Best banks for digital nomads: 2024 guide

Living the digital nomad life? Learn all about the best banks and alternatives to sort your finance on the go.

Be it for temporary reasons or a more permanent pursuit of the “American Dream,” moving to the United States of America always entails a few adjustments — but especially in 2020.

The United States, by and large, has the largest immigrant population in the world. With its approximately 45 million residents born overseas, the US maintains its reputation as a ‘melting pot’ culture. And that’s part of what can make a move to the US exciting.

We’ve compiled a list of tips and tricks to make your life in the States a home run, even if the last year has been unusually difficult for dealing with a move internationally.

Moving can be expensive — whether it’s a domestic or international move. The costs can easily reach several thousands of dollars. So, where possible, it’s important not to make things unnecessarily more expensive, and one of the areas you can save a huge sum is in international money transfer fees and exchange rates.

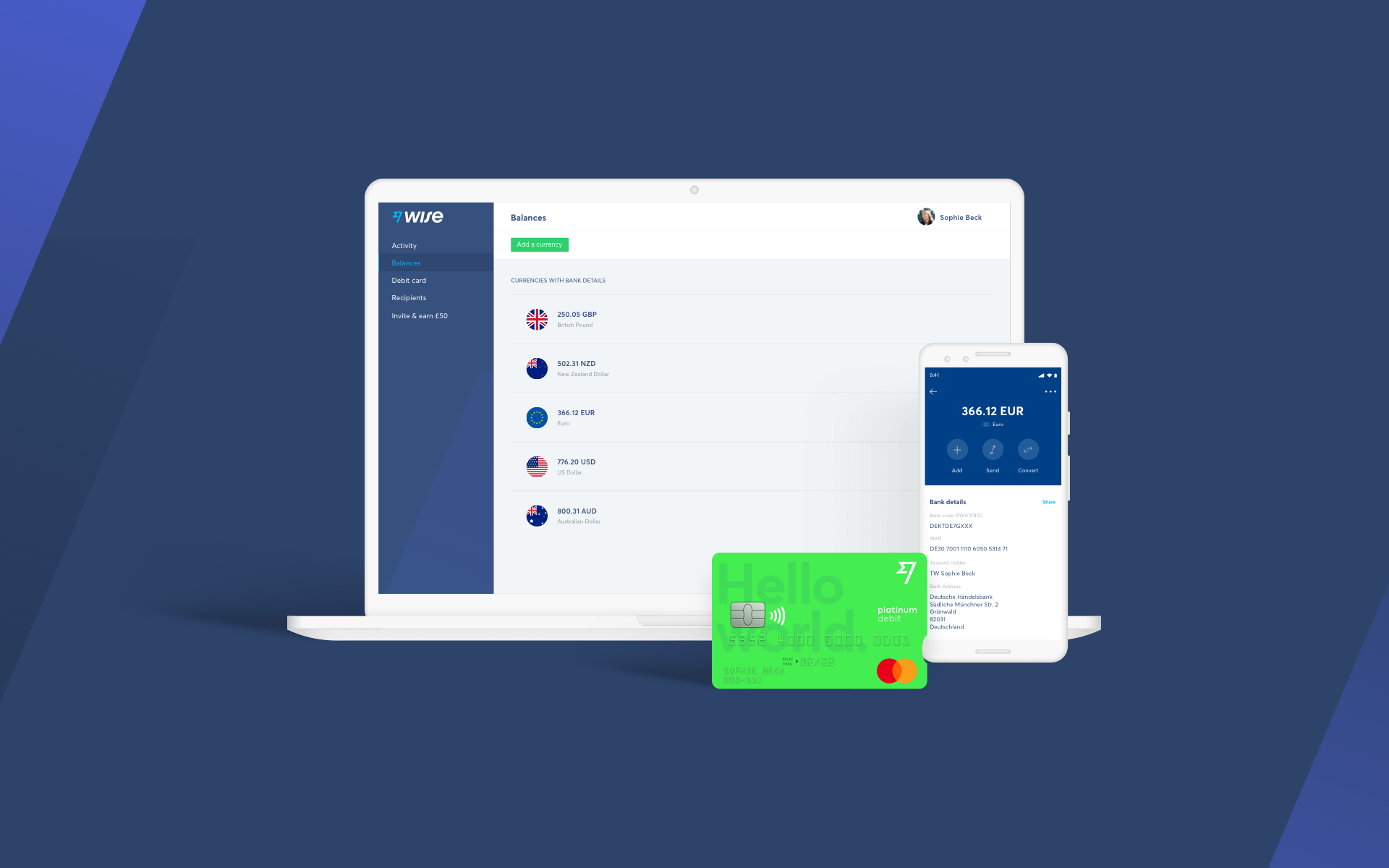

With Transferwise, you can send money using low cost bank transfers and fast transfers via credit or debit. Wise’s online account lets you send money for a fraction of the price compared to banks and PayPal. Whether you need to pay for

Wise’s online account lets you send money for a fraction of the price compared to banks and PayPal — no matter whether you’re transferring money for loans, a home, moving costs or to support family.

