What is the 90 day rule on Airbnb?

What is the 90 day rule on Airbnb? Learn all about rules and restrictions for using your London-based property to make passive income with short-term rentals.

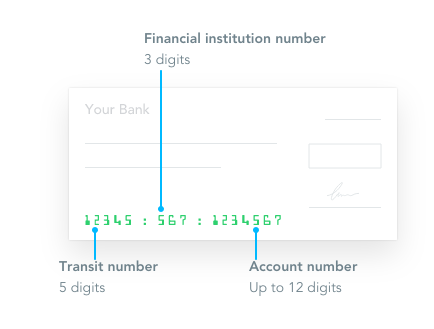

In order to send funds to and from your Canadian bank account, you will need to have three account details at hand; Financial Institution number (3 digits), Branch Transit Number (5 digits) and Account Number (5-12 digits). These details help Wise send funds to and withdraw funds from the right account.

If you have your checkbook to hand, have a look at the illustration below for how to find these details.

You can usually find these details by logging into your internet bank. From there you should easily be able to see the account number of the account you would like to use, the institution number of the bank and the transit number of the branch.

Here is a list of institution numbers for Canadian Banks.

Please note: These numbers are accurate to the best of our knowledge, but if you are unsure it is always best to check with the recipient's bank. These numbers should only be used to confirm details you already have.

Sometimes banks display institution and transit numbers as a routing number. A routing number for electronic payments contains a zero (called the "leading zero"), a three-digit financial institution number and a five-digit branch number.

Routing number format:

0YYYXXXXX

where:

YYY - institution number

XXXXX - transit number

For example, if Bank’s routing number is 026011242, the institution number is 260, and the transit number is 11242.

You can check the validity of the Institution and Transit number combination on Canada Banks Information website: http://canada-banks-info.com/routing-numbers

Sending money to or from Canada? Banks and other money transfer companies hide their fees in bad exchange rates. Don't get caught out - with Wise you get the exchange rate you find on Google and only pay a low transparent fee.

Check out the calculator at the bottom to see how much you can save today.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

What is the 90 day rule on Airbnb? Learn all about rules and restrictions for using your London-based property to make passive income with short-term rentals.

Have a look at our guide that covers how to manage your Airbnb remotely, from automating the check-in process all the way to handling local regulations.

How much do Airbnb property managers charge? Here's an in-depth overview to find out all about the management fees and charges that might arise.

How to report Airbnb income on tax return? This guide will tell you all about reporting your rental income for both domestic and international properties.

Get a full overview of the best Airbnb tax software systems that will help you easily track and manage expenses for your rental property.

How much is Airbnb tax for American hosts? Take a look at our in-depth guide on this topic and simplify your taxation process while staying compliant.