet specific eligibility criteria.⁶

There are a few ways to make the mortgage process a little easier:

- Improve your Canadian credit history by opening a Canadian bank account or getting a credit card

- Use a mortgage broker to help you navigate the pre-approval and mortgage application process

- Pay a larger down payment to get a better interest rate³

Applying for pre-approval can also speed up the approval process. Pre-approval isn’t necessary – and it doesn’t guarantee loan approval – but it can help you understand exactly what you need to do to secure your mortgage.⁴

In Canada, you’ll need to renew your mortgage when you reach the end of a term, unless you’ve paid the balance in full.

Canada’s mortgage renewal system gives you a chance to regularly review your contract. You may be able to alter your payment frequency or increase payments to pay off your mortgage sooner, for example.¹²

Speak to your lender for further advice and support.

Getting a mortgage in Canada can be tough for non-residents, but it’s not impossible.

You’ll need to ensure you meet your bank’s eligibility criteria. You may also need to make a down payment of at least 20% for your new home.

Yes, non-residents can get a mortgage in Canada. Make sure to gather all the necessary documents, such as proof of identity, residency, and income.

The Prohibition on the Purchase of Residential Property by Non-Canadians Act prohibits foreigners from buying certain property in Canada, so make sure to consult a real estate agent before going ahead with your property search.

Many traditional banks may require you to have a good credit history in the US before you can purchase property in Canada – and you may need to put down at least 20% as a down payment.

However, some lenders may be more flexible. If your provider sees you as a financial risk, you may end up paying a higher rate of interest for your mortgage.

You can get a 30-year mortgage in Canada, but it’s not the right choice for everyone. You’ll typically pay less per month, but you may end up paying more interest on your mortgage.

You’ll also be in debt for longer, which could prevent you from saving for retirement later in life.¹³

You can get a mortgage in Canada as a non-resident, but you’ll need to carefully research your options. Make sure to choose the right mortgage type for you – and look into any fees or requirements for your loan contract.

Explore mortgage interest rates and consult a broker for advice and support about your big move!

To start spending your money in the US, Canada, and further afield, check out Wise.

Sources

Sources checked 10.31.2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn all about different ways to get an overseas property mortgage as an American and gain unique insights to prepare yourself for the whole process.

Get a full overview of the best property management software systems for small landlords to easily track and manage their overseas property.

How to buy your first rental property overseas? Here's a detailed guide that can help you understand the challenges and steps for making an investment.

What are the best property management software systems for managing student housing? Take a look at our list and choose the most suitable option for you.

Are you thinking about making smart property investment decisions and wondering how rental yield is calculated? Have a look at our guide to find out.

Have a look at the in-depth guide on the Singapore rental yield market and get a detailed breakdown of opportunities in different areas within the country.