How to open a bank account in Costa Rica as a foreigner: US guide

Learn all about opening a bank account in Costa Rica as an American, including costs, requirements, and alternatives.

If you’re headed abroad for work or study, an international bank account can make it easier to manage your money across different currencies, and cut down on banking costs.

International bank accounts are available from major US and global banks, although features and fees can vary widely.

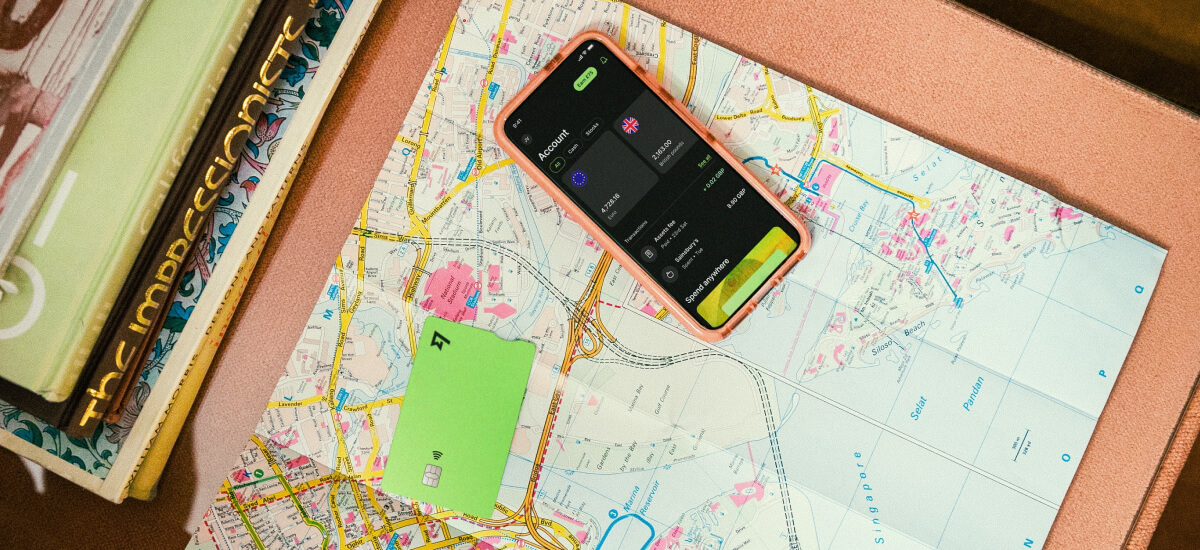

This guide covers all you need to know, plus we’ll introduce the Wise Account, an alternative to a bank account and flexible, low cost option to hold and exchange 50+ currencies with the mid-market rate.

US citizens and residents can open a global bank account with a bank, or they can opt to use an alternative online Money Service Business , like Wise.

US banks don’t usually have a great selection of multi-currency account options — and to access those that are available you may run into strict eligibility criteria and high minimum balance requirements.

You may also find that international bank accounts from regular banks only offer a handful of major currencies, which might not be convenient if you’re traveling extensively.

If you’re looking for an international account you can use for day to day spending when you’re abroad, and to hold and receive a broad selection of currencies, you may decide to skip international bank accounts entirely, and go for a specialist service like Wise instead.

If you need a fast, cheap and reliable alternative to international banks, try a provider like Wise.

With Wise you can hold 50+ currencies, spend with your Wise Multi-Currency Card in 170+ countries, and send money to 80+ countries quickly — or even instantly¹, with the mid-market exchange rate and low fees from 0.41%².

You’ll also get local banking details to get paid to your Wise account from 30+ countries, so you can use your Wise Account to receive, hold, send and spend foreign currencies easily, and with low, transparent fees.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Banking is a global industry, so you might well find you can open an account with a bank with branches in your destination country before leaving the US.

Here are the top 4 international banks to consider.

| 🏆 Best for long term expats |

|---|

HSBC® has been in business for over 150 years, and operates across Europe, Asia, the Americas, Africa and the Middle East³.

Find HSBC branches and wealth centers across the US, and access a network of 55,000+ ATMs here and overseas⁴.

