Cost of an Accountant: What to Expect for US Small Business Services

Wondering about the cost of an accountant for your small business? Find out what to expect and how to budget for professional services.

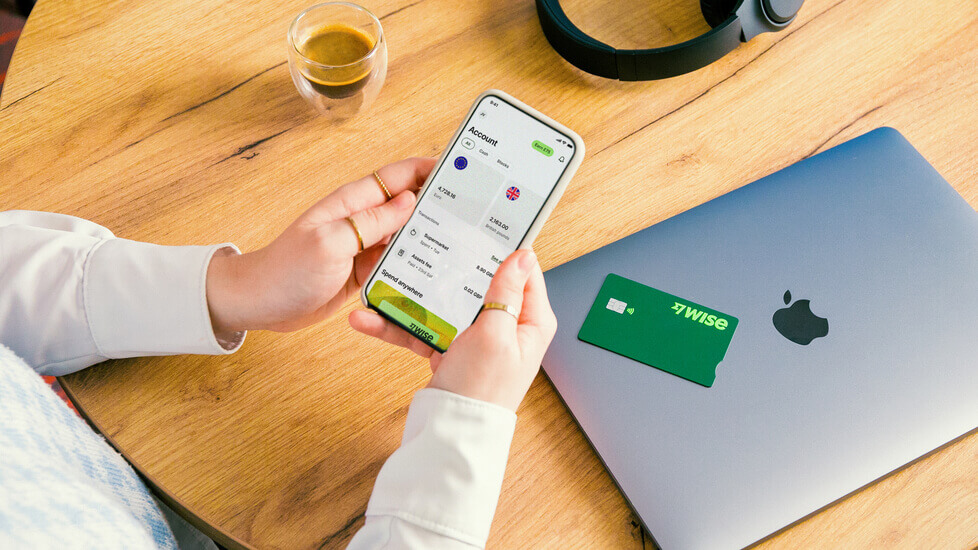

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in 40+ currencies. You can also send money to 160+ countries.

But is the Wise Business account free in the US? Read on to find out.

| This information is valid only for the US Wise Business account, other countries may have different pricing and fees. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information. |

|---|

Registering for a Wise Business account is free for US registered businesses. After registering for a free account, your business can send payments to 160+ countries.

This means that you can use your free Wise Business account to pay suppliers and contractors around the world, using the mid-market rate for any international transfers.

With the free Wise Business account, you cannot receive payments. In order to unlock this feature, there is a one-off fee of 31 USD to get account details. After paying this fee, you can get major currency account details to receive overseas payments like a local.

Wise does not have monthly account fees, or minimum balance requirements. You can simply register for free and start sending payments, or pay 31 USD once to get account details. There are no hidden fees to worry about. Wise believes in helping your business keep the most of its profit, rather than wasting it on mysterious bank fees.

The one-off fee enables you to use Wise Business as a complete business account, meaning you can send, hold, and receive payments. This makes it easy to receive payments from customers abroad.

For example, you can get a UK sort code and account number even as a US business, so your UK customers can pay into UK account details. This makes it easy for customers to pay you, and also means that you know exactly how much you’ll receive. You can then exchange the GBP to USD, or your preferred currency, all within your Wise Business account.

Open a Wise Business account online

If you’re not sure whether you need the free Wise Business account, or if you require account details for a one-off fee, you can always register for free and then see how your business needs develop. In any case, you’ll already be saving money by using Wise Business to send international payments.

| 🔍 Read the guide on how to open a Wise Business account |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering about the cost of an accountant for your small business? Find out what to expect and how to budget for professional services.

Get essential bookkeeping tips for small businesses, from tracking expenses to managing cash flow and preparing for taxes.

Discover the key differences between PayPal Business and Wise Business. Compare features, fees, and benefits to find the best solution for your business needs.

Want to know how to set up direct deposit for your employees? Let’s go into the steps, costs/fees, documents, and tools you can use.

Understand the definition of a business partnership, explore its types, advantages, and disadvantages, as well as how to form a partnership

Learn what remittance advice is, how it's used in business transactions, and why it's important for accurate financial records.