Wise’s multi-currency account also lets you hold balances in over 40 currencies, send and receive payments, and spend or shop internationally with its debit card. It means you won’t be charged the high international transaction fees or exchange rates that other providers charge. Transferwise’s mission of “money without borders” helps you feel more in control of your money and less like it’s falling out of your pocket.

Wise has previously outlined expected costs of living in the US. You’ll want to familiarize yourself with that.

Popular cities Americans and expats alike, like New York City, San Francisco, Boston, and Los Angeles, often end up top in lists of the most expensive places, but they are totally manageable if you budget properly.

While Wise is a great option for all your international banking needs, you may need a domestic bank account too. Unlike other parts of the world, the US has not yet embraced neobanks that widely. However, many of the more traditional, such as Wells Fargo, Capital One, or Bank of America, have apps that allow you to check both your checking and savings accounts.

Also, it should be noted that Americans love credit cards and “points.” You’ll often see them paying for items under $5 dollars with their credit card, which depending on where you’re from, can seem strange. Oftentimes, too, their credit cards come with points on certain purchases for travel or food. So, that five dollar coffee and muffin actually earn them 3x the dollar amount in points. These points can be used to pay for purchases like travel tickets, depending on the provider. And you will typically need a credit rating to be eligible for rent or loan applications, so it’s worth investigating this quickly.

Along with the 2020 presidential elections, COVID has not once been out of the headlines this year. The US tightened its borders earlier this year to curb the spread, making much international travel come to a near halt. You should check carefully the whether restrictions will affect your travel plans — for example, entry is not permitted for anyone travelling from the Schengen zone, UK and Ireland, among other regions.

Each state has been enforcing its own measures to curb the spread of the coronavirus, which typically include details on when to quarantine, guidance on mask wearing, and information on restaurant or business closures, etc. For the most up-to-date information, you’ll want to track local news for the particular measures that will affect you. But keeping abreast of national news will also be helpful.

The Center for Disease Control (CDC) and Johns Hopkins’ University of Medicine have great COVID resources, with the latter mapping out the spread worldwide. The Department of Health and Human Services has this helpful guide on testing centers nationwide.

Health care is a bit of a perpetually hot topic in the United States.

If you come from a country with a universal healthcare system, the private market and employer-sponsored health care offerings may feel a bit alien. PPO and HMO? Deductibles and copays? Primary and secondary insurance? Just ask your HR/benefit representative at work or, if you’re self-employed, a proper broker, insurance representative, or look into HealthCare.gov.

A group of Ivy League-educated investment bankers could confidently be talking about their work at dinner and, yet, I assure you, splitting the bill and calculating the tip will cause them to sweat more than their latest merger and acquisition. Seriously.

A table of Americans will often study that slim, white piece of paper with a certain unmatched scrutiny and you’ll hear “15% or 20%? What do you think?” They’re talking about tipping. In the United States, you often tip restaurant staff 15% of 20% on top of your bill. Also, with COVID upending restaurant services, salon operations, and the like, definitely consider overtipping when possible. They’ll appreciate it.

Bear in mind, tipping also extends to bartenders, hairdressers, taxi drivers, handymen, and so forth, but the percentages on those are a little less of a rule book.

Even in this crazy year, moving to the US is still a worthwhile decision. And while there can be a lot of moving parts or adjustments to make, Wise will at least make some of your financial tasks, such as money transfers, a bit easier and more affordable.

| Need to send or receive money internationally? Wise can help you manage your money across borders more cheaply and easily. Join our 16 million customers at wise.com, or through our Android or iOS app. |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Living the digital nomad life? Learn all about the best banks and alternatives to sort your finance on the go.

Discover the easiest countries to get citizenship in 2024. From investment options to simplified naturalization processes, find out where you can become a citiz

Wondering about the cost to move overseas? We'll dive into all the factors affecting international relocation costs, so you can plan your move with confidence.

Need to move your belongings overseas without breaking the bank? Explore the best and most economical methods for shipping your stuff internationally with our c

Need to relocate your furry friend overseas? Our comprehensive guide to pet relocation offers tips, costs, and everything you need to ensure a safe journey for

Planning a move overseas? Our guide helps you navigate the process of selecting the best international movers to ensure a smooth, worry-free transition to your