You can open an international account in 30 different territories⁵, allowing you to get an account set up before you move, using your local credit history in the US.

If you’re a Premier customer you’ll find there are no fees for this service, although other account types do come with transaction and service charges.

Learn more with our full HSBC review

| 🏆 Best for frequent international ATM withdrawals |

|---|

It’s possible to open a Charles Schwab® account in the US which comes with no opening fees, no foreign transaction fees and unlimited rebates on international withdrawals⁶.

Accounts can be opened online provided you have all the documents required.

You can also open a Charles Schwab account once you move, in certain countries — but it’s worth noting that some international accounts are intended for investors and require high minimum deposits⁷.

Read further: Charles Schwab review

| 🏆 Best for global transfers |

|---|

Citibank® has a network of branches and offices in 95 countries globally⁸.

Depending on where you’re headed you may be able to open a Citibank offshore account once you’ve arrived at your destination — or you might choose to open an account at a local Citibank before you leave.

Terms and conditions of accounts will vary, so check out both options before you decide.

Citibank globally offers currency services across 144 different currencies — handy for sending money internationally. Learn more about Citibank international transfers here.

Check out our Citibank review for more details

| 🏆 Best for spending overseas |

|---|

Capital One® might be a good choice if you travel often and like to spend on your card. You’ll be able to choose from a range of checking and saving accounts with Capital One⁹, depending on your personal needs and preferences.

If you choose a Capital One 360 Checking Account you won’t be charged any foreign transaction fee when you spend overseas¹⁰ — and Capital One’s credit card options can also come with no extra international charges.

Not sure if Capital One is for you? Check out this full Capital One US review to help you decide.

Choosing the best bank for your international travels can seem daunting. You’ll want to consider the costs and convenience of the accounts you look at, taking special care to read the terms and conditions of accounts offered from overseas brands.

Be aware that some fees which are not used frequently in the US may be common with foreign banks — and some of the fees you expect to pay here might not apply abroad. Taking some time to read through the key features, fees and limitations of a range of accounts will pay off.

If you’re moving around a lot while overseas, you’ll want an account that supports multiple currencies, with low fees and a good exchange rate.

The Wise Account could be a good fit. Hold dozens of currencies in the same place, and switch using the mid-market exchange rate when you need to.

With local bank details to allow you to receive payments easily from the US, UK, euro area, Canada, Australia, New Zealand, and more, this card might also suit if you’re on a working break and need to receive payments in foreign currencies as you travel.

CTA banner: The world's most international account at the tip of your fingers

Your options — when it comes to banking — may be influenced by the type of country or countries you’re visiting. In some countries you might have fewer choices when it comes to international bank accounts from banking brands.

However, alternatives like Wise can offer account services to people in most countries (aside from a small number of unsupported countries¹¹).

No matter where you’re headed, selecting a bank or alternative provider with intuitive and comprehensive online and mobile banking options might be the best bet, so you can manage your money at home and as you travel.

As we have mentioned, banking is a truly global industry. Check if your bank has operations overseas, or works with recommended partners.

You might find it easier to get accounts with these linked banks if so.

The exact requirements to open a bank account abroad will vary, but you can expect to be asked for the following in almost any country:

|

|---|

It’s important to note that if you hold over USD10,000 in total in foreign bank accounts at any point in a given year, you need to file a report of Foreign Bank and Financial Accounts — known as FBAR¹².

Filing is done online annually¹³ — and you’ll need to enroll and get a user ID to get started.

If you’re living, studying or working overseas, you’ll almost certainly need to send money either to or from your new home.

Maybe you have bills to pay back in the US after you leave, or perhaps you’re covering the costs of your rent or tuition fees from an account held at home, and need to receive it locally in your new international account.

Use this guide to top international banking options for the US, and compare accounts on offer with an alternative like the Wise account to see which gives you the flexibility and features you need.

Sources:

Sources checked on 05.10.2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn all about opening a bank account in Costa Rica as an American, including costs, requirements, and alternatives.

Learn all about opening a bank account in Monaco as an American, including costs, requirements, and alternatives.

Need to close Fidelity bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close Capital One bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close Santander bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close PNC Bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.